Aluminum industry leaders gathered at the United States Department of Commerce in late June 2017 to present their testimony. There is great uncertainty surrounding the issue of

In this analysis, we present four potential scenarios where tariffs are imposed and we discuss the implications for the aluminum industry value chain.

Procedures and timelines

When industry leaders gathered at the U.S. Department of Commerce (DoC) Auditorium in June, they presented testimony to aid the DoC in determining whether imports of aluminum threaten to impair the national security of the U.S.

This hearing followed a memorandum signed by the president on April 27, 2017, directing Secretary of Commerce Wilbur Ross to proceed expeditiously in conducting his investigation and to submit a report on his findings to the president. Per the rules of 232, the DoC has 270 days to submit its report to the president, putting the hard deadline at Jan. 22, 2018.

During the hearing, 32 industry representatives across the aluminum value chain presented testimony to illustrate their views on the pending investigation. In addition, another 88 companies, associations, and governments filed written testimony for the DoC’s consideration. Even with so much uncertainty regarding the potential actions, it seems clear that the decision will be one of or a combination of the following: 1) no presidential action; 2) restrict aluminum imports via

If imports are restricted via tariffs and/or quotas, there is still a set of important questions that must be answered:

- Will it be a broad-based action covering both primary and

semifinished aluminum products? - Will certain products be excluded from the restrictions?

- Will certain countries be excluded from the restrictions?

- Will there be any mention of “high-purity” aluminum in the restrictions and if so, how will it be defined?

- When will the restrictions become effective?

- Will the restrictions be applied indefinitely, or with an end-date?

For the purposes of this analysis, we’ll focus our scenarios on potential tariffs, given the ambiguity of any potential import quota. In addition, all scenarios will exclude Canada from any action given the following reasons, which illustrate how inter-linked the two countries are:

- NAFTA (the North American Free Trade Agreement) was created to eliminate tariff barriers to agricultural, manufacturing and services, between the U.S., Canada. and Mexico. Actions restricting imports of aluminum from Canada would be counter to this agreement.

- U.S. imports of primary aluminum from Canada accounted for 54 percent of the total in 2016.

- Adding in imports of

semifinished products, primarily in the form of plate, sheet,extrusions and wire, total aluminum imports from Canada reached new highs, exceeding 2.7 million metric tons in 2016. - Canada exported 71 percent of its primary aluminum output in 2016 to the U.S.

- Excluding Canada from any potential trade restrictions would certainly eliminate a number of supply chain challenges that would otherwise emerge.

Primary considerations

In a scenario with a 25 percent tariff on primary aluminum, Russia and the United Arab Emirates (UAE), two nations that accounted for nearly 30 percent of all U.S. primary aluminum imports in 2016, have the most to lose.

The U.S. has become an attractive market for primary aluminum exporters with regional premium differentials between $57 to $75 per metric ton in favor of the U.S. when compared with Europe and Japan respectively during the second quarter of 2017.

It’s not realistic to assume that all imports from these countries would come to a halt, but it is likely that imports would reduce as Canada capitalizes on the opportunity to regain lost market share.

It’s safe to assume that any trade action taken on primary aluminum would lead to a short-term rise in London Metal Exchange (LME) aluminum prices, based on speculation of a tight market. The bigger impact, however, would come from higher Midwest ingot and product premiums, as Canadian suppliers look to capitalize on a closed arbitrage window.

It’s conceivable to think that the application of a 25 percent tariff on primary aluminum would result in a fundamental change to the Midwest premium, taking the form of a “duty paid” premium similar to what exists in Europe. A duty-paid Midwest premium would provide significant benefits to domestic U.S. (and Canadian) primary aluminum producers, in excess of $400 per metric ton, assuming a $1,900 per metric ton LME price, a Midwest premium of 7.8 cents per pound (less freight) and a 25 percent tariff.

This could certainly encourage restarts and/or ramp-ups at curtailed or underutilized smelters.

A tariff on primary aluminum alone would be devastating to the downstream aluminum industry. A simple calculation finds that a tariff applied solely to primary aluminum would increase raw material costs for downstream manufacturers by some $500 per metric ton, further weakening their ability to compete with low-priced imports.

