Statistics from China’s General Administration of Customs (GAC) point to substantial declines in imported scrap volumes in January 2018 compared with previous figures.

Scrap metal shipments into China fell to 490,000 metric tons in January 2018 compared with 700,000 metric tons in December 2017 and 660,000 metric tons in January 2017, according to an online report from Reuters.

The January 2018 volume figure—a decline of 30 percent from the previous month and of 5.7 percent from one year ago—includes aluminum, copper

The copper scrap January 2018 total of 200,000 metric tons declined 27.5 percent from one year ago, Reuters reports.

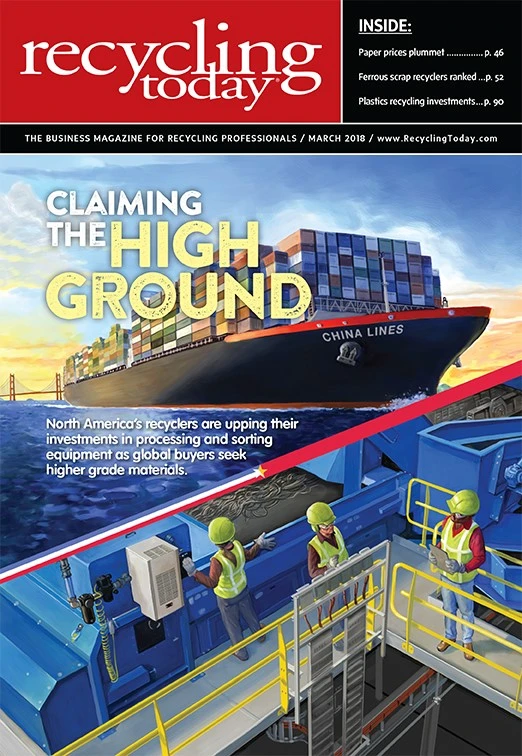

The declining volumes are tied to Chinese Ministry of Environmental Protection (MEP) policies intended to prohibit and restrict many types of imported scrap materials. The actions include an outright ban on some two dozen types of scrap and impending purity levels on others that recyclers contend cannot be met.

As a result of these scrap import restrictions, a forecast produced by one of China’s largest copper producers, Jiangxi Copper, estimates that some 500,000 metric tons less copper scrap will be imported into China in 2018 compared with 2017, according to an online article by Metal Bulletin.

The publication says Jiangxi Copper’s brokerage division disclosed its estimate in mid-January 2018, calculating a figure that would represent a 45 percent drop in imported red metal scrap.

Much of the drop will result from China’s MEP restricting the volume of wire and cable scrap and scrapped motors entering the nation, Metal Bulletin says.

In early 2018, the MEP has been slow to release import quotas for both types of scrap. As of mid-January, import quotas for the ports of Ningbo and Taizhou have been greatly reduced, while recyclers and scrap consumers in the Tianjin area in northern China and Guangdong province in southern China are still awaiting the issuance of quotas.

Domestically, Andy Wahl of Atlanta-based TAV Holdings Inc. and vice president of the Brussels-based Bureau of International Recycling (BIR) Non-Ferrous Metals Division reports in that organization’s World Mirror: Non-ferrous Metals dated January 2018 that spreads are widening for nonferrous metals dealers. Wahl adds that the spread for No. 2 copper scrap has more than doubled since the end of 2016.

Additionally, he writes, “higher trucking costs have made overseas shipment more attractive of late in cases where the processor is close to export ports. It is actually cheaper to export metal in most instances than to ship within the USA if the distance exceeds 500 miles. In short, therefore, the export market is keeping a little pressure on the spreads of domestic consumers.”

Explore the March 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- APR, RecyClass release partnership progress report

- Clearpoint Recycling, Enviroo sign PET supply contract

- Invista expanding ISCC Plus certification program

- Redwood partnership targets recycling of medium-format batteries

- Enfinite forms Hazardous & Specialty Waste Management Council

- Combined DRS, EPR legislation introduced in Rhode Island

- Eureka Recycling starts up newly upgraded MRF

- Reconomy Close the Gap campaign highlights need for circularity