Over its 24-year history, Toledo, Ohio-based Kripke Enterprises Inc. (KEI) has become one of the most notable nonferrous scrap brokerage firms serving the scrap processing industry in North America. In 2016, the company traded 145 million pounds of nonferrous scrap, primarily in the form of aluminum—45 million more pounds than it traded in 2011, which is when KEI first exceeded 100 million pounds.

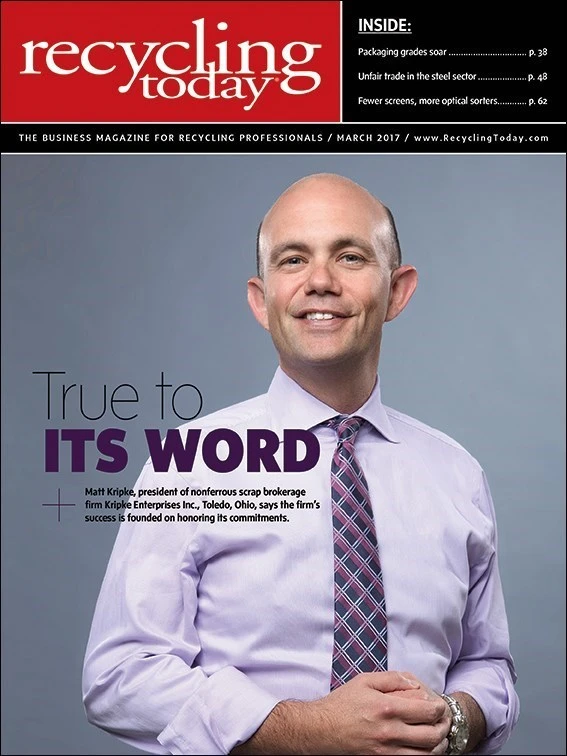

President Matt Kripke attributes the company’s growth in part to its credo: We do what we say. “By always treating our suppliers and consumers with this credo in mind, we are able to satisfactorily manage issues and problems,” he says.

KEI’s use of product price hedging, customer credit controls and conservative risk management also has helped the company preserve capital and minimize losses, Matt says, contributing to its steady growth over the last two decades.

Gaining scale

Larry and Joan Kripke, Matt’s parents, founded KEI in 1993. At that point, Larry had a considerable resume in the nonferrous scrap business that included running a secondary smelter, a copper granulating line, a hedging operation and many other aluminum and copper operations.

He began his career in the nonferrous scrap industry in 1965, working for his family’s scrap metals brokerage firm, Sherwin Metals, in Toledo. In 1976, Tuschman Steel and Sherwin Metals merged to form Kripke-Tuschman Industries, and Larry became head of nonferrous operations. In 1983, OmniSource Corp., Fort Wayne, Indiana, acquired Kripke-Tuschman. Larry remained with OmniSource following the sale, eventually heading the Ohio nonferrous trading group, before leaving to form KEI in 1993.

Matt joined KEI in 1994 after a five-year career in sales with Vector Marketing.

“Way back when I came in with my dad, he was very clear,” Matt says. “Dad said, ‘I worked for a big company and have managed a lot of people, and I’m not interested in doing that any more. I don’t want to grow this company; you will have to.’”

When Matt started with KEI, he added other marketing opportunities and expanded the company’s sales territory.

Matt began running the company in 2010. Of his time at the helm, he says, “The fundamentals have remained the same, but the size and scope of what we do, that has changed over the last five or six years.”

In the last 10 years, the volume of material KEI handles has doubled, with much of the growth occurring in the aluminum sector, Matt says.

As KEI’s volume has grown, so has its trading staff. In 2001, the company added Marvin Finkelstein, who today also serves as vice president of its southern region and is based in KEI’s Boca Raton, Florida, trading office. Andy Golding joined the company’s Toledo office in 2005 and serves as vice president of sales and marketing. Chad Kripke and Eric Phillips joined the company in KEI’s Toledo office in 2008. Chad now serves as vice president of the northern region. Eric was hired to manage KEI’s warehouse and moved into the trading group in 2011. Todd Engle, who works out of Boca Raton, joined the firm in 2012. Most recently, KEI added Patrick Richardson to its trading team in Toledo.

“Our philosophy is to build the business from within in order to build it successfully,” Matt says. “KEI has always chosen its staff carefully and effectively to create a team of market experts.”

Andy handles Kripke’s recruiting. “When we let someone into our company, it is like welcoming them into our family,” he says. “We take great care of them, and, therefore, they always return the favor.”

Matt says the firm’s no-commission structure for its trading staff is unique among brokerage firms. “This builds a team approach and ensures all personnel are on an equal playing field,” he says. “They all pull for each other and for the company as a nucleus. We believe this structure is the most effective basis to allow the employees to then concentrate on serving the customers as their first priority.”

One of the best lessons Matt says he learned from his father is “people don’t care how much you know until they know how much you care.” He credits Larry’s success as an entrepreneur and leader to this philosophy, adding that he “loves his employees like family and treats them all with respect.”

In total, KEI employs 17 people as well as periodic temporary laborers in its Toledo warehouse. The company uses this 50,000-square-foot space to consolidate loads, perform light processing and handle rejections for its dealers.

Specializing in aluminum

Early in its history, KEI made the strategic decision to focus on aluminum scrap, which currently accounts for 95 percent of the nonferrous scrap the company trades in, Matt says. “Back then, as a young company, money was tight, and our decision was based on eating up less of our line [of credit] with a lower-priced nonferrous commodity,” he explains. “Now, we have plenty of capacity, but we have developed an expertise.”

