Amyriad of business, political and demand-driven factors are converging within Mexico’s growing recycling sector that hold both promise and concern for the companies doing business there.

Amyriad of business, political and demand-driven factors are converging within Mexico’s growing recycling sector that hold both promise and concern for the companies doing business there.

On the promising side, the North American nation has been a long-time supporter of free trade agreements, as witnessed through its thriving Maquiladora Program, in place since the 1960s, under which thousands of international corporations have located operations in the country, taking advantage of its adept and affordable labor force.

Now a key pillar of Mexico’s economy, maquiladora operations also have helped drive the growth of its recycling sector, both directly and indirectly.

With growing numbers of manufacturers and their supply chains having established operations to Mexico, scrap recycling companies that do business there have found a complex mix of conditions in terms of acquiring and processing these secondary commodities.

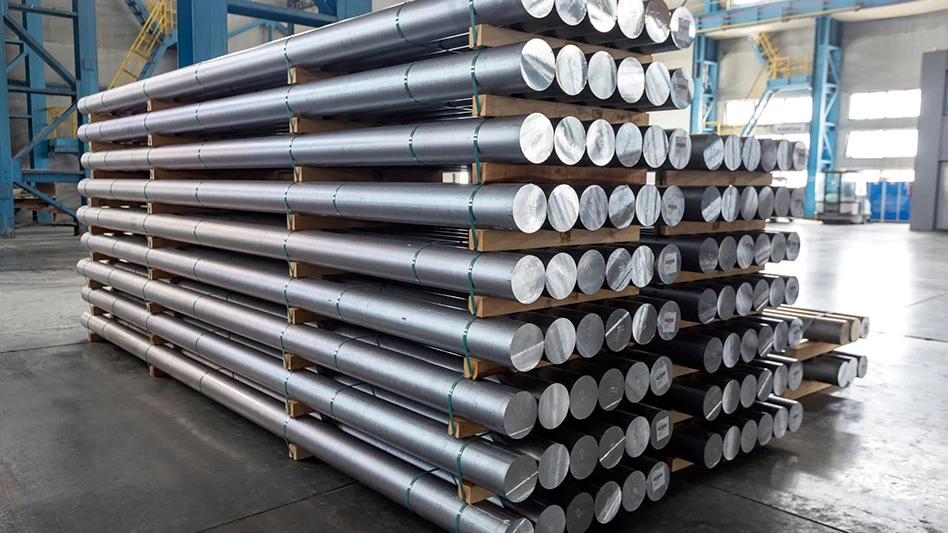

Driving metal trade

A key driver of Mexico’s manufacturing sector has been the automobile industry, with just about every major carmaker having established a presence there in recent decades. As such, the steel and aluminium sectors have followed suit, with numerous mills, foundries and smelters also calling Mexico home. And where metals consumers reside, scrap metals operations to supply them are not far behind.

Ignacio Sanchez, vice president and managing director of the Buenos Aires, Argentina-based office of Scrap Service, a division of Tenaris Group, discussed Mexico’s ferrous sector during a presentation at the Bureau of International Recycling’s (BIR) World Recycling Convention, held in early June in Miami, Florida.

Sanchez said that Latin America’s diverse markets are characterized by growing demand, a lack of scrap and poor infrastructure. As such, Sanchez commented, Mexico’s steel production capacity is expected to grow from its current level of around 24 million tonnes to 28 million tonnes by 2018. Major steelmakers with operations in Mexico include Deacero, Simec, Turnium, Tenaris and Gerdau, he said. Most of these mills also have new investment projects planned for the coming years, with just about all of these in the area of electric arc furnace technology, a heavily scrap-dependent model.

For this reason, Sanchez added, ferrous scrap needs in Mexico are also expected to grow. In 2013, the country required some 11.6 million tonnes of scrap, of which 1.3 million tonnes was imported.

“Exports are low and reducing each year due to increasing demand in the country.” Sanchez said.

Sanchez said Mexico’s industrial scrap is concentrated in the northeast region of Mexico, where industrialization has been strong: the areas of Monterrey, Tamaulipas and Coahuila. Meanwhile obsolete scrap is generated more evenly from throughout the country.

