Image courtesy of Umicore's 2020 earnings presentation

Brussels-headquartered precious metals recycler and refiner Umicore says it posted its strongest financial performance ever in 2020, despite the severe disruption brought by the COVID-19 pandemic in its end markets. The company attributes the results in part to an exceptional platinum group metals (PGM) price environment, noting in its earnings presentation that rhodium prices, in particular, "surged in the second half of 2020 in a context of tight supply and high demand from the car industry as a result of increasingly stringent emission norms."

In that presentation, Umicore notes that current prices for precious and PGM metals already are well-above the average received prices in 2020.

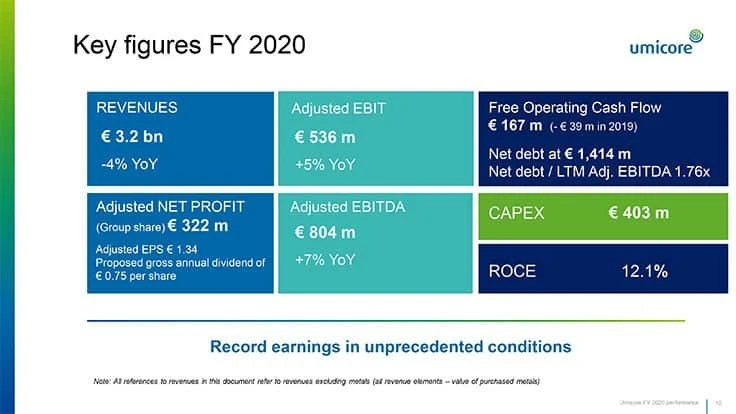

After solid performance in the first half of 2020, with strong results in its Recycling segment offsetting the impact of the automotive industry downturn on the results of its Catalysis and Energy & Surface Technologies divisions, the second half of the year saw a strong sequential improvement in the group’s revenues and earnings driven by continued operational performance and high metal prices in Recycling, as well as strong growth in Catalysis, the company says. Full-year adjusted earnings before interest and taxes (EBIT) were 536 million euros, up 5 percent compared to the previous year, while adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 7 percent to 804 million euros.

Umicore’s Recycling business doubled its adjusted EBIT relative to 2019, driven by strong growth across business units, reflecting high metal prices, high activity levels despite the COVID-19 crisis and favorable trading conditions.

While the company says its revenues in Catalysis decreased, its strong market position in gasoline technologies for light-duty vehicles, particularly in China and Europe, and higher sales of heavy-duty diesel and fuel cell catalysts, ensured that decrease was less than what occurred in the global car market. Adjusted EBIT declined more than revenues for the full year, reflecting the significant impact of the pandemic in the first half of the year, Umicore adds.

Revenues for Energy & Surface Technologies reflected the impact of the pandemic as well as lower sales of cathode materials for high-end portable electronics and energy storage applications. The decline in adjusted EBIT was more pronounced, reflecting significant negative operating leverage and the impact of an unfavorable pricing environment for cathode materials due to substantial industry overcapacity in China, according to the company.

CEO succession planning

Umicore’s supervisory board and CEO Marc Grynberg, who has led the company since 2008, say this is a good time to start preparing for a succession plan for the CEO role. The supervisory board will begin work to identify a successor who will build on company’s fundamentals to bring Umicore to its next stage of development.

“Marc is Umicore’s longest-serving CEO to date and, since 2008, he has shaped Umicore’s strategy with foresight and determination,” says Thomas Leysen, chairman of the supervisory board. “I know Marc as a leader who is driven by values and cares for people, which has earned him the respect of all Umicore’s stakeholders. I have always enjoyed working with Marc and I am glad that Umicore can continue to count on his full engagement until a worthy successor is appointed and takes over.”

Grynberg says, “I am proud of the manner in which we have transformed Umicore over the past 12 years and prepared this wonderful company for further growth. Our success would not have been possible without the support of Thomas Leysen, the supervisory board and the talent, dedication and hard work of my management board and our 11,000 colleagues. I will lead Umicore with as much engagement, energy and passion as ever until my successor is in place, and I will be pleased to assist the board with a smooth transition in due course.”

Maintaining its strategy

Despite the significant challenges caused by the COVID-19 pandemic, the long-term drivers that support Umicore’s growth strategy remain intact, according to the company. The push toward clean mobility is stronger than ever, with various governments including green recovery measures and stimuli for cleaner mobility in their crisis recovery packages, in particular Europe and China.

Against this background, Umicore chose to move forward with its ambitious growth strategy in cathode materials and made significant progress with the construction of its greenfield plant in Nysa, Poland, which upon commissioning by the end of the first half of 2021, will be the first industrial-scale cathode materials plant in Europe, the company says. In addition, Umicore is moving ahead with its growth plans in fuel cells for automotive applications as well as the expansion in its light-duty and heavy-duty catalyst production in China to cater to growing demand for its technologies as emission norms continue to strengthen.

In Recycling, Umicore says it continues to invest to improve the environmental and safety performance of the Hoboken recycling plant, near Antwerp, Belgium.

Because of the pandemic, Umicore implemented measures to protect cash flow and strengthen its liquidity while also reassessing its production footprint and the carrying value of certain assets.

Outlook

While the global economy is showing signs of recovery from the severe downturn caused by the COVID-19 pandemic in the first half of 2020, a high degree of uncertainty remains with respect to the evolution of the pandemic and the pace and speed of the recovery in different regions, Umicore says. As a result, visibility on end market demand remains poor. Against this backdrop and under the assumption that the ongoing COVID-19 outbreak would not result in additional material or protracted disruptions to the economy or Umicore’s operations, the company says it expects to achieve substantial growth in earnings in 2021, with growth in all business groups:

Catalysis should benefit from its technology offering in gasoline applications in China and Europe, the initial impact of China VI legislation for heavy-duty diesel applications and savings from the footprint adjustments and cost improvements carried out in 2020.

In Energy & Surface Technologies, volume growth should more than offset the impact of pricing pressure, underused capacity in China and some 50 million euros increase of fixed costs in rechargeable battery materials. Adjusted EBIT for Energy & Surface Technologies is expected to grow meaningfully, in line with current market expectations, the company says.

Recycling should continue to strongly benefit from favorable metal prices, a supportive supply mix as well as moderate volume growth in precious metals refining. If current elevated metal price levels were to prevail throughout the year, Umicore says the business group’s adjusted EBIT would increase very significantly compared to 2020.

Documents related to the company’s 2020 results can be found here.

Latest from Recycling Today

- GFG mill in Australia enters bankruptcy process

- Azek Co. acquires Oregon-based plastic recycler

- Ace Green Recycling inks lead, lithium licensing agreements in Armenia

- Call2Recycle partners to start high-energy battery recycling program

- Closed Loop Partners releases report on small-format packaging recovery

- Battery recycling and reuse management platform launches

- Elemental Holding secures European funding

- BCA subsidiary offers EV battery pack shredder