Recycling Today archives

Lake Forest, Illinois-based Packaging Corp. of America (PCA) has reported third quarter 2023 net income excluding special items of $185 million, or $2.05 per share, which compares with a $2.85 per diluted share figure in last year’s third quarter, a decline of 28 percent.

While the company netted more than $360 million income during last year’s third quarter, that amount receded by 28.2 percent to just $258.6 million in this year’s third quarter.

Reported earnings in this year’s third quarter include special items primarily for certain costs at the Jackson, Alabama, mill for writing paper-to-containerboard conversion related activities.

“Excluding special items, the 78 cents per share decrease in third quarter 2023 earnings compared to the third quarter of 2022 was driven primarily by lower price and mix ($1.33) and volume (9 cents) in the Packaging segment, higher depreciation expense (11 cents), lower volume in the Paper segment (4 cents), a higher tax rate (2 cents), and other expenses (2 cents)," PCA says.

“These items were partially offset by lower operating costs (58 cents), a lower share count resulting from share repurchases in the second half of 2022 (11 cents), higher prices and mix in the Paper segment (4 cents), lower converting costs (4 cents), lower scheduled maintenance outage expenses (4 cents), and lower freight and logistics expenses (2 cents)."

Remarks Mark W. Kowlzan, board chairman and CEO of PCA, “We were able to exceed our guidance for the quarter with better demand in our Packaging and Paper segments and by remaining focused on process efficiency optimization efforts across our mills and corrugated products facilities," adds Mark W. Kowlzan, CEO of PCA. "The scheduled maintenance outages at our mills were executed well, and we also ran the containerboard system in a very cost-effective manner to match our supply with demand, which included keeping our Wallula, Washington, mill temporarily idled during the quarter.

“With the stronger demand in our Packaging segment, we ended the quarter with inventory levels lower than anticipated. Based on our current outlook for improving demand together with current plans in the first half of 2024 for scheduled mill maintenance outages and completing the final phase of the containerboard conversion of the No. 3 machine at our Jackson, Alabama, mill, we are planning to restart the No. 3 machine at our Wallula mill during the fourth quarter in order to bring our inventories to desired levels.

“In our Packaging segment, we expect less market-related downtime as we build our inventories back to appropriate levels along with higher shipments per day in our corrugated products facilities, although our plants will have one less shipping day compared to the third quarter. We also expect lower average prices primarily due to the majority of the May decrease in the published benchmark index grades being realized throughout the third quarter as well as a seasonally less rich mix.”

Noting the effect of scrap paper prices, Kowlzan continues, “Operating and converting costs will increase driven by higher recycled fiber prices, seasonal energy costs and the re-start of the Wallula mill. Depreciation expense is estimated to be slightly higher, and scheduled maintenance outage expenses will be lower. Considering these items, we expect fourth quarter earnings of $1.76 per share.”

If that estimate is correct, it would mark a percent quarter-on-quarter 14.1 percent earnings per share decline for PCA.

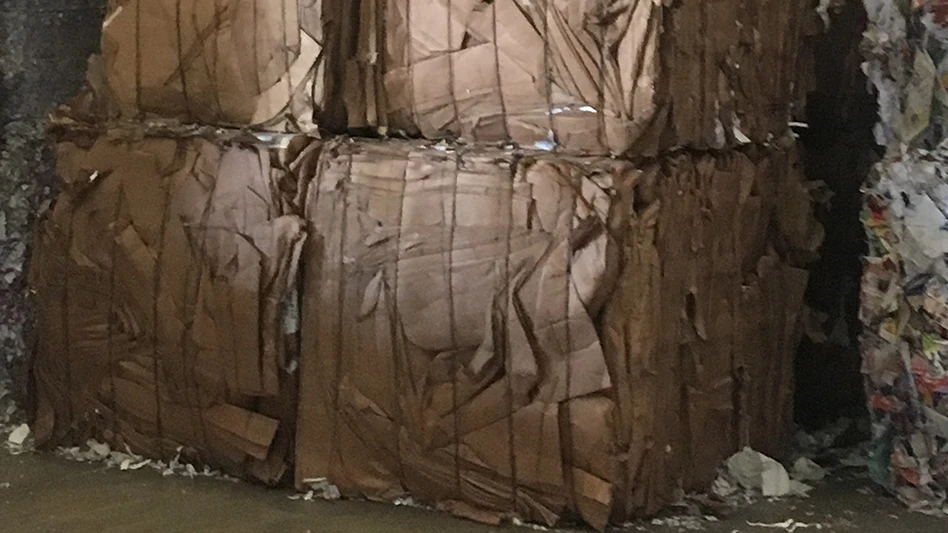

PCA is the third largest producer of containerboard products and a leading producer of uncoated freesheet paper in North America. PCA operates eight mills and 86 corrugated products plants and related facilities and, according to its 2021 Responsibility Report, the company’s mills consume about 1.2 million tons of recovered fiber annually.

Latest from Recycling Today

- Radius to be acquired by Toyota subsidiary

- Algoma EAF to start in April

- Erema sees strong demand for high-volume PET systems

- Eastman Tritan product used in cosmetics packaging

- Canada initiates WTO dispute complaint regarding US steel, aluminum duties

- Indianapolis awards solid waste contract, updates recycling drop-off program

- Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- GPR’s hubbIT platform recognized in Georgia State University’s Marketing Awards for Excellence in Innovation