When scrap traders gathered for the 2017 Bureau of International Recycling (BIR) World Recycling Convention & Exhibition in Hong Kong in May of that year, China’s looming import restrictions already had placed threatening clouds over some scrap trading.

Just one year later, however, when some 1,100 BIR delegates convened for the 2018 event, held in late May at the Sofia Hotel in Barcelona, Spain, those clouds had blossomed into a full-blown storm.

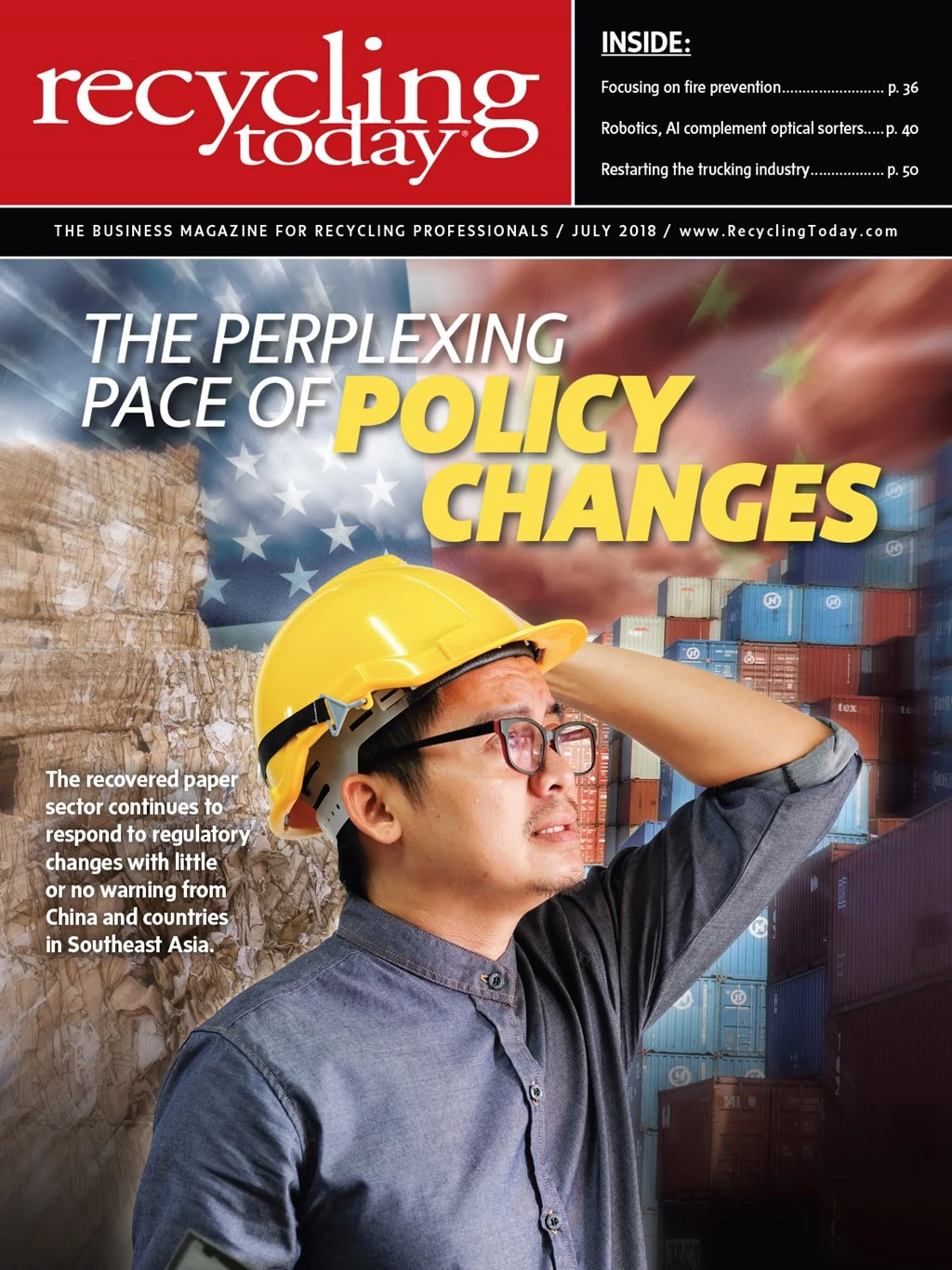

In the 12-month interim, China’s scrap import restrictions broadened and tightened. They also appeared to be spreading to neighboring countries in Southeast Asia. At the same time, U.S. President Donald J. Trump tweeted that trade wars were good and began issuing tariffs that provoked numerous responses even as recyclers gathered May 27-30 in Spain.

