Winter weather affecting travel in several U.S. regions in January continued through the first two weeks of February, and the subsequent tightening of ferrous scrap generation and transportation likely contributed to a rise in recycled steel prices.

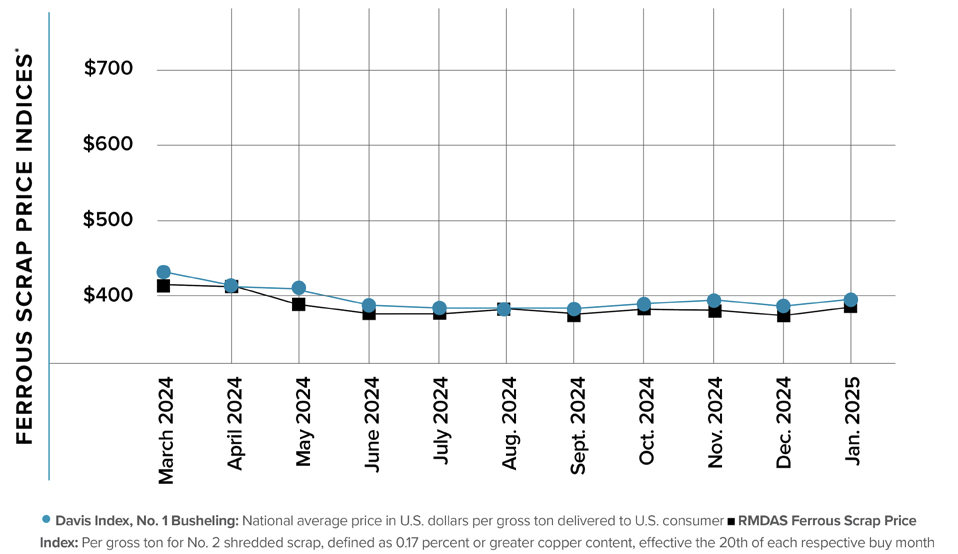

After shredded scrap ended 2024 at less than $375 per ton on average, as of the second week of February, Davis Index had U.S. mills paying $406 on average.

At that time, a recycler whose company does business in several U.S. regions predicted the price for shredded and other benchmark grades likely would rise during the rest of the month.

“Scrap flows are still lethargic, and weather is still a factor nationally affecting scrap availability.” – U.S. scrap processor and trader

“The polar vortex, for most of January, was the pivotal event escalating the upturn of scrap prices,” the contact tells Recycling Today. “Cold weather and storms reduced scrap intakes by over 40 percent in some regions in January.

“This was after mills overdid inventory reductions in November and December of last year. The net effect was too little scrap at a time when some modest restocking started in January, and scrap prices increased by about $20 per ton.”

As the second week of February progressed, more disruptive weather moved in, with weather services predicting a series of three ice and snowstorms for parts of the Midwest and eastern U.S.

“After all settles, the market will be up by more than $40 for shred and busheling and more than $30 for cut grades in February,” the recycler says. “Scrap flows are still lethargic, and weather is still a factor nationally affecting scrap availability.”

Also in February, American steel mills enacted price increases for hot-rolled coil (HRC) steel, rebar and other mill products. Metals industry analysts have cited rising scrap costs as well as a 25 percent tariff on inbound steel announced by President Donald Trump as likely factors.

The Steel Manufacturers Association, which represents recycled-content electric arc furnace steelmakers, has endorsed the tariff regimen as positive for its own sector and American industry overall.

However, the recycler contacted by Recycling Today is not as uniformly supportive, saying, “There is more optimism and concern about the tariffs. While tariffs could help some, it hurts others, including the all-important consumer.”

Before the White House announced its across-the-board tariff on all inbound steel, it announced and then delayed a tariff on all inbound materials and products arriving from Canada and Mexico.

Such start-and-stop actions emanating from the White House do not sit well with business planners, according to the recycler.

“It’s less about the tariffs and more the uncertainty that creates the concern,” he says. “How do you plan for the unknown? Unfortunately, chaos is the agenda for the next four years.”

As of mid-February, overseas buyers had been slow to react to the rising prices, though reports from Davis Index during the second week of February indicated buyers representing mills in Turkey and the Indian subcontinent were making higher offers for U.S. scrap.

Atilla Widnell of Singapore-based satellite tracking and analysis firm Navigate Commodities says traders should refer back to the first Trump administration and its set of tariffs regarding pricing circumstances for the rest of this year.

In a February LinkedIn post, Widnell says, “Domestic U.S. flat-rolled HRC benchmarks surged 40.9 percent (or $270 per short ton, to $930 per ton) in the seven months after the implementation of President Trump’s first round of tariffs [in] 2018.”

Calling those increases “a harbinger of things to come in 2025,” Widnell says American HRC buyers, along with galvanized steel and tubes and pipes, are among those likely to “feel the most pain” as post-tariff pricing sets in.

In the first five weeks of this year, mills in the U.S. operated at 74.2 percent capacity, according to the Washington-based American Iron and Steel Institute (AISI).

Although U.S. mills produced about 0.3 percent more steel, or 23,000 tons, in the first five weeks of 2025 compared with early 2024, the mill utilization rate was down from 75.4 percent in early 2024 because of added capacity.

Looking back to 2018 for his example, Widnell says the new tariffs—if they stay in place as announced and without exemptions—could cause the U.S. mill capacity utilization rate to rise from 10 percent to 15 percent as the year plays out.

Explore the March 2025 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility