Recycling Today archives

What once seemed an inevitable and rapid global shift from internal combustion engine (ICE) vehicles to electric vehicles (EVs) has taken on a more regional appearance as portrayed by panelists at a recent Bureau of International Recycling (BIR) meeting.

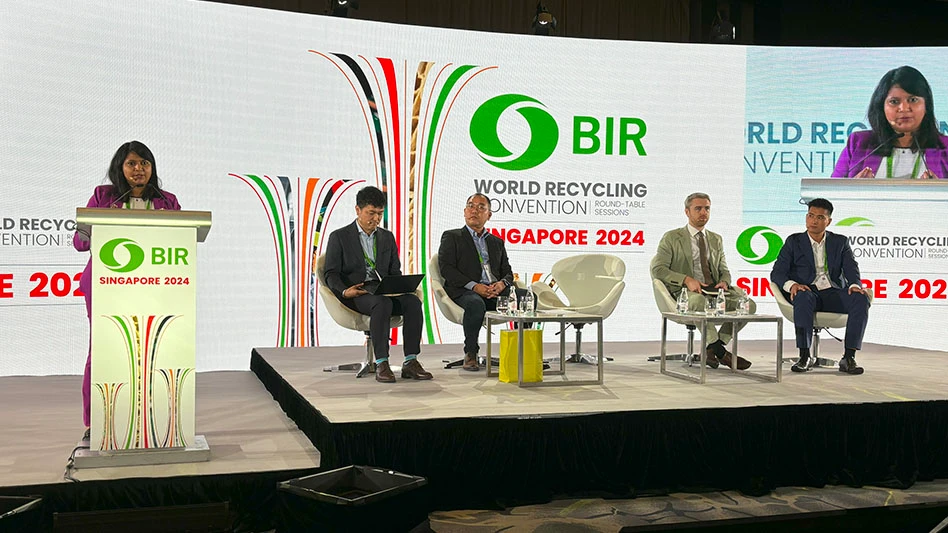

Presentations at the Electrics/Electronics/EV Batteries Committee meeting of the BIR, held in Singapore in late October, covered several topics, including the state of the EV market and the battery materials tied into it.

Lee Allen of United Kingdom-based business information firm Fastmarkets said prices of EV battery metal powders and oxides have been down steadily (and in some cases dramatically) since January 2023. That likewise has affected the value of black mass, a recycled-content powder that contains nickel, cobalt, lithium, manganese and trace amounts of other metals.

Fastmarkets tabulates more than a dozen black mass prices, he said, reflecting the global trade that has developed in EV battery materials.

Much of the black mass devaluation is tied to suppressed pricing in the lithium carbonate market, Allen explained, adding that pricing for nickel salts has not fared as badly in 2024.

Black mass is most in demand in China, where the government and the market have made a rapid shift away from ICE vehicles and toward EVs. South Korea, which also has a vibrant EV battery industry, is another net importer of black mass.

Meanwhile, in the United States and Japan, where EV battery production growth has been slower, black mass tends to be exported. Although numerous investments in EV battery recycling have been announced in North America and Europe, several of those also have been delayed or postponed, Allen said.

He pointed to a delayed Umicore project in Canada, a canceled Glencore and Li-Cycle project in Italy and the postponed Li-Cycle hub in Rochester, New York, as examples of investors backing away from initial enthusiasm to boost their presence in the EV battery recycling sector. (The Li-Cycle Rochester hub could get new life thanks to a recently announced offtake agreement with Glencore.)

Presenter Desmond Toh of Singapore-based GLC Recycle was on hand to represent a company going forward with its EV battery recycling investments.

GLC Recycle was formed in 2022 and has set up EV battery repurposing and “eco-hybrid” (hydrometallurgical and pyrometallurgical) recycling facilities in Singapore and Laos. Both facilities are expanding to be able to handle 72,000 metric tons of EV batteries and battery production scrap annually.

Toh portrayed a global EV market poised to generate 25 million metric tons of EV battery scrap annually, with much of it generated in Asia.

Guest speaker Lionel Lai, who works from Hong Kong for U.K.-based Majestic Corp., said his company is poised to play a role in automotive and electronics recycling markets as they develop. While currently it focuses on recycling catalytic converters generated by the ICE sector, Majestic intends to take part in the shift toward processing end-of-life electronics and other base metals that likely will be in greater demand globally.

BIR delegates who throughout the event heard numerous presentations pertaining to recycled material import and export restrictions could have been heartened to hear from Sadamitsu Sakoguchi from the Industrial and Hazardous Waste Management Division of Japan’s Ministry of Environment.

Sakoguchi provided an overview of Japan’s regulations pertaining to electronic scrap and end-of-life battery materials imports. The rules have been designed to adhere to the Basel Convention while still recognizing the role recycling plays in "converting today’s challenges into tomorrow’s solutions.”

He described Japan as “the top country of e-scrap recycling, in terms of the processed volume, among Organization of Economic Cooperation and Development (OECD) countries.”

Not only does the nation recycle its internally generated electronics, including batteries and printed circuit boards (PCBs), in 2022, more than 48 percent of the electronics items recycled were imported, with 80 percent of that volume coming from other OECD countries, said Sakoguchi.

According to the government official, e-scrap imports into Japan are not scrutinized, but the facilities allowed to recycle them are. The imported materials are processed in Japan only at preconsented recovery facilities with high ESM, or environmentally sound management, capabilities.

Likewise, the materials can only be transported by trucking firms with a specific permit.

The 2024 BIR World Recycling Convention Round-Table Sessions was held at the Raffles City Convention Center/Fairmont Hotel in Singapore on Oct. 27-29.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program