Including the semis

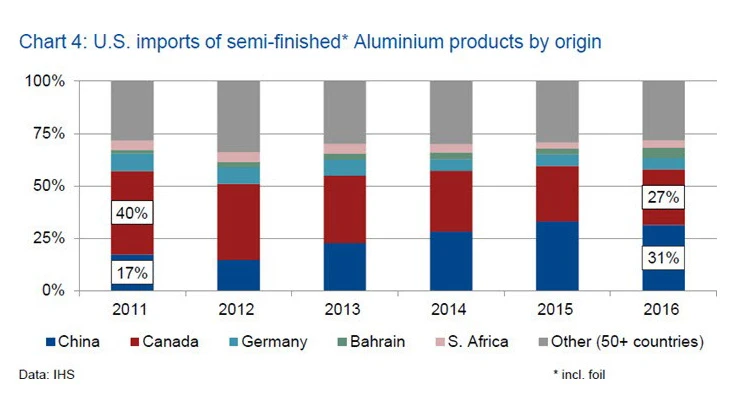

A scenario with a 25 percent tariff on both primary and

It goes without saying that any tariff on semis is a direct shot at China, but one that would be necessary to save the U.S. downstream industry in the event tariffs are placed on primary aluminum.

A duty applied to semis in addition to primary aluminum provides relief to domestic downstream manufacturers. It’s interesting to note the comparison between the benefit to a primary producer versus a semis producer, especially on lower-priced sheet products, where that delta is nearly 2x. Basically, if you increase semi producers’ raw materials costs you need to have a higher duty on semis imports to give them the same benefit as a primary producer.

If a 25 percent import tariff is levied only on all

Excluding foil for a moment, a sizeable portion of the Chinese imports are general commodity grade products such as 3003/5052, or “common alloy” coil and general engineering plate. The price for imported Chinese common alloy coil averages $1.13 per pound, compared to CRU’s June price assessment for

This would level the playing field for domestic suppliers of common alloy and likely push out cheaper imports from China. This also has the potential to bring back domestic production of common alloy, a product that has been decreasingly profitable and subsequently phased out of several mills as a result.

What about foil?

In 2016, imports of plain aluminum foil from China accounted for 73 percent of total U.S. foil imports, a figure that has grown from 49 percent in 2011. The domestic industry stated that the import surge from China was driven by low import pricing that caused U.S. producers to lose significant sales and profits, according to the U.S.-based Aluminum Association.

CRU estimates that peak U.S. foil capacity of 757,500 metric tons was reached in

In April 2017, the U.S. International Trade Commission (ITC) made a unanimous preliminary determination that unfairly-traded imports of certain aluminum foil from China is causing injury to U.S. producers. The preliminary injury determination means the antidumping and countervailing duty cases against imports from China will proceed. Preliminary determinations for countervailing duties were due in early June, but were delayed, leaving many wondering whether the proceedings on foil are held up until a decision is made regarding the Section 232 case.

High purity as a high priority

The high-purity aluminum market in the U.S. is small, and any actions taken solely on high-purity primary aluminum imports would have minimal impact

For the sake of clarity, we’ll consider any primary aluminum at or above 99.9 percent of aluminum content to be high-purity. CRU data suggests the U.S. imported 43,000 metric tons of high-purity primary aluminum in

The Hawesville, Kentucky, smelter belonging to Century Aluminum, with

CRU estimates the U.S. produced 91,000 metric tons of high-purity primary aluminum in 2016, 82 percent of which was produced at Hawesville. The smelter is currently operating at 40 percent of capacity, producing an estimated 101,000 metric tons of aluminum per year.

However, none of this currently is high-purity aluminum, according to a statement made by Century Aluminum CEO Michael Bless in his testimony to the DoC in June, citing competitively priced imports as the reason for ceasing production.

Total U.S. consumption of primary aluminum (of all purities) was 5.37 million metric tons in 2016. Total supply of high-purity aluminum in the U.S. (production plus imports) accounted for only 2.7 percent of total U.S. primary aluminum demand in 2016.

Reading the tea leaves

In light of the testimony and the overarching themes, CRU believes that either no action will be taken or that there will be a broad-based tariff applied to both primary and

Country-specific quotas are also likely to be considered, with the potential for volumes being capped at a certain percentage of prior year averages, and then duties applied to any volume exceeding that cap. It’s also possible any actions implemented could be used as a weapon to bring China to the negotiating table, and then lifted once the two countries arrive at a negotiated solution.

While much remains unknown about the current Section 232 national security investigation on steel imports, we have set our expectations. This self-initiated investigation is directed more at providing relief to U.S. steelmakers and to providing a platform for future trade negotiations than truly investigating steel imports and national security. In other words, the premise that national security is under threat is false; it is being used as a tool to arrive at

CRU expects to see quick action

The author is a senior analyst and team leader for North American aluminum at London-based CRU. He can be reached at doug.hilderhoff@crugroup.com.

Latest from Recycling Today

- Magnomer joins Canada Plastics Pact

- Electra names new CFO

- WM of Pennsylvania awarded RNG vehicle funding

- Nucor receives West Virginia funding assist

- Ferrous market ends 2024 in familiar rut

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities