It appears 2013 will end with a whimper rather than with a roar for most nonferrous scrap metals. Many scrap dealers’ expectations of fairly healthy markets for most nonferrous metals in the second half of 2013 never came to fruition. In fact, as 2013 unfolded, dealers’ moods seemed to trend toward the pessimistic.

Lack of supply, margin compression and fierce competition for available material created an exceptionally difficult business environment for nonferrous scrap dealers.

While these challenges have not yet abated, some positive news could be coming to light that may result in improving markets.

The U.S. economy continues to improve, though slowly. However, the U.S. has been posting positive economic indicators over the past few quarters. Auto sales have been good, and residential construction is starting to improve. Volatility remains, however, preventing sustained improvement in nonferrous metals.

Perhaps the most promising news, however, has been from the economies of Western Europe. This sector, which has been contracting for several straight years, has recently posted positive growth. The European Commission is forecasting that the economies of European Union member nations will expand by 1.1 percent in 2014 after a 0.4 percent contraction in 2013. In 2015, the eurozone is forecast to grow at 1.7 percent.

While the macroeconomic outlook is moderately better, the outlook for nonferrous scrap markets is less bullish.

Sidney Lazarus with the South African company Non-Ferrous Metals Works, sketched out a fairly comprehensive nonferrous scrap market outlook for different regions of the world at the Bureau of International Recycling (BIR) Autumn Round-Table Sessions in Poland in late October.

China, Lazarus said, recently reported that its economy grew by 7.8 percent in the third quarter, which is higher than in the previous quarter. Along with this economic growth, he said the most recent PMI (Purchasing Manager Index) showed a slight positive number at 50.2, with expectations that PMI may increase to more than 52 in the short term, which would denote a more optimistic outlook among purchasing managers.

Meanwhile, in the U.S. the biggest problem remains the lack of scrap. Lazarus said “premiums and prices being paid are sometimes higher than the intrinsic value, as works and consumers require raw material to produce their products.”

Shifting to Europe, he said, most operations were short of material and prices were very high. As a result, many scrap metal traders have filed for bankruptcy, while others are barely surviving amid the extremely difficult trading conditions.

Despite these challenges, signs of hope are visible. The Chinese government is reportedly discussing significant cuts in aluminum production. Several sources say roughly half of the aluminum produced in China is produced at a loss. If this production—perhaps 10 million tons—is removed from the market, the aluminum sector could improve quickly.

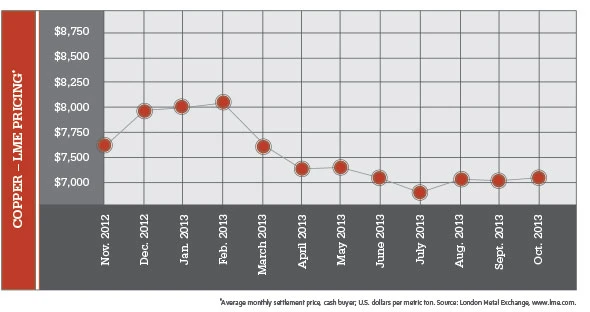

Copper has rallied modestly in light of fairly positive economic reports from the U.S. and the Federal Reserve’s quantitative easing policy.

Also, copper inventoried in London Metal Exchange warehouses has declined to 469,000 tons as of early November, the lowest since March.

Explore the December 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards

- Goldman Sachs Research: Copper prices to decline in 2026

- Tomra opens London RVM showroom

- Ball Corp. makes European investment

- Harbor Logistics adds business development executive

- Emerald Packaging replaces more than 1M pounds of virgin plastic