S&P Global Platts Analytics

S&P Global Platts, an independent provider of information and benchmark prices for the commodities and energy markets, has launched three new daily spot price assessments for U.S. postconsumer polyethylene terephthalate (PET) bottle bales, effective April 1.

According to S&P Global Platts, the postconsumer plastic bottle price assessments will “bring crucial market insight and price transparency" based on the company's experience building independent and robust assessment methodologies. The provider says it hopes this new transparency will help increase market participants’ understanding of how recycled plastics are evolving into tradable commodities.

“Our new recycled plastic assessments offer market participants crucial price transparency that helps develop open and fair markets at a time when the supply of quality recycled plastics raw material is their top challenge,” says Ben Brooks, head of plastics recycling price reporting at S&P Global Platts. “U.S. legislators are considering proposals that mandate radical change to minimum recycled plastic content, which will only increase the need for independent pricing based on a robust methodology.”

S&P Global Platts states that this service may especially help if legislation such as the Break Free from Plastic Pollution Act of 2020 passes. That legislation was unveiled in February and aims to create a nationwide container-deposit system where producers would be required to fund waste and recycling systems as part of an extended producer responsibility (EPR) program. This legislation would shift the burden of waste collection and recycling from taxpayers and states to producer companies. It would also propose incremental increases in the minimum recycled content used in foodservice products to 25 percent by 2025, with a three-year moratorium on new polymer-resin plant construction feedstocks.

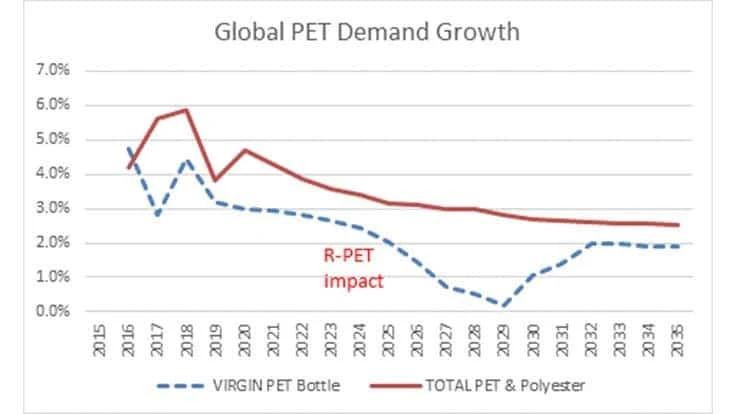

“Plastics recycling is a critical component of the circular economy,” adds Rob Stier, petrochemical analyst at S&P Global Platts. “In a market where demand will continue to outweigh supply, securing a reliable source of recycled plastics at a fair price will be challenging and S&P Global Platts Analytics forecasts that competition for quality, recycled plastics will be fierce over the next decade. The trend seen in Europe with recycled PET flakes pricing higher than virgin PET may become the new normal, with buyers having to pay a premium for food-grade recycled PET. Therefore, having confidence in the recycled plastics prices will be increasingly important to help market participants meet the recycled content demanded by the marketplace.”

According to S&P Global Platts, its daily assessments will reflect price information for the Greater Los Angeles and Chicago areas on a free-on-board (FOB) basis, as gathered and published through Platts’ price assessment process, closing at 4 p.m. CST.

FOB Los Angeles prices will reflect premium-grade material, primarily sourced from redemption centers, with a minimum PET content of 70 percent, and curbside material with a minimum PET content of 60 percent. Bales sourced from the Los Angeles area should consist of at least 80 percent clear bottles.

The Chicago assessment will reflect mixed-colored bales, excluding black and solid colors, sold on an FOB basis with a minimum PET content of 60 percent and gathered from a curbside collection process. Bales could consist of clear, transparent green, or transparent light blue bottles.

The assessment will reflect material that is picked up on the same day up to seven days forward from the date of the transaction. Prices will be published in U.S. cents per pound. Transaction volumes for both locations will reflect a typical range of 35,000 to 40,000 pounds (approximately one 53-foot trailer load). S&P Global Platts offers more information on its new price assessments here.

Latest from Recycling Today

- Hindalco to invest in copper, aluminum business in India

- Recycled steel price crosses $500 per ton threshold

- Smithers report looks at PCR plastic’s near-term prospects

- Plastics association quantifies US-EU trade dispute impacts

- Nucor expects slimmer profits in early 2025

- CP Group announces new senior vice president

- APR publishes Design Guide in French

- AmSty recorded first sales of PolyRenew Styrene in 2024