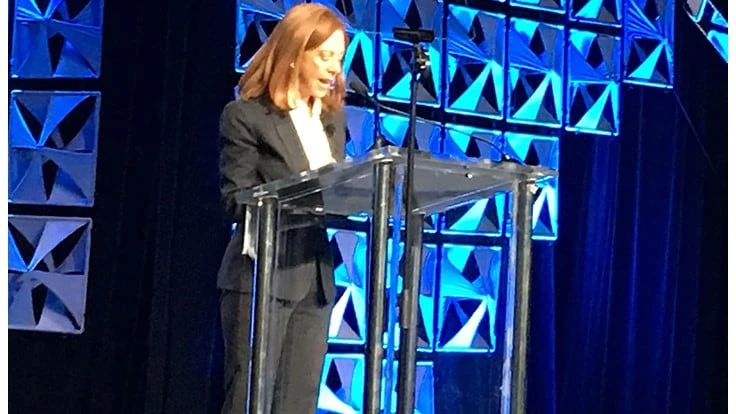

Photo by Brian Taylor.

Portland, Oregon-based Schnitzer Steel Industries Inc. has reported increased revenue and profits for its second quarter of fiscal 2021, which ended Feb. 28, 2021.

The company says its net income of $46 million in the quarter was more than triple the $15 million net income it experienced in the first quarter of fiscal 2021 and was more than nine times its net income of $5 million in the second quarter of fiscal 2020.

According to the firm, its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $71 million in the quarter represented a boost from the $40 million EBITDA figure in the first quarter of fiscal 2021 the $28 million figure in the year-ago second quarter.

The scrap recycling, auto dismantling and steelmaking company says its performance benefited from “strong global demand for recycled metals and finished steel products, with selling prices for ferrous and nonferrous scrap reaching multiyear highs.”

A sharp increase in selling prices during the quarter contributed to the company’s “strong margins,” the firm says. It also notes, however, that ferrous sales volumes were impacted by severe weather, “which affected the timing of shipments.”

Regarding the scrap market in the December 2020 to February 2021 period covered by the quarter, Schnitzer says its average ferrous scrap selling price was $387 per ton, an increase of nearly 44 percent compared with $269 in the prior quarter. The company’s average nonferrous scrap selling price was 83 cents per pound, a 29 percent increase from the average 64 cents per pound the prior quarter.

The company says it also benefited from continued strength in West Coast demand for finished steel products. (Schnitzer’s steel mill is located in Portland.)

“We are exceptionally pleased with our performance during the quarter, reflecting our best operating income per ton since 2008,” says Tamara Lundgren, the company’s chairman and CEO. “Price volatility during the quarter was significant, but trading was maintained at much higher price levels than in the recent past, reflecting the stronger demand associated with both the economic recovery and positive structural commodity trends.”

On the scrap processing side going forward, Lundgren comments, “Since the end of the second quarter, we have commissioned two of the advanced metal recovery technology systems which are key to the execution of our strategic plan and the achievement of our sustainability goals.”

Lundgren also points to trends favoring the recycling sector, commenting, “Decarbonization and broader ESG (environmental, social and corporate governance) factors, together with the catalytic effect of global stimulus, are serving as structural drivers of demand for recycled metals. Scrap, in other words, is an important strategic solution for companies, industries and governments that are focused on carbon reduction.”

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program