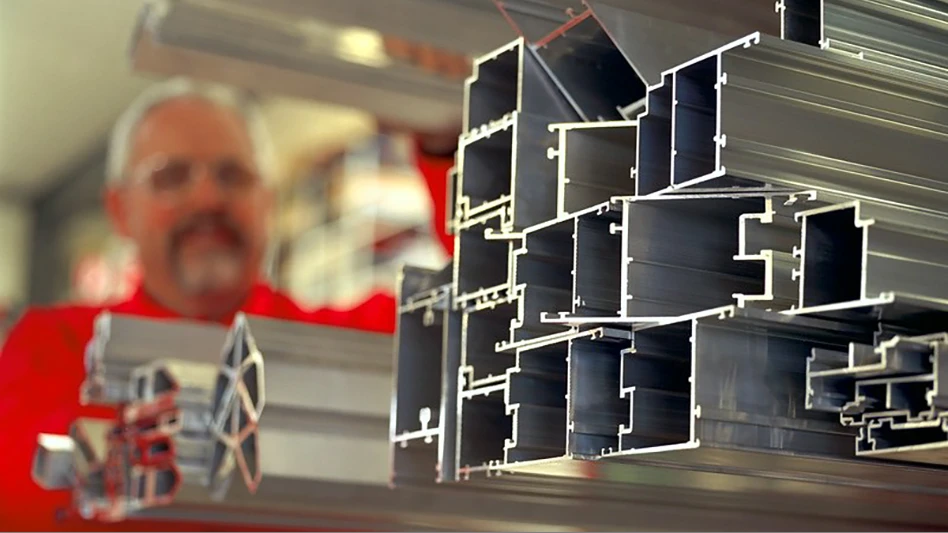

Photo courtesy of Hydro ASA

Norway-based Norsk Hydro ASA enjoyed a profitable 2024 third quarter. What may be of concern to recyclers is that its nonrecycling-focused business units yielded higher returns compared with the aluminum recycling-intensive operations housed within the global company.

Hydro's adjusted earnings for the third quarter of 2024 of $672.67 million before interest, taxes, depreciation and amortization (EBITDA), up 84.3 percent from $365 million in the same quarter last year, were positively affected by higher aluminum and alumina prices, lower raw material costs and positive currency effects.

RELATED: The Scrap Show: Duncan Pitchford, Hydro Aluminum Metals

“This was partly offset by lower recycling margins, extrusions volumes and energy prices," the company says.

For Hydro's Extrusions business unit in the third quarter, adjusted EBITDA decreased about 33 percent compared with the same quarter last year, driven by lower sales volumes and decreased margins from recycling.

“North American extrusion demand is estimated to have decreased 4 percent during the third quarter of 2024 compared to the same quarter last year and 7 percent compared to the second quarter," Hydro says. "The transport segment has been particularly weak, driven by lower trailer build rates. Automotive demand is facing headwinds due to weaker sales of electric vehicles. Demand continues to be soft in the building and construction, and industrial segments, however, underlying demand is expected to gradually improve into 2025 driven by lower interest rates.

"Automotive extrusion demand continues to be challenged by weak sales of electric vehicles across Europe, particularly in Germany. Demand for building and construction, and industrial segments has remained moderate after summer with no clear signs of improvement over the coming months, although lower interest rates may support demand into 2025.”

The global company, which has significant aluminum scrap-consuming operations in the United States, reports that positive upstream revenue drivers continued into the third quarter, supporting record results in bauxite and alumina.

“The positive development in our upstream revenue drivers continued in the third quarter, supporting strong results in our upstream business, countering the overall effects of the challenging downstream market,” says Eivind Kallevik, president and CEO of Hydro.

While the company portrays factors in the global aluminum and primary aluminum sectors that worked in its favor during the summer of 2024, it also says the downstream aluminum market continued to be challenged by weak demand and recycling margins in Europe and North America, while automotive extrusion demand remains weak due to low electrical vehicle sales in Europe, especially in Germany.

“Building and construction and industrial demand continue to be moderate, with potential 2025 support from lower interest rates," Hydro says. "Low activity in these markets limits aluminum scrap supply, squeezing recycling margins and reducing remelt production in both Hydro Extrusions and Metal Markets.”

“Hydro is responding with short and long-term actions to strengthen robustness in extrusions," Kallevik adds. "While responding to the challenging market with firm mitigating actions, we are continuing to invest in the long-term robustness of our operations."

The Hydro Extrusions business unit is “actively" navigating challenging markets to address weak demand.

"By leveraging production flexibility and implementing cost-cutting programs, Extrusions aims to maintain margins," Hydro says.

The company points to a recent investment in an automated press in Cressona, Pennsylvania, replacing two old presses, as exemplifying the commitment in Extrusions to enhance efficiency and productivity.

“However, achieving the $730.6 million EBITDA target for 2025 will require an extrusion market recovery of more than 20 percent volume growth and a recovery of remelt margins in line with historical averages," Hydro adds.

“Weak markets are pressuring recycling margins, and active measures are [being] taken to boost profitability and secure competitive scrap sourcing”

The firm points to its Alusort joint venture, launched in partnership with Michigan-based Padnos, as enabling plants to process more postconsumer scrap and “reinforcing the company's leadership in recycling more postconsumer scrap.”

Longer term, Hydro cites a strategic partnership with global automaker Mercedes-Benz as the type of collaboration that can help build low-carbon value chains, underscoring that sustainability in aluminum solutions.

“Together, we aim to lift sustainability throughout our shared value chain, from mine to end consumer product,” says Kallevik.

The company’s comments accompanying its third-quarter 2024 results also refer to an $82.8 million unrealized derivative loss on London Metal Exchange-related contracts.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program