Bulent | stock.adobe.com

LKQ Corp., headquartered in Chicago, has reported its third-quarter 2023 financial results, which show revenue of $3.6 billion, an increase of 15 percent relative to $3.1 billion for the third quarter of 2022.

Parts and services organic revenue increased 3 percent (4.3 percent on a per-day basis), foreign exchange rates increased revenue by 3.6 percent and the net impact of acquisitions and divestitures increased revenue by 10.5 percent year over year, for a total parts and services revenue increase of 17.1 percent, according to LKQ. However, other revenue for the quarter fell 17.5 percent given weaker commodity prices relative to the same period in 2022.

“Our third quarter results reflected some tailwinds and headwinds,” LKQ President and CEO Dominick Zarcone says. “On the positive side, we experienced strong organic growth in our Wholesale – North America and Europe segments, drove excellent margins in Wholesale – North America and generated robust free cash flow. Unfortunately, these strengths were offset by a combination of unusual, transitory items in Europe, continued softness in commodity prices and difficult market conditions impacting our Specialty and Self Service segments. Our success since implementing the operational excellence strategy in 2019 gives us confidence in our ability to take decisive actions and drive improved execution. We have great assets and an exceptional team, which we believe will enable long-term growth and value creation. The fundamentals of our business remain strong.”

Net income for the third quarter of 2023 was $207 million compared with $261 million for the same period in 2022. Diluted earnings per share totaled 77 cents compared with 95 cents for the same period of 2022, a decrease of 18.9 percent.

On an adjusted basis, net income for the quarter totaled $231 million compared with $266 million for the same period of 2022, a decrease of 13.2 percent. Adjusted diluted earnings per share were 86 cents versus 97 cents for the same period in 2022, a decrease of 11.3 percent, according to the company.

Diluted earnings per share decreased in the third quarter given unusual items in Europe related to a legacy value-added tax issue related to LKQ’s Italian operations and strikes in Germany, which had an estimated 6 cent impact; fluctuations in commodity prices, which had a 4 cent effect; higher interest rates and average debt balances, which drove a year-over-year increase in net interest expense, excluding the effect of Uni-Select borrowings, of 4 cents; and continued underperformance of its Specialty segment of 3 cents. As a partial offset to these factors, the lower share count and favorable foreign currency translation provided a combined 10 cent year-over-year benefit (4 cents on an adjusted basis), and LKQ says its North America operations, excluding Uni-Select, performed favorably compared with the prior-year period.

LKQ completed the acquisition of Canada-based Uni-Select Inc. on Aug. 1, which involved acquiring all of the issued and outstanding shares of the company for CA$48 per share in cash, representing a total enterprise value of approximately CA$2.8 billion, or $2.1 billion.

In October, the company entered into a definitive agreement to sell GSF Car Parts Ltd., which was completed Oct. 25, to Epiris Fund III, a private equity fund based in the United Kingdom. The company says the divestiture fulfills LKQ’s undertaking to the UK’s Competition and Markets Authority to sell the GSF business in connection with its acquisition of Uni-Select Inc.

At the time, Rick Galloway, senior vice president and chief financial officer of LKQ said, “The proceeds from the sale of GSF will be utilized to reduce our total debt, putting us in a better position to begin implementing a more balanced capital allocation strategy, which includes share repurchases.”

Regarding the outlook for the rest of 2023, Galloway says, “We are reducing our full-year guidance on revenue and earnings per share due to our underperformance in the third quarter and expected fourth-quarter effects from additional strike activity in Germany, the anticipated dilution from the Uni-Select acquisition, soft commodity prices and a continuation of difficult market conditions for our Specialty and Self Service segments. We are raising our free cash flow guidance due to our continued solid cash flow generation.”

LKQ revised the full-year outlook for organic revenue growth from parts and service to 4.75 percent to 5.75 percent compared with 6 percent to 7.5 percent initially. Adjusted diluted earnings per share are now $3.41 to $3.55 from $3.65 to $3.85.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

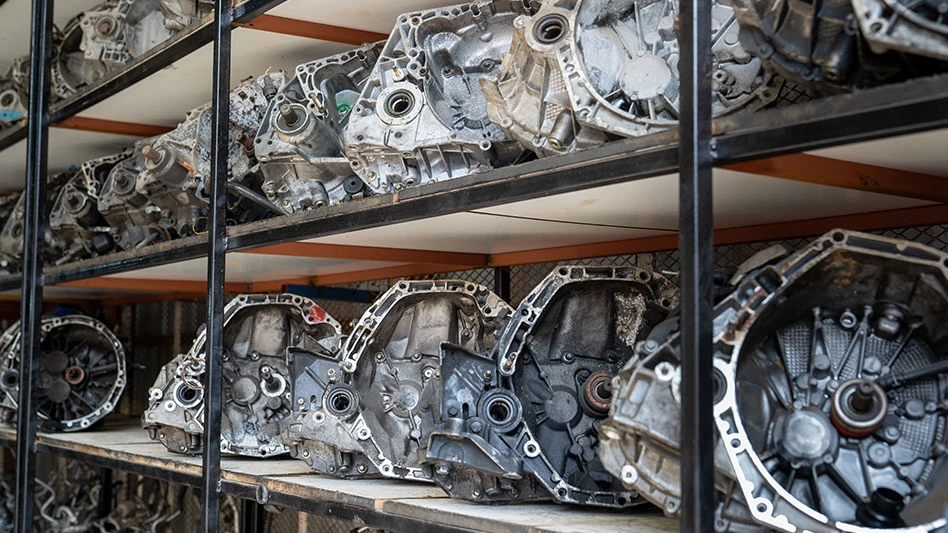

LKQ Corp. has operations in North America, Europe and Taiwan and offers its customers a broad range of original equipment manufacturer recycled and aftermarket parts, replacement systems, components, equipment and services to repair and accessorize automobiles, trucks and recreational and performance vehicles.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Recycling Today

- Athens Services terminates contract with San Marino, California

- Partners develop specialty response vehicles for LIB fires

- Sonoco cites OCC shortage for price hike in Europe

- British Steel mill’s future up in the air

- Tomra applies GAINnext AI technology to upgrade wrought aluminum scrap

- Redwood Materials partners with Isuzu Commercial Truck

- The push for more supply

- ReMA PSI Chapter adds 7 members