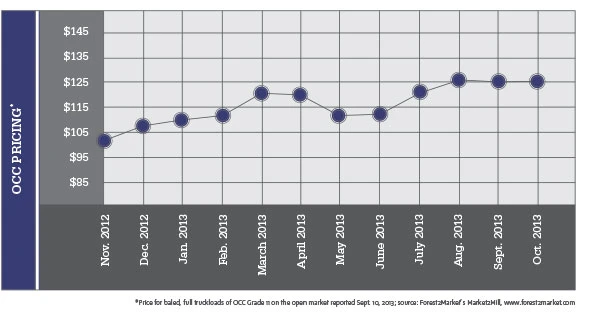

Paper stock markets are expected to end the year in fairly decent shape, with prices at levels that enable dealers as well as paper and paperboard mills to turn a profit. Recovered fiber flow, especially for bulk grades, such as old corrugated containers (OCC) and double lined kraft (DLK) cuttings, has been good, with domestic and offshore mills playing an active role in the market, according to sources.

On the domestic side, some mills appear to be pushing back on recovered fiber prices, though most vendors say they feel the downside is somewhat limited. With supply still an issue, many domestic mills are reluctant to push prices too low for fear of being left short on supply.

Several paper stock dealers say the domestic market is more stable than it has been recently, which is giving them the chance to strengthen their bottom lines.

Domestic board mills appear to have enough inventory to meet current needs, though they are not turning away orders. In terms of OCC demand, the shift by a number of mills from producing newsprint to kraft packaging could create a tighter market for the material going forward. However, much of the new capacity has yet to create ripples in the marketplace.

One lingering concern is the lack of available supply. This is not limited to OCC but also includes a number of other paper stock grades. The old newspapers (ONP) grade continues to diminish. During the recent Paper Stock Industries ONP Summit, held during the Paper Recycling Conference & Trade Show in Chicago in October, speakers expressed concern about the rapid decline in various ONP grades. Sean State, vice president of Pratt Recycling, Conyers, Ga., said he expected to see the gradual move toward commingling ONP with mixed paper to create a grade that the company can use at its mills.

In fact, paper stock dealers say they have seen a trend toward commingling ONP with mixed paper over the course of the year.

Reflecting on some of the bigger challenges with ONP, Beth Royse, the purchasing manager for the insulation company Green Fiber, told attendees of the Paper Recycling Conference that her company “used to be a primary consumer of clean, dry news.” However, with the changing nature of the recovered fiber stream, Green Fiber was looking to adjust the raw material it uses, she said.

Generation continues to be difficult as newspaper readership declines. Bill Moore, president of Moore & Associates, Atlanta, told attendees of the Bureau of International Recycling (BIR) Autumn Round-Table Sessions in Warsaw, Poland, in late October that ONP was fast becoming the “disappearing grade” in the United States. He forecasted that generation of ONP and old magazines (OMG) would slide from 4.82 million metric tons in 2010 to 3.49 million metric tons by 2016.

Moore added that North American consumption of OCC and kraft paper should show a modest improvement in the near future, growing from slightly more than 19 million metric tons in 2010 to 19.43 million metric tons by 2016.

Moore added that North American consumption of OCC and kraft paper should show a modest improvement in the near future, growing from slightly more than 19 million metric tons in 2010 to 19.43 million metric tons by 2016.

Despite decreased ONP availability, demand remains, especially on the offshore market, for No. 9 over-issue news. Several exporters say Asian buyers are aggressively trying to lock in orders for this grade at fairly good prices.

The challenges being seen in the United States are similar to those being seen in Europe. During the recent BIR conference, several speakers pointed to sluggish markets for newsprint and printing and writing paper, dwindling supplies of some recovered fiber grades, bulk grade quality challenges, the fragile global economy and increased protectionism from various countries as negatively affecting the industry.

Ranjit Baxi, the former president of the BIR paper division, said some countries were putting in what he termed “excessive” documentation demands and spot inspections at the point of export in Europe. He added that while China and its Operation Green Fence have generated most of the challenges, other Asian countries are starting to reintroduce quality specifications.

Speakers at the Paper Recycling Conference Europe, also held in Warsaw in late October, echoed the challenges seen in many recovered fiber markets. A key problem in Europe is the lack of demand from mills, speakers said.

Capacity shutdowns continue throughout Western Europe, with Norske Skog recently announcing plans to permanently close another machine at one of its mills in Germany. This closure will remove 225,000 metric tons of coated mechanical paper from the market.

Explore the December 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility