Recycling Today archives

Current and prospective investors in plastic recycling remain uncertain about how or whether the Global Plastics Treaty being written by the United Nations Environment Program (UNEP) will provide genuine backing to their efforts.

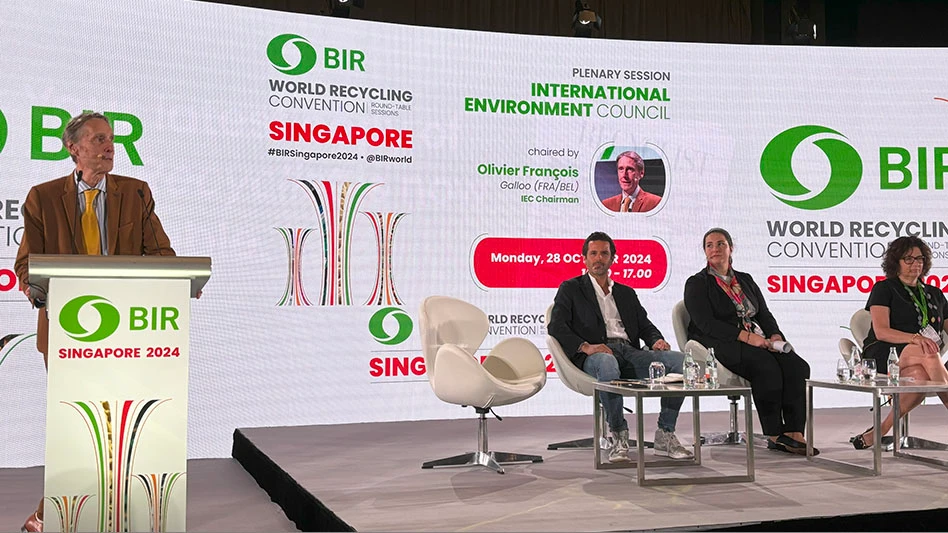

At the International Environment Council (IEC) meeting of the Brussels-based Bureau of International Recycling (BIR), held in Singapore in late October, several presenters expressed skepticism as to whether the treaty will create mandatory recycling targets that would provide a boost to a global plastic recycling market that has experienced a difficult year.

BIR Trade and Environmental Director Alev Somer was among those who cautioned recyclers that a ratified version of the treaty may end up being a voluntary agreement rather than a legally binding treaty.

Plastic recycler Max Craipeau of Singapore-based Greencore Resources says a legally binding version of the treaty would have a greater impact in Asia, from where most of the world’s ocean-bound plastic emanates.

Craipeau said a mandatory recycled content percentage for packaging was particularly important, calling it “essential” for plastic recyclers to be profitable in Asia. “If not, it will be like Europe,” said Craipeau, referring to a situation where brand owners and packaging producers seem to have bypassed recycled-content resins this year when the price drifted higher than that for virgin material.

Sophie Sicard of France-based Paprec, who joined the discussion remotely, said extended producer responsibility (EPR) program backing—which could be a part of the final UNEP treaty—could be useful to increase collection in Asia and other parts of the world with developing economies.

However, she cautioned, EPR programs must not become monopolies and competitors to our industry, another challenge to plastic recycling investors that has reared its head in Europe.

Robin Wiener, president of the Washington-based Recycled Materials Association (ReMA), said that organization sees proposed aspects of the Global Plastics Treaty it favors but others that cause concern.

Among welcome aspects would be attention to design for recycling (DFR), potential targets or mandates for recycled content percentages and financial support for recycling collection and other infrastructure.

Less welcome, Wiener said, would be recycled materials export controls, EPR programs that hinder private enterprise and any equating of plastic scrap-to-energy or fuels (known by its adherents as chemical recycling or advanced recycling) with mechanical recycling.

In reference to the latter, Wiener said, “If you label waste management technologies and waste management processes as recycling, that's not recycling. Definitions become incredibly important in the treaty.”

Overall, Wiener characterized the treaty as “a very important step forward” to solving the problem of an estimated 14 million tons of plastic finding its way to the planet’s oceans each year.

“I appreciate the full life cycle [of plastic] is being looked at,” she said.

The treaty’s view toward the recycling industry, Wiener said, is that it “is not the whole solution, but is part of it. I’m glad they’re not throwing us under the bus.”

The future of the treaty remains unclear, with perhaps only a little more clarity to be provided at the fifth (and potentially final) Global Plastics Treaty meeting in Busan, South Korea, Nov. 25 to Dec. 1.

“We have basically only a compilation text which is definitely very far from the final treaty that we could have, and there are still many open questions, starting with whether this will be a voluntary agreement or a legally binding instrument,” Somer said.

She and other panelists referred to intense lobbying that has taken place at the previous four meetings, with much of that lobbying pressure exerted toward making a nonbinding treaty that places few burdens on primary plastics producers.

Recyclers Sicard and Craipeau said at the very least the UNEP treaty should support the plastic recycling that is already occurring. To Sicard, that includes cross-border trading, calling some current and proposed trade restrictions “not sustainable.”

Craipeau said global mechanical recycling investments to recycle polyethylene terephthalate (PET) beverage bottles have demonstrated proof of concept for mechanical recycling, although in Asia he says only 30 percent of PET bottles are collected for recycling.

He said a treaty that mandates and enforces recycled content targets and perhaps deposit-return systems can act as a “pull mechanism” for the remaining PET bottles and, ideally, other forms of plastic packaging.

The 2024 BIR World Recycling Convention Round-Table Sessions was held at the Raffles City Convention Center/Fairmont Hotel in Singapore on Oct. 27-29.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Recycling Today

- Republic Services, Blue Polymers open Indianapolis recycling complex

- Altilium produces EV battery cells using recycled materials

- Brightmark enters subsidiaries of Indiana recycling facility into Chapter 11

- Freepoint Eco-Systems receives $50M loan for plastics recycling facility

- PET thermoform recycling the focus of new NAPCOR white paper

- Steel Dynamics cites favorable conditions in Q1

- Hydro starts up construction in Spain

- Green Cubes unveils forklift battery line