Image courtesy of The Aluminum Association

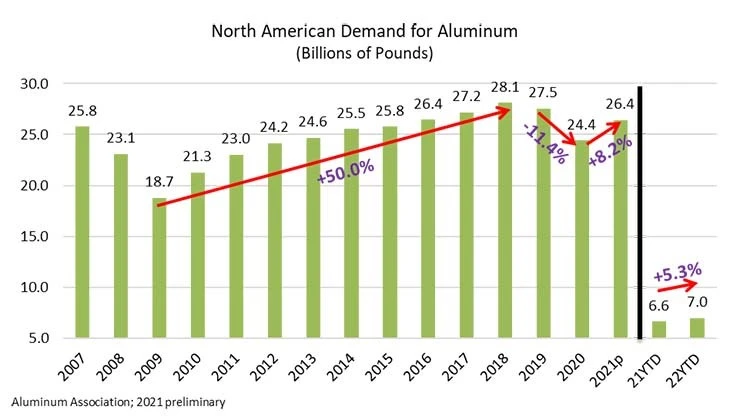

The Aluminum Association, Arlington, Virginia, has released preliminary estimates as part of its monthly Aluminum Situation Report showing a 5.3 percent growth in demand for the aluminum industry in North America through the first quarter of 2022. This follows estimated 8.2 percent demand growth through the end of 2021 and comes during a period of significant investment by U.S. aluminum producers, fabricators and recyclers.

“The picture for the U.S. aluminum industry remains very strong,” says Charles Johnson, president and CEO of the Aluminum Association. “Economic recovery, demand for recyclable and sustainable materials and robust trade enforcement are all making America a very attractive place to make aluminum, as evidenced by the fastest pace of investment for the industry in decades.”

The report states that aluminum demand in the United States and Canada totaled an estimated 7 million pounds in the first quarter compared to 6.6 million in the first quarter of 2021. All major semi-fabricated product categories saw increased year-over-year demand growth in the first quarter, led by sheet and plate products by 15.2 percent and extruded products by 7.3 percent. Overall, mill product demand grew 11 percent year-over-year through the first quarter.

Aluminum exports, excluding scrap, to foreign countries declined 29.8 percent in the quarter. Imported aluminum and aluminum products into North America grew by 37.4 percent year-over-year in the quarter after growing 21.3 percent in 2021. While growing, these import levels remain below record volumes last seen in 2017.

The association’s index of net new orders of aluminum mill products has shown an increase of 1.8 percent year-to-date.

Over the past year, the aluminum industry has collectively committed or invested nearly $3.5 billion in U.S. manufacturing and more than $6.5 billion over the past decade. This included a $2.5 billion investment by member company Novelis to build a greenfield low carbon aluminum rolling mill and recycling facility in Bay Minette, Alabama, which is the single largest domestic aluminum investment in decades, according to the association.

The association says the Aluminum Situation Report is one of more than two-dozen ongoing industry reports developed by them through surveys of aluminum producers, fabricators and recyclers.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program