Alpert & Alpert, one of America’s largest independent scrap metal recyclers, will be celebrating its 75th anniversary next year. The Los Angeles-based firm will also be opening a new state-of-the-art recycling facility in Long Beach within the next few months that, company President Alan Alpert says, will put Alpert & Alpert in position to be one of the world’s largest scrap metal recyclers.

Alpert notes that this is a good time to be in the scrap metal recycling business on the West Coast. "Demand has been incredibly strong for the last couple of years," he says.

That demand, he notes, has been driven by the Asian markets, especially China. "We export a large percentage of the material we purchase," he says. "There was a slight dip in orders for ferrous metals in the spring due to changes and some reconfigurations in China," Alpert says, "but the orders began picking up again in mid-June."

METALS MOVING. George Adams Jr., president of Adams Steel, based in Anaheim, Calif., and John Sacco, president of Sierra Iron & Metal, which is based in Bakersfield, Calif., agree with Alpert’s assessment.

Both men are national officers with the Institute of Scrap Recycling Industries Inc. (ISRI), Washington, and both represent established, successful companies. Sierra I&M is an almost-60-year-old medium-sized scrap metal processor with a sister company that sells processing equipment, while Adams Steel has been a growing business for 30 years.

"The demand has been fairly strong, especially from China, and the prices have been very high," Sacco says. The market price for ferrous scrap has exceeded $100 per ton throughout the year—and sometimes well above that, he notes.

In scrap markets, though, what goes up also comes down. "While it is hard to tell the future, forecasts are for continuing fairly decent demand. It is just that China is still such an unknown. From what I understand, demand from China is good, but I hear the banking system there is a shambles."

Alpert also anticipates continued strong markets in China and elsewhere in East Asia, but suggests that the demand may be more commodity-specific than it has been in the past.

The industry leaders report that domestic demand is also strong right now. Alpert notes that with the economy growing again, industrial output and, with it, the amount of scrap being generated are up.

Sacco reports that 90 percent of Sierra’s iron output goes to domestic buyers, while its nonferrous material is mainly sold overseas. "A lot of the available domestic scrap was cleaned out during the first part of the year," he says. "We’re not sure how much obsolete scrap is still out there."

He notes that Sierra has added some more staff during the first half of the year and purchased some new equipment. "We may buy a few more pieces," he says.

Adams reports that his firm is in the process of installing two new car shredders, replacing two older shredding plants. He says the new shredders should be in place and operational by the end of the year.

Alpert says that his firm is always looking for expansion possibilities. "We are careful to expand in a measured and controlled manner," he says. "We have built our reputation on quality and integrity. We want to make sure we are able to uphold that reputation."

A FUTURE FOR FIBER. For paper recyclers in the western United States., the amount of export tonnage to Asia varies according to distance from markets and the local demand for their products. Therefore, while a recycled paper processor such as Fiber Trade Inc., based in Burlingame, Calif. (near San Francisco), ships 90 percent of its product overseas, Far West Fibers in Portland, Ore., has more than enough buyers in the area to account for all of its production.

Far West Fibers has been in business for almost 25 years. The company processes more than 400,000 tons of recycled paper per year. "We deal in predominantly bulk- grade paper," says John Drew, the company’s president.

Drew reports that while the company exports a small percentage of its product, most of its output is sold to pulp and paper mills in the northwestern states. "The mills have been reliable customers who have honored their contracts despite contamination issues and the state of the economy," he says.

Business is "on the mend," Drew observes, as the economy improves. "Alan Greenspan is keeping a lid on inflation," he says.

Drew reports that he is seeing many of the company’s clients registering higher sales volumes as consumer demand grows. That translates into more recycled paper being made available for Far West Fibers.

The size of newspapers, however, has been shrinking, he points out. That is cause for some concern. It’s not just that readership has changed and circulations are down. As well, the press size for many periodicals and dailies has changed.

