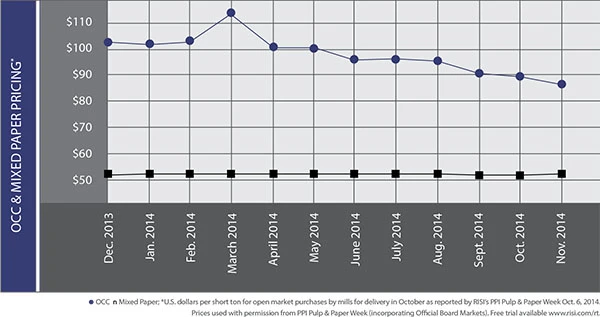

Paper stock markets are expected to creep along through the end of the year. Market conditions for most paper stock grades have gradually deteriorated throughout the second half of the year, and prices have softened as the year draws to a close. As 2015 approaches, paper recyclers say clarity is hard to find.

Prices for bulk grades likely will remain under pressure as slack exports continue, sources say, and little upward momentum is forecast for most recovered fiber grades.

The chilliest outlook appears to be for bulk grades, most notably old corrugated containers (OCC). China, traditionally a large consumer of OCC generated in North America, has not been purchasing material aggressively, resulting in further price declines for the material. One source says prices for double-sorted OCC at the port in New York City have dipped by $10 per ton from October to November.

The slow pace of offshore buying has been a concern for many paper stock dealers. With exports ebbing, many paper stock dealers say domestic mills are more aggressive with their pricing and are insisting on better quality material.

In light of reduced offshore buying of low grades, domestic paperboard mills have reduced their recovered fiber inventories, sources say.

Adding to the concerns of many paper stock dealers is the lack of growth in generation of new material. Traditionally, OCC generation picks up at the end of the year because of the holidays. As of mid-November, however, few sources were reporting a notable increase in OCC availability.

High grades, including most pulp substitutes, have displayed a moderately better market outlook, though several sources say prices have not moved upward over the past 12 months. A growing concern is the lack of generation from commercial printers and envelope shops.

While markets have been fairly listless in most regions of the country, paper stock dealers on the West Coast are expressing growing alarm over labor issues at ports along the West Coast. Because West Coast recyclers are more dependent on export markets than recyclers in other regions of the country, the slowdown in activity at the largest ports in the region is exacerbating problems.

A number of sources say union workers at all ports on the West Coast have slowed down, which is backing up the loading and unloading of vessels that are destined for Asian buyers. The labor problems began at ports in Seattle and Tacoma, Washington, and moved to the California ports of Los Angeles and Long Beach. Combined, the four ports handle nearly 80 percent of all containerized cargo shipments at West Coast ports.

The problems began when the workers’ contract expired June 30. Negotiations between the longshoremen’s union and terminal operators have been difficult, and longshoremen have essentially been operating in slowdown mode, sources say.

This move, according to a large exporter, has resulted in a “slow death” for his business. The exporter estimates that he is unable to load perhaps 15 percent of his containers in light of the slowdown.

“I can’t cut costs anywhere else to make up for the loss in shipments,” he says.

Even though the exporter says he is renting warehouse space to store his company’s baled material, he worries the situation will worsen.

The challenge of obtaining sufficient shipments of clean old newspapers (ONP) has been an ongoing concern for many consumers of this material, including Resolute Forest Products, Montreal. However, Resolute recently sold most of its paper recycling collection assets to EWJ International Inc., an affiliate of Jordan Trading, a well-respected paper recycling company based in New York. The sale involved AbiBow Recycling LLC, which includes the ubiquitous Paper Retriever and EcoRewards programs. Paper Retriever bins are used by schools and churches to raise money through paper recycling.

Explore the December 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- OnePlanet Solar Recycling closes $7M seed financing round

- AMCS launches AMCS Platform Spring 2025 update

- Cyclic Materials to build rare earth recycling facility in Mesa, Arizona

- Ecobat’s Seculene product earns recognition for flame-retardant properties

- IWS’ newest MRF is part of its broader strategy to modernize waste management infrastructure

- PCA reports profitable Q1

- British Steel mill subject of UK government intervention

- NRC seeks speakers for October event