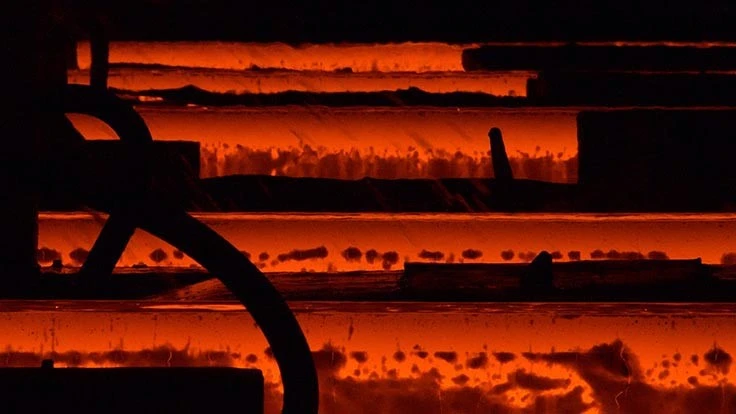

Irochka | Dreamstime.com

According to a report from Reuters, U.S. officials are considering levying tariffs on steel and aluminum based on how much carbon the producing country's industries emit. Reuters cites two people familiar with the plan, which is an attempt to address climate change and "dirty" metals made in China and elsewhere.

The proposal from the U.S. Trade Representative's office will be negotiated with the European Union and would create a global "club" of market-oriented countries seeking to reduce carbon emissions, according to Reuters. “Emissions intensity" standards for steel and aluminum production and products would be established, according to a document describing the proposal that Reuters saw.

“Global arrangement" member countries with emissions greater than the established standards would pay higher tariffs when exporting metals to countries with lower emissions, whereas countries with steel and aluminum plant emissions at or below those of the importing country would pay no carbon-based tariffs, Reuters reports.

Countries outside the low-emissions club would be subject to a higher tariff rate when exporting steel and aluminum to countries within the club.

“This is all very conceptual and there’s a lot of work ahead on this,” Reuters quotes one of its sources as saying. “The details are going to be very important.”

Reuters says the proposed low-emissions metals club “would exclude China and other ‘nonmarket’ economies dominated by state-owned or state-directed enterprises, setting out criteria to prohibit member countries from contributing to the problem of unviable excess steel and aluminum capacity.”

The plan would favor U.S. steel, roughly 70 percent of which is made using the electric arc furnace (EAF) method using scrap as the primary input rather than coal-fired blast furnaces and iron ore.

In a March 2022 Recycling Today report, Becky E. Hites of Steel-Insights LLC, Douglasville, Georgia, writes that in the U.S, publicly traded steel companies that report capital investments spent $59.5 billion over the past two decades to maintain and develop their facilities, in part shifting to 71 percent EAF-based steelmaking in 2020 compared with 47 percent in 2000. She says this increased recyclability in the industry, reduced costs, integrated new technologies and improved competitiveness.

“Globally, integrated steelmaking accounts for 73 percent of the total, while in China integrated steelmaking accounts for 91 percent of the total (heading toward an estimated 88 percent by 2026),” she writes.

Hites says the U.S. likely leads Europe in steel industry decarbonization. Europe is working to replace iron ore-based steelmaking, which accounts for 57 percent of its total, with recycling-based steelmaking, currently 43 percent of its total.

Reuters says the EU has proposed a carbon border adjustment and carbon trading schemes that are more complex than the tariff proposed by the United States, and reconciling these different systems could take time.

Reuters adds that the Biden administration's legal authority for putting carbon-based tariffs in place is far from clear.

Latest from Recycling Today

- Lautenbach Recycling names business development manager

- Sebright Products partners with German waste management equipment company

- WasteExpo transitions to biennial format for enhanced experiences

- Study highlights progress, challenges in meeting PCR goals for packaging

- Washington legislature passes EPR bill

- PureCycle makes progress on use of PureFive resin in film trials

- New copper alloy achieves unprecedented high-temperature performance

- Gränges boosts profits and sales volume in Q1 2025