"I have a small scale at home and I am in the habit of weighing the Sunday paper," he comments. "Until the economy began to turn around last year, the ad sections were pretty thin and the weight of the paper was down. But there has been good growth in the Portland and Seattle areas, and the ads are back to where they were. That means more recycled paper for us."

Drew feels that Far West Fibers has done a credible job of maintaining volumes and profitability through the down times of the last few years. "We just have to continue slogging it out and keep an eye on costs."

Richard Tavola, president of 15-year-old Fiber Trade Inc. is equally upbeat about export sales. "Our business is growing at 6 [percent] to 8 percent per year," he says. "We are seeing increased demand in Asia but not as much demand domestically. There are no new mills being built in North America."

Fiber Trade sells about $30 million worth of product per year, Tavola reports. Pricing remains good for all grades of paper, he says. In the spring and early summer, mixed paper was selling for $90 per ton.

"One mill in China has been buying up all our excess inventory," Tavola says. "We expect there will be some cutbacks in orders at some point, but we are not sure when. We don’t foresee any increases but, if there is a downturn, we think the price drop-off will only be about $5 per ton."

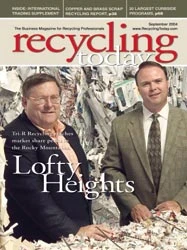

Brad Heinrich’s problem in terms of exports is that Denver is too far away from anywhere else. "We probably export about 10 percent of our production," says the president of Denver-based Tri-R Recycling. "The freight costs from here are very high regardless of which direction we ship."

Tri-R Recycling has been in business in Denver for 27 years. (See "Lofty Heights," starting on page 26 of this issue.) The company processes 11,000 tons of recycled paper per month. Other than the shipping costs, Heinrich says that everything is positive.

"Demand is really high," he says. "We have been tracking the average price over the past 10 years and prices have been increasing. Right now, they are $20 above average across the board. Mill inventories are low, and we are soon into the Christmas box and packaging season. The near-term outlook is positive."

|

Oregon Scrutinizes Container Recycling |

|

The Oregon Department of Environmental Quality (DEQ) has begun a year-long, statewide recycling study that will help the state get a more accurate picture of the numbers and types of beverage containers that Oregonians are recycling as well as the effectiveness of special curbside programs and recycling depots. DEQ hopes that getting more specific information about the number and types of containers Oregonians are recycling, plus data about residents’ use of curbside collection programs, can help community recycling programs statewide. DEQ expects to release preliminary results in January 2005 and conclude the study in June 2005, issuing a report summarizing study findings later that year. Some of the objectives of the study include the following: • Getting a more accurate picture of the average amount of recyclables set out Sponsored Content Labor that WorksWith 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals. • Determining the amount of material set out at the curb that is not recyclable. • Determining the amount of curbside material that is not properly prepared by • Gaining a better understanding of how materials are collected. • Evaluating the recycling of rigid plastic containers by resin type being • Determining the number of other beverage containers—by container and The emphasis will be on residential collection, but samples will be taken from commercial recycling locations and recycling depots as well as from single-family homes and apartments, the DEQ says. The agency expects to collect, sort and measure more than 100 curbside recycling samples consisting of recyclables from more than 2,500 households. Once data is gathered, DEQ will assess the effectiveness of recycling collection systems currently in use throughout the state. |

"It’s mostly paper,’ Heinrich says. "We were handling some curbside collection before that was also primarily paper products."

To accommodate the anticipated larger volumes of paper, Tri-R Recycling has ordered new sorting and processing equipment. The single-stream sorting system, reports Heinrich, costs in the $2 million range and measures 90,000 square feet. It is scheduled to be installed by June of 2005. "We are modifying our existing plant to house the new machinery," Heinrich says.

All the processors seemed to agree that American secondary fiber retains the highest quality in the world, a factor that helps them market material in good markets and in bad.

The author is a freelance writer based in Winnipeg, Manitoba, Canada. He can be contacted at myron@autobahn.mb.ca.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the September 2004 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- European project yields recycled-content ABS

- ICM to host co-located events in Shanghai

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- Aimplas doubles online course offerings