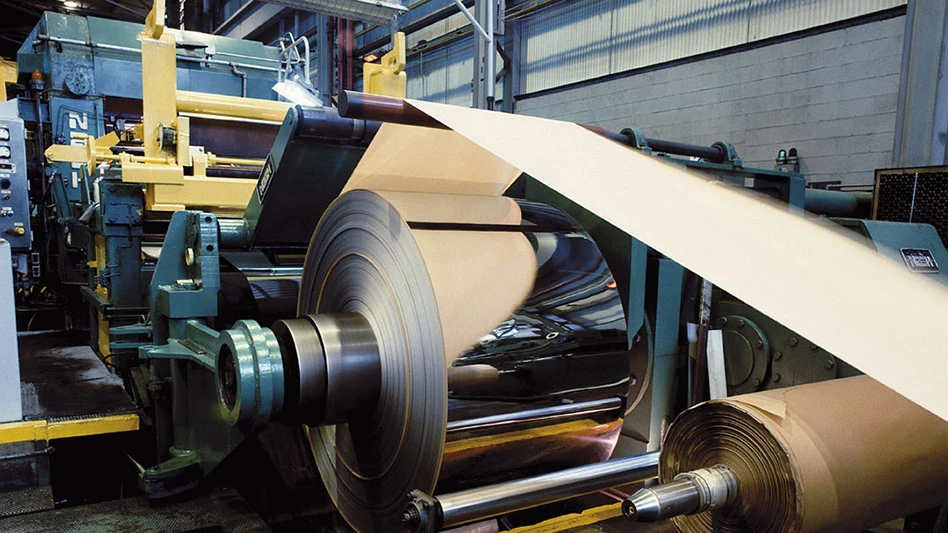

Photo courtesy of Cleveland Cliffs Inc.

Cleveland-Cliffs Inc. has announced its intention to make a bid to acquire Pittsburgh-based United States Steel Corp. If the merger is completed as proposed, it would fully consolidate blast furnace/basic oxygen furnace (BOF) steelmaking capacity in the U.S.

“On July 28, I approached U.S. Steel’s CEO and board with a written proposal to acquire U.S. Steel for a substantial premium, valuing the company at $35.00 per share with 50 percent cash and 50 percent stock,” Cleveland-Cliffs President and CEO Lourenco Goncalves said in an announcement Aug. 13.

The offer has met with initial rejection from U.S. Steel, with the company posting a letter from its president and CEO David Burritt to its website Aug. 13 that indicates Burritt and the U.S. Steel board of directors are unhappy with how the proposal has been managed by Goncalves and Cleveland-Cliffs.

“We discussed with your counsel questions that would need to be better understood in order for both of us to appropriately assess the antitrust risk of your proposal; and while your counsel agreed that this would need to be analyzed, and was amenable to our proposal to work on this together, this still has not happened,” Burritt says.

“After multiple conversations about, and our team’s engagement in good faith negotiations over, the terms of the nondisclosure agreement (NDA), we were shocked to receive a letter on Friday, Aug. 11, stating that you refused to sign the nearly completed NDA unless we agree to the economic terms of your proposal in advance.

“Our board—or any board—could not, consistent with its fiduciary duties, agree to a proposal of which 50 percent is represented by your stock without conducting a thorough and completely customary due diligence process, to evaluate the risks and potential upsides and downsides inherent in the transaction, including the stock component.”

However, within hours after posting the bid rejection news release, U.S. Steel made two more weekend announcements: one concerns the start of a “strategic alternatives process” while the second indicates Cleveland-Cliffs has been invited to be part of that process.

In the Aug. 13 announcement, Cleveland-Cliffs and Goncalves say they have the backing of the Pittsburgh-based United Steelworkers (USW) union for the proposal.

“Under the terms of the USW collective bargaining agreement with U.S. Steel, the USW has the right to counter this proposal,” Cleveland-Cliffs writes. “On this matter, the USW has affirmed in writing to Cliffs that it endorses the transaction and will not exercise this right. Furthermore, the USW has also stated that it will not endorse anyone other than Cliffs for a transaction.”

“Our proposal has the full support of the United Steelworkers union," Goncalves adds. "We have proven in our previous M&A [merger and acquisition] transactions our strong track record of significant value creation and our ability to grow the business through the addition of thousands of union jobs.”

In a letter of support signed by USW President Thomas M. Conway, the USW leader writes, “Cliffs has shown itself to be an outstanding employer to all its workers [and] we have no doubt that the extension of our strong partnership with Cliffs to the 11,000 union-represented employees at U.S. Steel will benefit the employees, their families and the communities in which they operate.”

As Burritt indicates in his letter, a proposed merger would almost certainly face regulatory scrutiny, as it combines the assets of the remaining two integrated (from mined iron to BOF output) steel producers left in the U.S. The two companies also operate some scrap-fed electric arc furnace (EAF) steelmaking capacity, including U.S. Steel’s Big River Steel campus in Osceola, Arkansas.

In terms of blast furnace/BOF capacity, U.S. Steel operates complexes in Granite City, Illinois; Gary, Indiana; and Braddock, Pennsylvania. Cleveland-Cliffs, meanwhile, now owns mills formerly operated by AK Steel and Luxembourg-based ArcelorMittal, with complexes in Riverdale, Illinois; Burns Harbor and East Chicago, Indiana; Dearborn, Michigan; and Cleveland and Middletown, Ohio.

In Canada there currently are three blast furnace/BOF campuses operating, although two of them—operated by ArcelorMittal and Algoma Steel—are in the process of converting to EAF technology. That would leave Hamilton, Ontario-based Stelco Inc. as the only non-Cleveland-Cliffs BOF mill operating in the U.S. and Canada if the merger occurs.

Although the proposed merger would consolidate BOF capacity within the U.S., Goncalves portrays the merger as necessary to create a globally competitive steel producer.

“With this transaction we will create the only American member of the Top 10 steel companies in the world, joining a select group of just three other companies outside of China—one European, one Japanese and one Korean,” Goncalves says. “We believe that having Cleveland-Cliffs as a world-class, internationally competitive steel company is critical for our country to retain its economic leadership and to regain its manufacturing independence.”

Regarding the terms of the offer made, Cleveland-Cliffs says it has proposed acquiring 100 percent of the outstanding stock of U.S. Steel for a per share value of $17.50 in cash and 1.023 shares of Cliffs stock. As of the close of market on Friday, August 11, 2023, this offer represents a 43 percent premium to U.S. Steel’s share price.

Having made the offer in late July, Cleveland-Cliffs says the initial proposal to U.S. Steel was rejected as being "unreasonable" by the board of directors of U.S. Steel via a letter Cliffs received Aug. 13. “As such, Cliffs feels compelled to make its offer publicly known for the direct benefit of all of U.S. Steel’s stockholders and also make it known that Cliffs stands ready to engage on this offer immediately," the company says.

“Although we are now public, I do look forward to continuing to engage with U.S. Steel on a potential transaction, as I am convinced that the value potential and competitiveness to come out of a combination of our two iconic American companies is exceptional," Goncalves says.

"The numerous benefits we are excited about include the combination of our complementary U.S.-based footprint, our ability to leverage our in-house metallics capabilities, and enhancing our shared focus on emissions reduction.”

In the metallics sector, both companies process iron to produce iron-based furnace feedstock, while Cleveland-Cliffs also owns the Detroit-based Ferrous Processing & Trading (FPT) network of scrap recycling yards.

“The transaction provides immediate multiple expansion to U.S. Steel stockholders, while simultaneously derisking U.S. Steel’s future capital spend with our substantial expected free cash flow and very healthy balance sheet," Goncalves says of the proposed merger.

Cleveland-Cliffs says the proposed transaction has the unanimous approval of Cliffs’ board of directors and is not subject to any financing condition.

The steel producer says it has been advised in the process by several Tier 1 U.S. and international banks, and names New York-based Moelis & Co. LLC, Wells Fargo, J.P. Morgan and UBS, while New York-based Davis Polk & Wardwell LLP is serving as legal counsel.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program