Speculation more so than market fundamentals may be influencing the rising price of refined copper following the announcement that China plans to ban all types of Category 7 scrap materials, which includes many forms of plastic scrap, mixed paper and scrap motors, wire and cable.

According to an article in Barron’s, refined copper prices increased 7 percent in July, fueled by concerns surrounding China’s proposed scrap import ban and the belief that demand for refined copper will increase as a result.

However, the French bank Natixis along with a number of commodity sector analysts and journalists believe speculation is the primary factor behind the increase in prices. They posit that the low-grade copper-bearing scrap still will find its way into the country after initial processing in other nearby nations.

Natixis has concluded that the lower grade scrap copper targeted by China’s proposed ban “will still be circulating in the market and is likely to end up in surrounding developing ASEAN (Association of Southeast Asian Nations) countries in order to be processed. The processed scrap copper would then return to China as an acceptable copper import. This should mean that the end product from scrap will be unchanged and at a similar price that Chinese refiners would have processed the scrap metal for.”

Analyst Gianclaudio Torlizzi of Milan-based T-Commodity says China may have imported about 1.2 million metric tons of copper scrap in 2016 and likely will import a similar amount in 2017.

Those figures are based on the weight of the copper and not on the steel or plastic attachments that come with it, he says. Delving into that aspect of the imports,

Torlizzi continues, “Some quarters believe the material will still likely end up in China but simply be dismantled and sorted elsewhere first, with other countries in Southeast Asia seen as likely destinations. If this is the case, ultimately the ban could amount to just a crackdown on some dismantling businesses in China seen as heavy polluters.” He concludes, “Simply put, the ban is unlikely to affect China’s copper supply.”

According to a news item from Platts that was posted to the Hellenic Shipping News website, the price of copper on the Shanghai Futures Exchange (SHFE) also increased in early August, following confirmation from the China Nonferrous Metals Industry Association (CNIA) that it had been notified about the country’s ban on scrap wire,Get curated news on YOUR industry.

Enter your email to receive our newsletters.

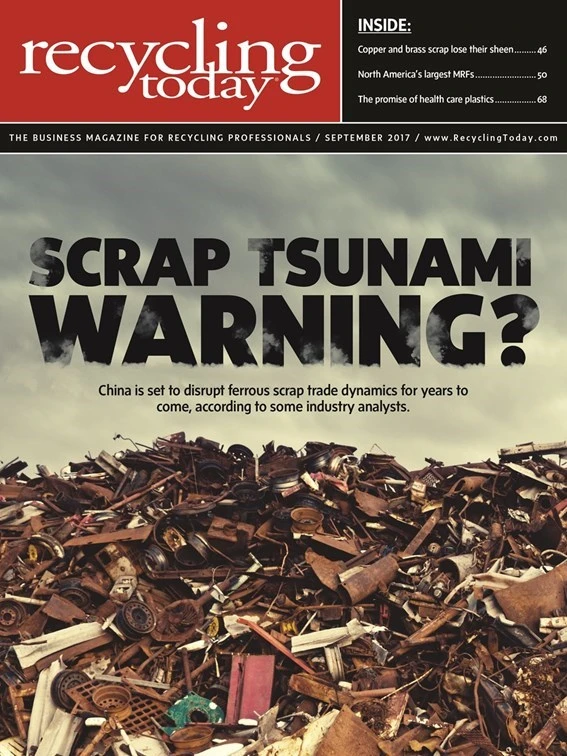

Explore the September 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- ReMA board to consider changes to residential dual-, single-stream MRF specifications

- Trump’s ‘liberation day’ results in retaliatory tariffs

- Commentary: Waste, CPG industries must lean into data to make sustainable packaging a reality

- DPI acquires Concept Plastics Co.

- Stadler develops second Republic Services Polymer Center

- Japanese scrap can feed its EAF sector, study finds

- IRG cancels plans for Pennsylvania PRF

- WIH Resource Group celebrates 20th anniversary