Middle Kingdom withdrawal

Murat Bayram of EMR and Surendra

Borad Patawari of Gemini Corp.

The Chinese government continued to make it clear in the second half of 2017 and the first half of 2018 that it intends to greatly restrict imported scrap, whether as part of an anti-pollution effort or in a protectionist move to bolster its own recycling industry.

Nonmetallic scrap markets have been the most drastically affected. The plastic scrap market was the first and has been the most uniformly restricted, with Chinese regulators frequently referring to such shipments as “foreign garbage.”

BIR Plastics Committee member Steve Wong of Hong Kong-based Fukutomi Co. Ltd., who also helps lead the China Scrap Plastic Association, noted that China used to bring in as many as 7 million metric tons of plastic scrap annually, but that flow has been reduced to a trickle in 2017 and 2018.

The import ban has been enacted to boost China’s domestic recycling industry. Wong said China’s estimated 14 percent plastic recycling rate is low in part because just 2 percent of the nation’s postconsumer plastic packaging is estimated to be recycled.

Plastic scrap traders in other parts of the world have boosted their shipments to other Asian countries, including in Malaysia, Thailand and Vietnam, where many Chinese recycling entrepreneurs have shifted operations.

Jason Schenker

Wong said those nations would nonetheless be unable to absorb 7 million metric tons annually. Furthermore, governments in those nations are increasingly emulating China’s approach in scrutinizing such shipments. He said Malaysia’s government had stopped issuing approval permits for plastic scrap as of May 23, 2018.

Wong described the situations in Thailand and Vietnam as pointing toward similar strict outcomes, adding, “Taiwan, Hong Kong and South Korea [are] about all that’s left,” but those nations do not have the capacity to accept great volumes.

Committee Chair Surendra Patawari Borad of Belgium-based Gemini Corp. said, “Indian imports will grow, but [from] a very small baseline figure.” He said annual imports of polyethylene terephthalate (PET) scrap into India have grown from 3,000 to 12,000 metric tons per month, but the “main stumbling block is the difficulty in getting import licenses” in India, where just 35 companies have them and no new ones have been issued since 2015.

Imported scrap paper also is facing tightened (some would say unattainable) quality restrictions in China, which was a foremost topic at the BIR Paper Division meeting. In the recovered fiber sector, the primary victims of the sudden policy changes ultimately may be paper and board manufacturers and buyers in China.

Current BIR President Ranjit Baxi told attendees of the convention that prices of old corrugated containers (OCC) and other recovered fiber grades in China have skyrocketed, causing ripple effects in its paper industry.

Baxi, who is with London-based J&H Sales International, said with OCC pricing between $440 and $480 per ton in China, “Chinese mills buy at these high prices” and, in turn, finished containerboard prices in China are now hitting from $700 to $800 per ton.

Baxi said Indian and Association of Southeast Asian Nations (ASEAN) containerboard mills are beginning to take advantage of this situation by shipping finished containerboard to Chinese converters and box producers. “Should Europe be thinking of shipping finished corrugated to China?” he asked.

Per statements by the Chinese government, it wants to steer China toward secondary commodity self-sufficiency, but Baxi said it is unclear how long this will take. In the meantime, China’s paper producers are being pressured by the government to keep their prices in check at the same time they are paying more for raw materials.

Former BIR Paper Division President Dominique Maguin of France-based La Compagnie Des Matieres Premieres said, “I cannot imagine the Chinese market being able to continue in that way. I don’t know how the industry can afford to pay this high price for its raw materials.”

Metallic headaches

Global trade barriers also are disrupting metals markets, with China’s restrictions being joined by a U.S.-versus-the-world trade war that appeared to be gaining momentum as of late May. Combined with Chinese restrictions and enforcement, the turmoil was the focus of conversations at BIR metals meetings as well.

