Photo by DeAnne Toto

Singapore-based Navigate Commodities uses proprietary maritime and satellite technology that enables its users to monitor their clients, competitors and vendors in real time.

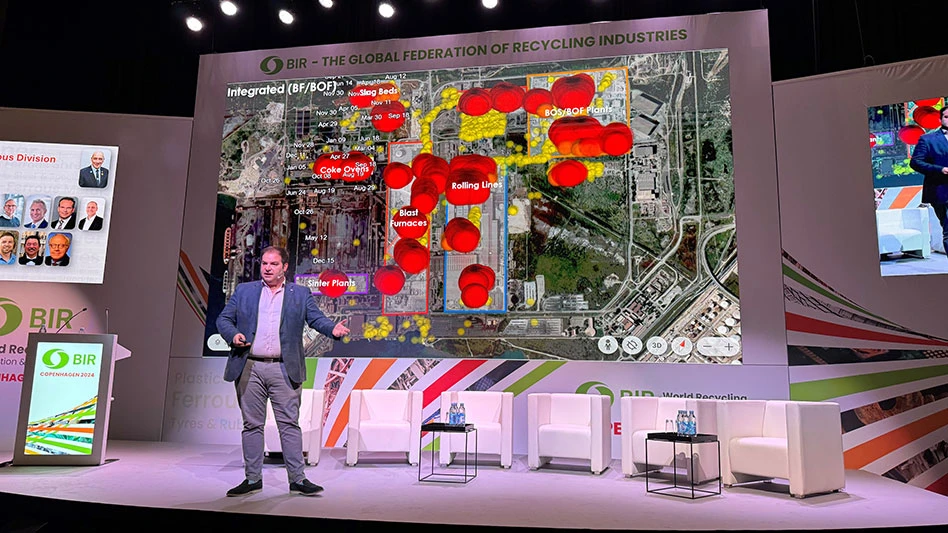

The company’s Managing Director Atilla Widnell, addressing the Ferrous Session during the Bureau of International Recycling (BIR) World Recycling Convention and Exhibition in late May, said the company monitors the movement and consumption of dry bulk commodities over land and sea using these powerful satellite-based technologies, tracking short- and deep-sea vessels and barges, stockpiles and melt shop activity around the world.

These capabilities provide a “high-level view of supply and demand globally,” he added, providing “real-time data to help in decision making” rather than relying on “backward-looking data” the industry typically has used.

In the area of vessel tracking, Widnell said, “Looking at barge flows has never been done before.” The company uses the barges’ GPS signal to determine where they are moving at any given time.

Using Navigate Commodities, it is possible to acquire a national consumption picture for steelmaking raw materials and identify where material is being acquired.

Navigate Earth uses thermal infrared satellite imagery, meaning it cannot see the actual assets, only hot spots, Widnell said, to monitor “real time-ish smelting activity,” as the data are updated every four hours.

“Our data tends to lead customs data,” he said, noting that it also correlates with production figures from the World Steel Association, Brussels.

Navigate Commodities covers 99 percent of steel production globally, he said. The company can even see which coke ovens are being turned off in China.

Widnell offered his observations of the recovered steel marketing and said the focus on green transition and move to more electric arc furnace- (EAF-) based steel production is going to exceed the availability of scrap in key consuming markets. “I don’t believe all of these [announced EAFs] will come online because of the lack of available scrap.”

He said steel production in Turkey has been struggling over the last 18 months because of the country’s fiscal policy, and the country's lower steel production is affecting ferrous metal demand. “Turkey is becoming more of a price taker in terms of negotiations," he added.

Additionally, since the start of the Red Sea crisis last October, the number of vessels using the Suez Canal has fallen from 80 per day to approximately 40.

Widnell also observed that recycled steel generation is “not great” but slowly improving in most parts of the developed world and that the “terrible” domestic market for steel in China has put the country on a course to record annual steel exports of more than 100 million metric tons this year for the first time since 2016.

He cautioned against a number of looming risks to the ferrous scrap market, which include protectionist recycled ferrous metals trade policies, politicization of maritime trade routes, excess Chinese steel production, wider margins in export versus domestic markets and looming availability of direct-reduced-iron-grade feedstock in the form of the Simandou Mega Iron Ore Project in Guinea.

In the panel discussion that followed, Widnell said Navigate thought steel mills would be early adopters of its services, but the ferrous metals industry has been very receptive. He said the company works with three of the biggest steel mills in Europe but wants to serve both sides of the trade because the industry can benefit from better information symmetry.

Also speaking during the Ferrous Session was the BIR’s Rolf Willeke, who presented statistics from the 15th edition of “World Steel Recycling in Figures.”

Willeke confirmed that recycled steel use across key countries and regions declined by 12 percent last year to 411.28 million metric tons, despite a 0.2 percent increase in total crude steel production to 1.56 billion metric tons, representing verified data for 82.2 percent of global steelmaking.

China remained the world’s largest user of ferrous scrap, though its consumption declined 0.8 percent year on year to 213.68 million metric tons. This decline equates to a 21 percent share of its crude steel production.

Turkey’s use of recycled steel stood at 86.3 percent last year, with a 10.1 percent drop in the country’s overseas recycled steel purchases, which were 18.78 million metric tons. However, this decline failed to unseat Turkey from its long-held position as the world’s foremost recycled steel importer, with India in second place following a 40.4 percent increase to 11.76 million metric tons and Vietnam placing third for the first time at 5.143 million metric tons, a 19.6 percent increase.

The leading recycled steel exporter in 2023 was the EU-27 following a 9.2 percent year-on-year increase to 19.219 million metric tons. The USA placed second even though its overseas shipments fell by 6.9 percent to 16.26 million metric tons.

The BIR World Recycling Convention and Exhibition was May 27-29 in Copenhagen at the Bella Center.

Latest from Recycling Today

- Imbalance factors enter the recycled steel market

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe