Autumn has brought not only colder weather to parts of North America but also a frosty reception for ferrous scrap processors hoping to sell their products at stable prices.

Price indices calculated by American Metal Market (AMM) revealed an across-the-board drop in prices of $30 or more per ton for transactions conducted in the early November buying period.

The downward trend also was evident in transaction pricing collected by the Raw Materials Data Aggregation Service (RMDAS) of MSA Inc., Pittsburgh. RMDAS pricing in the period covering the first 20 days of October showed pricing dropping by $16 to $20 per ton in that time frame.

AMM’s ferrous scrap export index prices are now all below $300 per ton, with heavy melting steel (HMS) off the Pacific Coast selling for just $277.50 per ton. The Midwest indices calculated by AMM, meanwhile, have No. 1 HMS down to $314 per ton, shredded scrap at $326 and No. 1 busheling at nearly $354, losing $32 from its October value.

The drop in prices is not likely to make things easier for processors who have already bemoaned 2014 as a year of low margins and competitive pressure to procure scrap.

Addressing attendees of the 2014 convention of the China Nonferrous Metals Association Recycling Metal Branch (CMRA) in Guangzhou, China, in early November, Scott Horne of the Institute of Scrap Recycling Industries (ISRI), Washington, portrayed some of the factors at play in the current market.

Regarding global economic conditions, Horne said World Bank and International Monetary Fund (IMF) forecasts for 2015 do not lend support to the idea that a new calendar year will ease slow economic growth in Europe and elsewhere.

In the U.S., Horne noted that the light vehicle industry has returned as an important generator and consumer of scrap metals. However, the housing market in the U.S., he added, “remains bumpy at best.”

The health of the U.S. auto industry alone has not been enough to stave off the falling value of metals. At the same time scrap processors are contending with lower steel and ferrous scrap prices, they also are buying and selling in an environment where copper has lost 10 percent of its value in recent months.

In looking for good news, the fall in ferrous scrap prices potentially could bring about a rebound in interest from overseas buyers, with mill buyers in Turkey, Taiwan, South Korea, Egypt and India all seeking feedstock.

Working against that notion, however, is the strength of the U.S. dollar versus the euro and several other currencies. Many buyers in scrap-deficit nations are turning first to sources in Europe to take advantage of the euro’s current relative weakness against the dollar.

A Spain-based trader says he has benefitted in the past several months by trading in euros, as he has seen increased inquiries from spot-market Asian buyers.

An Oregon-based processor, meanwhile, describes his containerized ferrous export business as “negligible,” adding that he has sold his ferrous scrap through other channels.

An Oregon-based processor, meanwhile, describes his containerized ferrous export business as “negligible,” adding that he has sold his ferrous scrap through other channels.

One potential bright spot in the export market may involve Indian foundries. A ferrous trader based in the Great Lakes region says with land acquisition and permitting for large steel mills being so difficult in India, a growing foundry sector is stepping in to fill the void, especially for ferrous alloys and specialty steels.

The Great Lakes ferrous trader says he is aware of more than two dozen recent or planned installations of small induction furnaces into the iron and steel sector in India and in its neighboring nations.

The furnaces are capable of producing metal in batches of 50 metric tons or less at a time, though they can produce batches continuously for up to two weeks before requiring downtime for maintenance.

No individual induction furnace location can absorb a significant flow of scrap on its own. Collectively, however, the induction furnaces may soon start drawing upon container loads of imported ferrous scrap as they continue to ramp up their operations.

To what extent Indian steel foundries will turn to the United States for scrap supply is uncertain, with the stronger dollar posing one possible deterrent.

As Horne mentioned in his November presentation, developing Asian nations also are beginning to close their scrap supply deficits. He noted that one recent study forecasts China to be self-sufficient for red metal scrap by 2023. Other forecasts see China becoming a net exporter of ferrous scrap within several years as its auto industry grows and as structures built since its post-1980 economic revival begin to enter the demolition cycle.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

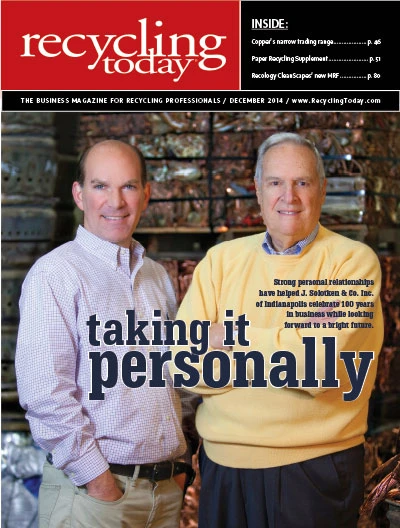

Explore the December 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Recyclers likely to feel effects of US-China trade war

- BCMRC 2025 session preview: Navigating battery recycling legislation and regulations

- Yanmar Compact Equipment North America appoints new president

- LYB publishes 2024 sustainability report

- Plum Creek Environmental acquires Custom Installation LLC

- Avis introduces Harris American Co.

- International Paper in talks to divest 5 European box plants

- Recycled PP from Polykemi, Rondo Plast used in flood protection product