Late May online auctions of plastic recycling facilities formerly operated by CarbonLite, which filed for bankruptcy in March, have allowed three established plastic recycling companies to expand their footprints in the United States.

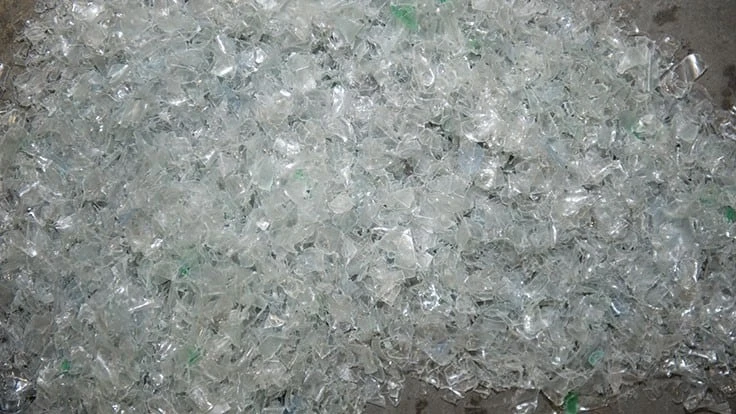

An online report from London-based Independent Intelligence Commodity Services (ICIS) indicates DAK Americas, a U.S.-based subsidiary of Mexico-based Alpek S.A., won the bidding for the polyethylene terephthalate (PET) bottle recycling facility in Reading, Pennsylvania, at the auction. A court filing in early May disclosed DAK Americas’ bid for the Pennsylvania facility.

The U.S. subsidiary of Thailand-based Indorama Ventures submitted the winning bid for a similar CarbonLite plant in Dallas, while equity firm TSG Shelf II Acquisition submitted the accepted bid for CarbonLite’s PET bottle recycling plant in Riverside, California. The sales are subject to review until a follow-up June 3 hearing.

TSG Shelf II Acquisition is a part of Houston-based equity firm The Sterling Group, other portfolio companies of which include Ohio-based PET recycling firms Evergreen and Greenbridge (formerly PolyChem), plus HPDE recycling firm Tangent Technologies. TSG Shelf II also submitted bids for the Texas and Pennsylvania facilities, which ICIS says have been accepted as backup offers should the Indorama or Alpek bids fall through or stall.

All three winning bidders have been adding plastic recycling capacity in North America in the past several years, with DAK Americas adding PET recycling capacity with an acquisition in 2019 while Indorama added rPET capacity in California that same year. TSG portfolio firm Evergreen earlier this year announced that it was adding capacity at its Clyde, Ohio, plant.

According to ICIS, Indorama bid nearly $64 million for the Dallas plant, while DAK Americas paid more than $98 million for the Reading facility. TSG Shelf II, meanwhile, paid $57.5 million for the Riverside PET bottle recycling plant.

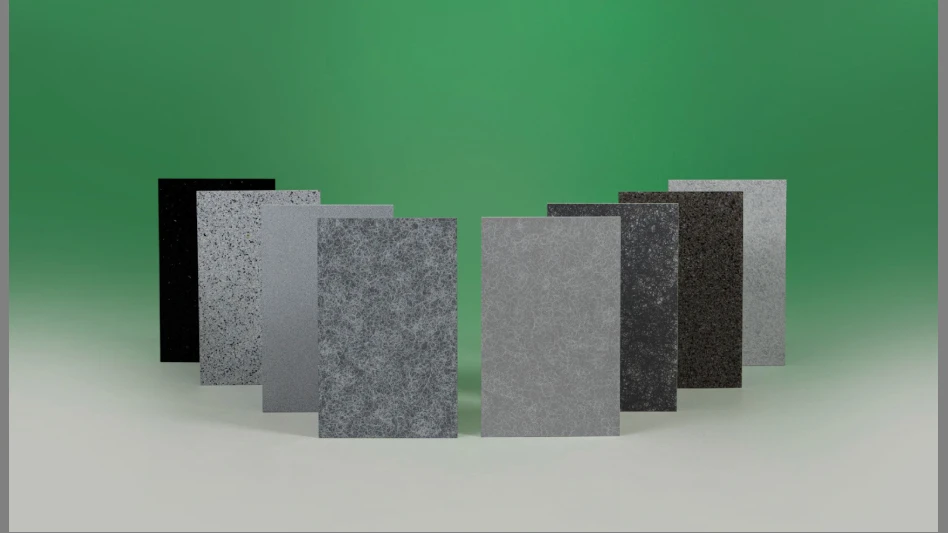

Both the Dallas and Reading plants can produce about 42,500 tons annually of recycled PET (rPET) pellets, while CarbonLite claimed a 50,000 tons per year capacity for the Riverside plant when it opened in 2010.

Sponsored Content

Don’t Let Screen Jamming Decrease Material Recovery

General Kinematic’s FINGER-SCREEN™ prevents material bypass with its tapered finger designs, unique cam-out surfaces, and staggered positions. It allows for continuous, dynamic material flow to enhance and optimize separation and classification. If your current setup is prone to process challenges, let GK’s FINGER-SCREEN™ be the solution!

Optimize your process today with GK!Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Recycling Today

- Tomra reports profitable Q4 2024

- US ferrous scrap, DRI consumption rise in 2024

- Minebea Intec credits load cells for durability

- Scrap not included in US steel, aluminum tariffs

- Lexington, Kentucky, partners with Trex to recycle plastic film

- New York county expands paint recycling program

- Aimplas develops demonstrator for plastic product digital passport

- Blue Whale Materials to partner with Call2Recycle