Alejandro Jaramillo, founder of Glorem SC, a service provider for the international recycling industry based in Tijuana, Mexico, delivered a market report on the aluminium scrap trade in Mexico and other Latin American regions during the BIR event. Jamarillo, also a second-generation member of the scrap recycling industry, serves as the Mexican representative on the BIR’s Nonferrous Board. He says Mexico’s long-standing commitment to free trade has been a major factor in attracting industry to the nation, and thus recycling, as the country supports 12 free trade agreements with 44 countries.

“Mexico has done a nice job of establishing free trade agreements with Europe, Japan and South American countries,” he says, “so that has helped diversify Mexican business.”

Jaramillo says Mexico also has been an appealing location for manufacturers because of its young population engaged in the labor force. The country also has low labor costs in comparison to somecountries and is becoming more competitive in comparison to China.

“Some indicators say that in 2020 Mexico’s labor costs will be cheaper than China’s,” he said, referring to predictions of a 273% rise in China’s labor costs by 2020.

Jaramillo says the demand for secondary aluminium throughout Mexico is high and growing, a result of the increasing numbers of automakers and secondary aluminium smelting firms installing facilities in the country.

The car industry has been a notable sector in Mexico, with some 3.1 million vehicles expected to be produced in the country in 2014, Jaramillo said. While the domestic market for vehicles has stagnated, Jaramillo says, “exports keep growing and Mexico is now the eighth largest producer of vehicles in the world.”

When it comes to nonferrous scrap, Jaramillo says Mexico presents a great opportunity for processing services, as much of the processing that used to be handled in China is now slowing down.

“Those processes are coming back to America,” he says. “Companies investing in establishing those processes I think have a good opportunity for turning a good business.”

He referred to cable chopping as one example of the kind of processing work that presents an opportunity in Mexico going forward.

However, Jaramillo also noted that the country’s complex tax structure may be preventing Mexican recyclers from investing in additional processing capacity at the current time. Recent changes in maquiladora laws regarding how scrap processors must document their transactions could create a strain on cash flow for some companies, he said.

“The problem is the fine points of the law were just very recently drafted, so there’s a lot of uncertainty about how to understand and interpret them,” he says. “If you get it wrong, you can have a bad fiscal exposure.”

Jaramillo says scrap processors still don’t have certainty on how to document their transactions.

“The Mexican scrap owner is more worried about the tax system and how to deal with the tax system than actually processing scrap, so that’s a huge huge distraction,” he adds.

Another challenge for ferrous scrap recyclers in Mexico has been a disconnect in pricing paid by the major consuming mills in comparison to what recyclers must pay to acquire the scrap. Recyclers typically pay based on the American Metal Market (AMM) basis pricing, but the mills do not. “What happens in Houston is not necessarily what happens in Mexico or Guadalajara,” he says. “Consumers don’t buy basis AMM. They don’t follow AMM.” Another issue, Jaramillo says, is the problem of price distortion caused by companies attempting to integrate VAT into scrap prices.

The large territory and underdeveloped infrastructure throughout Mexico also makes for complex logistics with regard to metals trade. Jaramillo conceded the country “has a bad reputation for underinvesting in infrastructure,” and he doesn’t expect that to change in the near term.

Another challenge, Jaramillo said, is Mexico’s slower than expected growth rate. The country’s economy grew at a rate 1.8 percent for the first quarter of 2014, a period for which the IMF forecast a 3 percent growth rate. But, he adds, the domestic market is growing better than others. “Even though we are not meeting our growth targets, the region is still growing at a better pace than developed economies,” Jaramillo said.

Evolving markets

Lane Gaddy, president of W. Silver Recycling of El Paso, Texas, says the firm has served consuming companies in Mexico throughout its 90-plus years in business. The company describes itself as the only full-service recycler on the U.S.-Mexico border. In late 2013 the company opened a consolidation center and trading office in the Monterrey, Mexico, suburb of Apodaca. The new office was set up to service the company’s industrial accounts in Mexico.

Gaddy says the ferrous market tends to dominate the recycling industry in Mexico. His company attributes the majority of its business to customers in Mexico, and this majority has grown in recent years.

“The industry we service continues to push further and further [south], and to provide value to our chain, we had to establish that office,” he says. The company now has six offices, including larger processing centers on the border in El Paso and Donna, Texas. The company specializes in copper and steel, but also handles plastics and paper.

“We are seeing more and more larger manufacturing operations locating in the interior of Mexico, as well as a lot of changes in the Mexican legislation, that we believed it necessary to have a physical footprint in Mexico,” he says.

