Veteran metals recyclers often are quick to say when prices drop suddenly or an old and respected company enters into bankruptcy that they have seen such things before and that there are ways to survive downturns and manage through them. Similarly, they are quick to point out to younger colleagues (or journalists) not to get too heady during the good times because those stretches don’t last forever either.

There is no disputing the notion that business history repeats itself and that the values of commodities rise and fall with great frequency based on supply and demand variables that hold true almost as steadfastly as any law of physics.

Nonetheless, it also seems difficult to dispute that the first decade and a half of this millennium produced a metals commodities market that often reached the outer limits of any bell-shaped curve in terms of price volatility, demand growth and global trading activity. Just as difficult to dispute is that the rapid economic development, infrastructure build-out and urbanization of China was the overarching factor during that 15-year stretch.

“As China enters 2016, however, a party-approved key term is ‘new normal,’ referring to the country’s slower growth economy.”

Although the nation’s economic reforms began taking hold in the early 1980s, at that point China and its 1.3 billion people were still largely agrarian. The nation’s leaders and its people would spend the next two decades beginning to put in place an infrastructure and a basic materials industry that could begin to propel China onto the roster of developed nations.

By the turn of the century, the momentum had built into a force that moved China into the lead positions as the world’s largest steel producer (1996), aluminum consumer (2004) and copper consumer (2002). The scrap recyclers who could supply metallic units to China’s hungry consumers enjoyed a surge of demand that allowed them to expand and further globalize their businesses.

As China enters 2016, however, a party-approved key term is “new normal,” referring to the country’s slower growth economy. The nation is so far ahead as the world’s largest steel and nonferrous metals producer that its crown is likely safe for some time. However, it also is supplying much more of its own scrap and is moving toward being far less of a net scrap importer.

Recyclers who have taken part in the global scrap market from 2000 to 2015 will undoubtedly witness future market disruptions that will create price volatility or sudden surges or drops in demand. The benchmark for comparison during such events, however, is likely to involve some of the peak volatility circumstances that arose when China and its 1.3 billion people moved rapidly from the underdeveloped side of the ledger to the family of developed nations.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

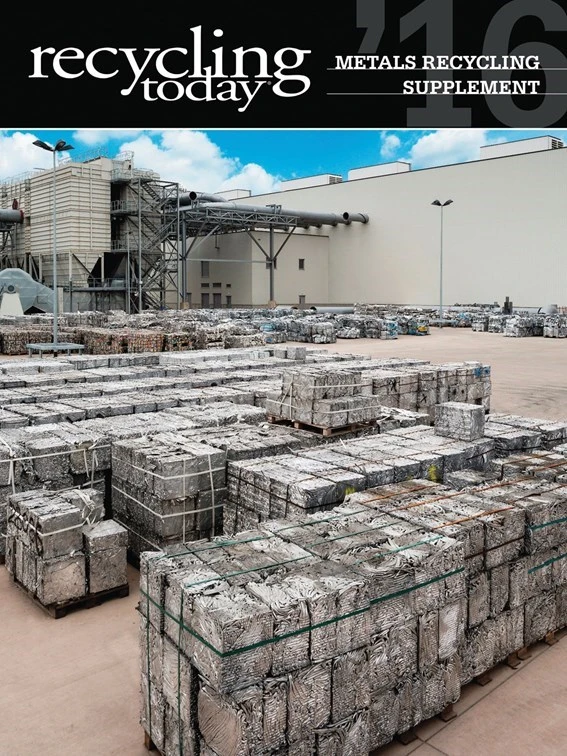

Explore the Jan 2016 Metals Recycling Supplement Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- Aimplas doubles online course offerings

- Radius to be acquired by Toyota subsidiary

- Algoma EAF to start in April