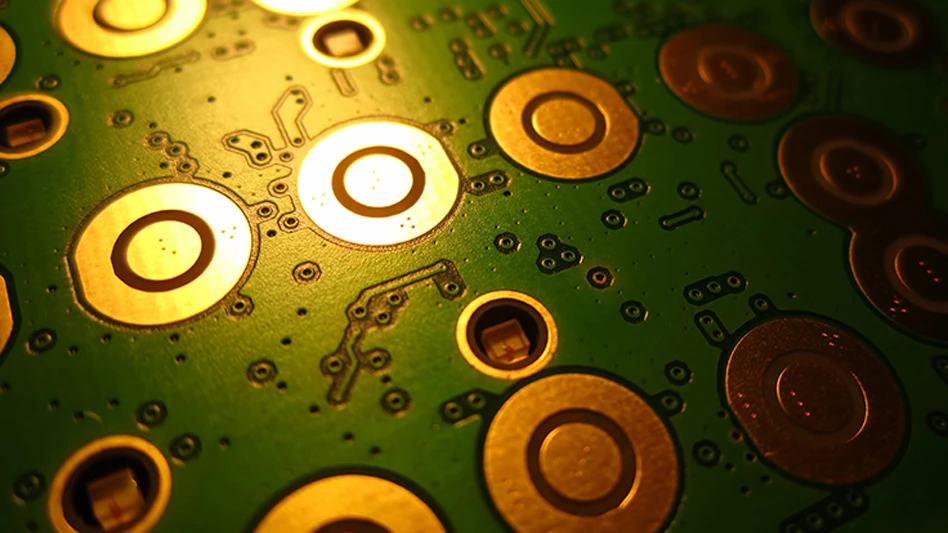

Nickondr | dreamstime.com

Majestic Corp. Plc has entered into a conditional share purchase agreement (SPA) to acquire the entire issued share capital of Telecycle Europe Ltd.

Telecycle is a specialist recycling business located in Deeside, Wales, recycling catalytic converters, telecoms and printed circuit boards for refining.

The transaction, if completed, would transfer ownership of Telecycle from Majestic CEO Peter Lai personally to Majestic, a company which he leads and in which he owns a more than 70 percent stake.

"This acquisition is considered a related party transaction under the [London-based]-Aquis Stock Exchange rules," Majestic says. "Having exercised reasonable care, skill and diligence, the directors of Majestic (excluding Peter Lai) deem the terms of the SPA to be fair and reasonable for Majestic's shareholders and an accretive acquisition for Majestic.”

The transaction is pending delivery of a "certain quantity" of containers of recyclable materials by Dec. 31 and the total consideration for the acquisition is up to 2 million British pounds ($2.6 million), to be satisfied in cash.

"The acquisition of Telecycle aligns with Majestic’s strategic goal to expand its presence in the U.K., a market Majestic deems to present significant growth opportunities," Majestic says.

Deeside is the home of Majestic's U.K. headquarters, while Malaysia is the site of its processing, sorting, baling and dismantling operations and Hong Kong hosts banking, logistics and administration functions.

“Telecycle, a profitable U.K.-based recycling business, has established a trusted supply source within the U.K. and currently acts as a tolling agent for Majestic," the company says. "At present, Majestic sources some recyclable material on an arm’s length basis with Telecycle, an existing affiliated company to the company.”

By acquiring Telecycle, Majestic says it will secure a steady supply of recyclable material, expand its network of suppliers and customers and eliminate any perceived conflicts of interest, thereby strengthening its market position.

“We are delighted to have conditionally agreed to acquire Telecycle and expand our U.K. operations," Lai says. "The U.K. market's commitment to sustainability and recycling makes this acquisition a crucial driver for future growth. We look forward to integrating Telecycle into Majestic and updating shareholders on our progress."

Lai’s LinkedIn profile also lists him as the founder of the WSF Group Ltd., a Hong Kong-based company that buys nonferrous and precious metal-bearing scrap for]processing at its recycling facilities in Hong Kong, Malaysia, China and Taiwan.

The Telecycle plant as a fully licensed and ISO-certified facility that Majestic says can help reduce the U.K.'s supply chain loss of critical and precious metals, including lithium, gold, cobalt, copper and nickel.

Majestic was founded in 2018 and Lai has been the owner of businesses in this sector since 1994.

A 2019 article from The Milllennial Source describes WSF Group as “an early mover into the metal recycling industry. The company was established in 1994 and grew to become a multimillion-dollar business, with nearly 200 employees across several countries.

The report adds, “In 2017, after a restructuring and rebranding, WSF was reborn as Majestic Corp., leaving behind past adversities. Although the reset marked a new beginning for the venture, lessons learned over the previous two decades have been carried forward to today, acting as a firm foundation for the company’s new identity.”

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program