In the ferrous sector, Gaddy says, metal tends to flow based on which market is higher. He says two years ago, the Mexican mills were “red hot.” Companies received “huge numbers to sell to Mexico,” he says. But in 2013, demand fell, causing some Mexican ferrous scrap to flow to U.S. mills. “It’s a true supply and demand play,” he says.

Gaddy points to logistics and a cultural advantage of Mexico as another reason for its growing appeal to industry. Looking at the auto industry in Mexico, with many of its supply chains also now in Mexico, finished goods time to market is much faster than it used to be when suppliers were based in China.

“We’re seeing a ton of companies bring [operations] back from China and expanding their Mexican operations,” he says. He points to the automotive, electronics and plastics sectors as key industry examples.

Gaddy says while Mexican scrap dealers have “done very very well in the last few years, as more industry has moved in,” 2013 was not a very good year, as Mexican steel mills weren’t paying suitably high prices for scrap. With industrial accounts tied into U.S. formulas, he says, recyclers didn’t have a way out of the contracts.

Gaddy refers to what has been punitive legislation against Mexican recyclers, in particular relating to maquiladora programs. He believes the moves are intended to promote the use of domestic suppliers.

Another issue he says is the Mexican government’s recent crackdown on VAT tax refunds to prevent fraud. “That is going to be very challenging for the marketplace to absorb these changes,” he says.

Gaddy says doing business in Mexico is not for the uninformed. “There’s a steep learning curve in time and money to understand how to operate in Mexico, and there are additional risks.” Beside material quality and theft, he cited foreign currency risk as another factor.

He says much of W. Silver’s business relates to production scrap from its industrial customers. That material may be sold to consumers in the U.S., Asia or Mexico. “It depends on what type of material it is,” Gaddy says. The copper, brasses and stainless tend to flow to the U.S. or overseas, whereas the steel and aluminium tend to stay in Mexico.

The company is also recycling a small amount of paper in the form of OCC (old corrigated cardboard) from existing industrial suppliers.

Postconsumer opportunities

The paper recycling industry in Mexico is growing but it has even more room for growth, says Frank Sanchez, who is vice president of strategic development for Centennial Recycling, based in Aurora, Colorado., in the U.S.

The company focuses primarily on recovered paper grades and Sanchez is involved in supplying Mexican paper mills with all the major paper grades, most notably OCC, white ledger and pulp substitutes.

Previously Sanchez worked for Bio-PAPPEL International, where he was based in New Mexico in the U.S.

He says Mexico’s paper recycling industry has changed in recent years, with a consistent drop in demand for imported OCC and other grades from Mexican mills, as recovery rates in Mexico have steadily increased. Over the last five years, he says, Mexican mills have become more vertically integrated.

“Now a lot of them have multiple recycling plants that help them recover waste paper at the grass roots level, so they are increasing the domestic supply that way,” he says.

For example, Sanchez says that recovery rates in Mexico used to be around 47% back in 2008, according to Mexico’s Champer of Paper. Today the rates are closer to 57%.

“You could say the majority of their furnish in Mexico is coming domestically now,” he says.

With this change, Sanchez says his company has increasingly worked to add value to transactions, looking at specific end products with an eye to the most cost-effective furnishes.

“We try to fit the right type of OCC to their use, and match it up on their end by generator,” he says.

He says another trend is major players converting smaller box plants to mega plants, and also converting to natural gas instead of oil to power their plants.

Sanchez points to curbside recycling as key opportunity area for Mexico. This practice is still very much in its infancy, says Sanchez, with a lack of recycling collection schemes and material recovery facilities.

“There is a lot of opportunity as far as developing MRFs and single-stream curbside,” he says.

The author is managing editor of Recycling Today Global Edition and can be reached at lmckenna@gie.net.

Explore the July 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Pettibone adds new model to telehandler line

- ICIS: One chemical recycling technique experiences pitfalls

- American Beverage marks 5-year anniversary of Every Bottle Back

- Prism Worldwide raises $40M in Series A, A1 funding

- Trademark Metals Recycling opens new Florida facility

- Amcor to acquire Berry Global in $8.43B all-stock transaction

- Crown qualifies coils produced at Constellium’s new recycling center

- Ecore receives investment from low-carbon fund