Division President David Chiao of Atlanta-based Uni-All Group Ltd. pointed to China’s scrap import restrictions as creating the foremost challenges in the market, joined by the increasing possibility that the measures will be copied in the ASEAN region.

In addition to scrap-specific measures, “The [trade] dispute between the United States and China is escalating [with] retaliation on each other.” Within days of Chiao’s comments, the U.S. also announced it was extending metals tariffs to Canada, Mexico and the European Union, with those countries announcing they intended to respond in kind.

“Taking all the challenges mentioned above,” Chiao said, “it is very possible a new chain of markets is forming.”

A panel of more than a half-dozen traders and processors discussed the swirling changes. Ibrahim Aboura of the United Arab Emirates-based Aboura Metals said, “Free trade and globalization are under dire threat.” He added, “Trading is vital for both sides,” providing “access and options to several different markets.” As of 2018, Aboura said, “Disorder is rampant,” with conditions changing “from one day to another.”

Dawal Shah of Mumbai-based Metco Marketing Pvt Ltd. remarked, “Let India not be another China,” saying instead he and others prefer “a sense of responsibility on the buy side.”

He continued, “India needs to build its own story, not follow one-time events.” He recommended the nation’s recycling industry leaders “improve our own domestic supply chains” and “work closely with government on a regulatory framework” relative to scrap imports.

Mogens Christensen of Denmark-based H.J. Hansen Recycling Industry Ltd. AS said of European recyclers, “We have to find new markets,” which has entailed “several treatment plants” being set up in Europe. To serve the new markets, he said, more “treatment locally” will be necessary.

Panelists at the Stainless & Special Alloys Committee meeting expressed concern that their sector pointed to what a smaller global trading market looks like for recyclers who would prefer to have access to a true worldwide market.

Barry Hunter of Hunter Alloys LLC, Boonton, New Jersey, expressed concern about consolidation within the stainless steel production center, pointing to the existence of “two major mill” companies in the U.S. and Europe.

For stainless scrap to move beyond its home region, there currently are “very limited elsewheres” for it to go, he said. “I think mills today are getting scrap for a discount because of a ‘captive audience’ for domestic scrap.”

An uncertain future

Throughout the three days of BIR meetings and sessions, recyclers and other presenters expressed optimism in the long-term, sustainable health of the recycling industry. That optimism was tempered, however, by the stormy trading climate that has only worsened since the convention ended May 30.

Jason Schenker of Austin, Texas, based Prestige Economics predicted that in “the next 12 to 24 months, tariffs are going to be a big problem” in the metals industry and the global economy overall.

Schenker, who served as a panelist at one session and as a guest speaker at another, remarked that the Federal Reserve and the International Monetary Fund (IMF) have acknowledged this potential damage but had not yet revised their 2018 or 2019 gross domestic product (GDP) forecasts downward. “Tariffs are like cockroaches, there’s never just one,” Schenker warned.

For his part, Schenker forecasts 2.5 percent GDP growth in the United States in 2018, but just 1.1 percent growth in 2019.

In addition to worries about the spreading trade war, he expressed concern about an angel investing “hype bubble” in the U.S. and beyond, and market cap values for some tech companies reminiscent of previous bubbles.

A panel of recycling industry veterans and leaders assembled for another BIR session offered several comments pertinent to the future of the recycling industry, and not all of them were gloomy.

William Schmiedel, president of global trade at Sims Metal Management, with U.S. corporate offices in Rye, New York, said Asia’s attention to its imported scrap quality can help raise processing standards globally. He says when Sims Metal Management exports materials, it looks for buyers who process “with proper and correct ways.” Schmiedel continued, “We are going to follow the correct procedures to clean materials in an environmentally sensitive manner. We should do it there as we would in our own country.”

BIR Director General Arnaud Brunet said the woes of 2018 may cause disruption to all and financial harm to some firms, but there is a silver lining. “It’s painful today, but beneficial tomorrow. This is a call for the industry to do better,” he stated. “Quality is the future of our industry.”

Explore the July 2018 RT Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility