A panel of speakers addressed resin markets and their potential effects on recycled plastics markets during a plenary session at the Plastics Recycling Conference, organized by Resource Recycling Feb. 1-3 in New Orleans.

Phillip Karig, managing director of Mathelin Bay Associates LLC, a St. Louis-based firm that offers supply chain and technical consulting services to the plastics processing industry, stressed the importance of surviving this difficult time.

He detailed the differences in the markets for polypropylene (PP) and polyethylene (PE) resins, noting that the “Shale Revolution” left PP producers feedstock constrained, leading to high prices.

“The PP price went up in January, though the oil price cratered,” Karig added.

This situation has created a multiyear seller’s market for PP, he said.

PE producers who are fully integrated to natural gas “are big winners in Shale Revolution,” Karig said, adding that a wave of North American PE capacity will hit the market this year.

PE buyers will gain leverage throughout 2016 and 2017 as a result, he predicted, adding, “It will be difficult for the PE market to maintain tightness through export plans.”

Regarding recycled plastics, Karig said, “A lot of scrap inventory plus sharp virgin price drops can break a recycler.”

He noted that decreased price spreads between virgin and repro are pressuring margins for recyclers. Additionally, excessive competition is increasing scrap costs and “pinching” supply.

Recyclers also are facing potential liability from customers who expect recycled plastics to “not only run like virgin but to be virgin,” he said.

Karig suggested that recyclers sell their value by creating food-contact-grade postconsumer recycled (PCR) resin in specific colors rather than black repro.

“The closer and sooner you work with the scrap generator, the more potential value,” he said. “Start talking with them when they are designing the product; don’t wait until they are selling scrap.”

Tison Keel, a director with IHS Chemical, said PET (polyethylene terephthalate) is in oversupply in North America, Asia and Europe. PET pricing likely will be constrained for several years in North America as a result.

Keel also said he anticipated the introduction of antidumping duties for PET.

Rationalization is the “only solution” to the overcapacity situation, he said, adding that 2017 will be an important transition year.

“The closer and sooner you work with the scrap generator, the more potential value.” – Phillip Karig, Mathelin Bay

Keel added that the low cost of virgin PET would test brand owners’ commitments to using recycled PET (rPET).

Joel Morales, a director for IHS Chemical’s North America polyolefins business, said the PE market was shifting from a seller’s market to a buyer’s market. However, he predicted that North American producers would have a cost advantage beginning this year.

Morales said PP has been a “lousy business” historically, though it is now “making a ton of money.” He predicted PP pricing would be driven by tight markets and increased outages in 2016.

While North American PP producers do not rely on export markets, Morales said PE producers can’t ignore them. “PE has to respect arbitrage, PP does not,” he added.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

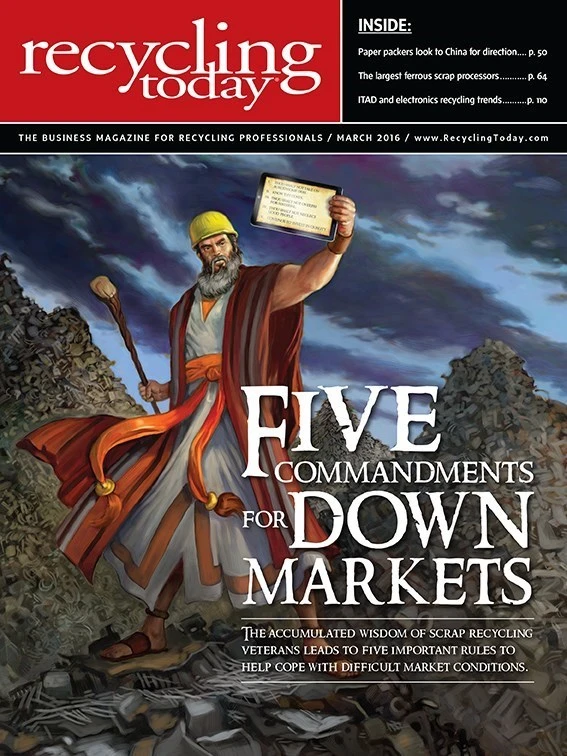

Explore the March 2016 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Toppoint Holdings expands chassis fleet

- Lego creates miniature tire recycling market

- Lux Research webinar examines chemical recycling timetables

- Plastics producer tracks pulse of wire recycling market

- Republic Services, Blue Polymers open Indianapolis recycling complex

- Altilium produces EV battery cells using recycled materials

- Brightmark enters subsidiaries of Indiana recycling facility into Chapter 11

- Freepoint Eco-Systems receives $50M loan for plastics recycling facility