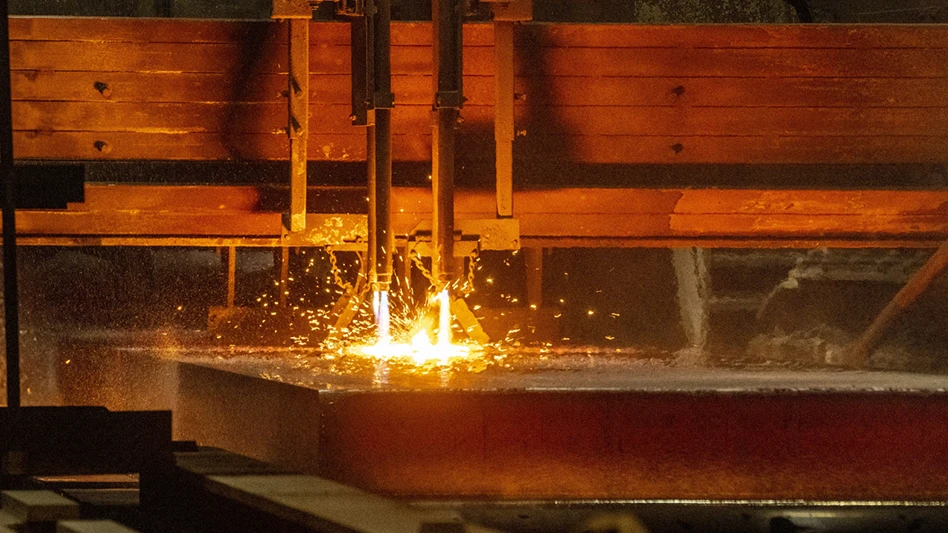

Photo courtesy of Cleveland-Cliffs Inc.

Cleveland-Cliffs Inc. says it has successfully amended its $4.75 billion asset-based lending (ABL) facility as part of the financing arrangements for its pending acquisition of Canadian company Stelco Holdings Inc.

The Cleveland-based iron mining and steelmaking firm announced that acquisition in July, assigning a total enterprise value of approximately $2.5 billion to the transaction.

Subsequently, Cliffs has completely replaced Goldman Sachs’ participation in its ABL with what it says are increased commitments from Bank of America, Wells Fargo, J.P. Morgan, Fifth Third, Truist, Capital One, BMO, Huntington and U.S. Bank.

PNC, Flagstar, UBS, MUFG, Regions, Barclays, ING, RBC and First Citizens banks also have maintained their existing commitments to the ABL.

“In this latest ABL amendment, our capital request was three times over-subscribed, showing continued strong support from our banking partners,” Cleveland-Cliffs President and CEO Lourenco Goncalves says.

“We thank our entire bank group for their participation as we focus on partners who share our strategic priorities. As we position Cliffs for further growth in the United States and Canada, this amendment reinforces our strong financial position and ability to close the Stelco transaction quickly and efficiently in the fourth quarter of 2024.”

As of the recent finalization of the ABL amendment, Cliffs reports no net borrowings on its ABL facility, and the amended ABL matures in 2028.

In addition to its pursuit of Stelco, Cliffs has pursued a bid to buy assets from Pittsburgh-based United States Steel Corp.

Late last year, the board of directors of U.S. Steel instead chose a competing offer from Japan-based Nippon Steel Corp. (NSC), but Cliffs and Goncalves continue to say they are ready to reenter the bidding arena if the NSC bid is not approved by the U.S. government.

Cleveland-Cliffs is vertically integrated from the mining of iron ore, production of pellets and direct reduced iron (DRI) and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling, and tubing. The firm employs approximately 28,000 people in the United States and Canada.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production