Image courtesy of the Aluminum Association

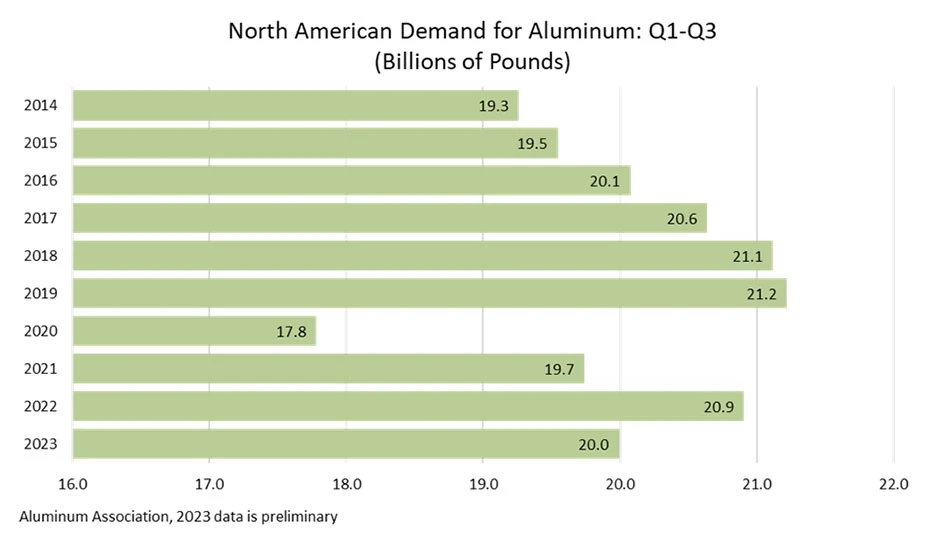

According to preliminary estimates, aluminum demand in North America (U.S. and Canada) declined 4.4 percent through the first three quarters of 2023, the Aluminum Association says. As of the first half of the year, demand had decreased by 4.5 percent.

Charles Johnson, president and CEO of the Arlington, Virginia-based Aluminum Association, says the softness follows near-record shipments in 2022 and remains near the 10-year average. “With nearly $6 billion committed to expand domestic aluminum operations since 2021 alone, the long-term outlook for aluminum remains strong,” he adds.

In the last decade, Aluminum Association member companies have announced more than $9 billion in investments for domestic manufacturing operations ($6 billion since 2021), including new, U.S.-based greenfield facilities for the first time since the 1980s, such as Aluminum Dynamics’ 650,000-metric-ton recycled aluminum flat-roll mill and two supporting satellite recycled aluminum slab centers. This increased investment is attributed to growing demand for sustainable packaging, safe and efficient vehicles, greener buildings and vital infrastructure, the association says.

The association’s monthly Aluminum Situation report indicates aluminum demand in North America, which includes shipments by domestic producers plus imports, totaled an estimated 19,993 million pounds through the third quarter of last year compared with the Q3 2022 total of 20,908 million pounds.

While semifabricated—or “mill”—product demand was off 9.5 percent year-over-year through the third quarter, electrical wire and cable saw 14.7 percent year-over-year demand growth as the electrical infrastructure market remains strong.

Aluminum exports (excluding scrap) to foreign countries increased 23.1 percent during the quarter, while imported aluminum and aluminum products fell more than 25 percent through the third quarter of 2023.

At 105.8, the Aluminum Association’s Index of Net New Orders of Aluminum Mill Products (baseline of 100) has shown a decline of 5.1 percent through November of last year.

The softer demand reflects what recyclers have been seeing for much of the last year as destocking of semifinished goods has had affected their scrap sales.

“Barring any major downturn in manufacturing, the market should return to what we might perceive as ‘normal’ in the second half of 2024,” Kripke Enterprises Inc. President Chad Kripke told Recycling Today late last year. “The timing of which lines up well with new greenfield casting projects coming online, which will be very scrap-intensive. If all the legacy mills and new cast houses are running at full capacity, there could quickly be a deficit of scrap in the U.S.”

Latest from Recycling Today

- Enfinite forms Hazardous & Specialty Waste Management Council

- Combined DRS, EPR legislation introduced in Rhode Island

- Eureka Recycling starts up newly upgraded MRF

- Reconomy Close the Gap campaign highlights need for circularity

- Nickel carbonate added to Aqua Metals’ portfolio

- EuRIC, FEAD say End-Of-Life Vehicle Regulation presents opportunity for recyclers

- Recyclers likely to feel effects of US-China trade war

- BCMRC 2025 session preview: Navigating battery recycling legislation and regulations