Marvin adds that while some scrap dealers take pride in selling directly to consumers, they “shouldn’t short sell the institutional knowledge that our company has in terms of what to do with any flavor of aluminum.”

Matt adds, “We have focused on educating ourselves on all of the consumers, their needs and what items may work as substitute products. We have become the experts in all things aluminum scrap in North America. Our supplier base uses us as a one-stop shop to help them find the best markets for their aluminum.”

Matt says KEI “specializes in a lot of the grades that are not as easy to place and might require someone with a little more knowledge.”

The company purchases material from scrap dealers throughout North America.

“Our Mexican suppliers are very important to our business, and a lot of that scrap comes back into the U.S.,” Chad says. “Also, we import and export a fair amount of scrap with Canadian suppliers and consumers.”

KEI’s consuming customers include companies that make coil, secondary alloys, slab, can sheet, billet and extrusions, Matt says. “We also sell into a number of smaller specialty homes that may use aluminum or copper as additives in their processes.”

He adds that most of KEI’s sales are based on formulas and are for an entire year. Matt and Chad work together to keep the company’s position hedged at all times. “We also utilize credit insurance to qualify our consumers and protect our risk,” Matt says.

The benefits of brokerage

Matt has a number of compelling reasons designed to persuade scrap dealers who don’t see the benefit of using KEI to sell their scrap metal.

First, he says the volume of material KEI trades in helps to ensure better prices than a scrap dealer handling a few loads per year might be able to negotiate.

Additionally, Eric says, most consumers pay within 30 to 60 days, while KEI has the ability to pay more quickly. “Thirty to 40 percent of our customers ask for quicker terms and like to use us as a bank, which we are happy to do.”

He continues, “In order to be successful in the recycling business, treat all employees, customers and consumers with total respect. It also helps to always pay to the negotiated terms! That sounds so basic, but, unfortunately, there are still companies out there that play with payment terms.”

KEI also helps to smooth out the market for scrap dealers, Matt says, buying material even when consumers claim not to be purchasing. “Scrap dealers would like to sell when the price is high,” he says. “Consumers, in general, if they don’t hedge, prefer to buy when the price is low. Because we hedge, we don’t care where the market is.”

KEI also uses credit insurance, which helps to protect its scrap dealers from risk. “We want to pay our bills on time and fulfill our promises,” Chief Financial Officer Scott Chaffee says, adding that KEI invests in credit insurance “for our suppliers.”

While Scott says credit insurance is expensive, “our feeling is that is part of what we are about: managing risk and making sure nothing catastrophic can wipe us out.”

To further aid in managing risk, KEI purchases Superfund Recycling Equity Act (SREA) reports from the Institute of Scrap Recycling Industries (ISRI), Washington, through its SREA Reasonable Care Compliance Program. The program is designed to help ISRI members perform due diligence on their consuming facilities. ISRI says it uses URS Corp. and one of the largest regulatory environmental databases in the nation to provide members with information that includes publicly available, comprehensive environmental compliance information compiled from more than 1,200 federal, state and local databases, Freedom of Information Act requests and facility questionnaires and supporting data.

KEI has been an ISRI member since the company’s founding.

“As brokers, we are not required to get these reports, but we take pride in protecting our scrap dealers,” Matt says of the SREA Reasonable Care Compliance Program.

The other selling point that Todd mentions is the level of customer service KEI offers to its scrap dealers, which includes providing a variety of options in the rare case of a rejection. “Our commodity is aluminum, but really we are a customer service company,” he says.

Beyond buying and selling

Roughly 20 to 30 percent of the volume of nonferrous scrap KEI handles passes through its warehouse and a few tolling locations, Matt says. “The rest of our volume is brokered from Point A to Point B.”

Chad describes the light processing KEI performs at its Toledo warehouse as “the stuff that other people don’t like to do or don’t have the workforce to do.” This includes cleaning dirty aluminum wheels and sorting mixed metal loads using hand-held analyzers. “It’s not very sexy,” he says, “but we found a niche for that.”

In addition to the extensive knowledge of the metals KEI deals in and the needs of its consuming customers, Matt credits the company’s honesty and attention to customer service as factors in its success.

When it comes to addressing issues, Andy says, “This is where our first-class service shines. We turn lemons into lemonade almost weekly. We pride ourselves on providing options and partnering with our dealers in the event there are any problems. Sometimes, we bring challenged loads to KEI’s Toledo warehouse for cleaning.”

Roughly 4 to 5 percent of the material KEI buys is contaminated metal that must be toll processed. The firm works with a small network of processors to do so. These processors melt down the irony aluminum, removing the steel as dross. The aluminum is then formed into sows or coils.

“We are doing some form of toll processing at all times,” Matt says. “Sometimes it’s 1 million pounds per month, other times it’s 100,000 pounds per month.”

Continued growth

Matt plans to continue to grow KEI in the coming years. As of now, he says the company is out of space in its Toledo warehouse. “We have been looking for a bigger space for a year or so now.

“Also,” he continues, “we are looking at other opportunities to grow our business, including one potential acquisition. If it comes to fruition, it will close late in the first quarter. So, yes, we plan on significant growth over the next five years.”

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the March 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- Aimplas doubles online course offerings

- Radius to be acquired by Toyota subsidiary

- Algoma EAF to start in April

- Erema sees strong demand for high-volume PET systems