November’s buying period for ferrous scrap turned out to be one of the more volatile periods of 2013, with domestic mill buyers paying $30 or more per ton compared with the month prior to secure scrap, which remains in tight supply.

By mid-November, bulk ferrous scrap shippers on the Atlantic, Pacific and Gulf coasts were anticipating that overseas buyers would begin confirming new purchases after having tested the waters without doing much buying for the previous several weeks.

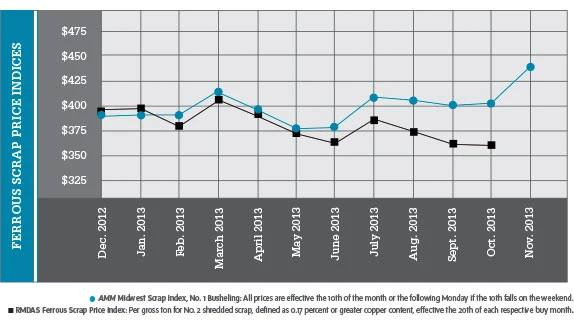

The combination of confirmed and anticipated demand helped the American Metal Market (AMM) November indexes, which track Midwest steel mill purchases in the first 10 days of the month, rise $30 or more per ton. This allowed No. 1 busheling prices to remain well above the $400 per ton threshold at $431.18 after falling to $401 per ton the month before.

Ferrous scrap processors and brokers credited prewinter inventory buildups at mills as one reason for the price increases as well as a realization by mills that ferrous scrap supplies are genuinely low and not likely to increase in December, January or February.

“A lot about the scrap market has changed in the past few years, but the fact that winter weather messes with supply in half of the U.S. is one of those things that hasn’t changed,” comments one Midwestern recycler.

A scrap buyer in the Pacific Northwest says October and November continued a pattern of competitive pressure in the ferrous market, as shredding plant operators and other recyclers tried to secure enough supply to keep machinery fed and to fill orders. “It’s kind of the new normal,” he remarks. “I’m not sure why buyers would think we have excess inventory that we’ll eventually sell at a discount.”

Encouraging news on the demand side could be found in the rate of domestic steel output in the first full week of November. According to the American Iron and Steel Institute (AISI), Washington, D.C., the 1.83 million tons of steel produced in the week ending Nov. 9, 2013, represented a 4.9 percent increase from the 1.74 million tons produced in the week ending Nov. 9, 2012.

Steel mills in the U.S. in early November turned out product at a 76.3 percent capacity rate, up significantly from the 70.1 percent capacity rate one year earlier.

A strong steelmaking finish to 2013 can help close the gap on what so far has been a year of decline for steel output in the U.S. Year-to-date production through Nov. 9 stands at 83.2 million tons, a 2 percent decrease from the 84.9 million tons made during the same period in 2012.

One of the global factors steel industry analysts are watching closely is the series of ongoing signals from the Chinese government that its steel industry is bloated with overcapacity.

In early November, the China Daily newspaper and website reported on the latest in a series of announcements from government ministries identifying industrial sectors considered to have excess capacity.

According to the report from the Beijing-based news outlet, two national government ministries (the National Development and Reform Commission and the Ministry of Industry and Information Technology) sent a video message to local governments urging them “to implement a directive from the State Council, which is the country’s cabinet.” The directive offers guidelines to phase out old capacity and restrict support of new capacity.

According to the report from the Beijing-based news outlet, two national government ministries (the National Development and Reform Commission and the Ministry of Industry and Information Technology) sent a video message to local governments urging them “to implement a directive from the State Council, which is the country’s cabinet.” The directive offers guidelines to phase out old capacity and restrict support of new capacity.

Although the nation’s steel capacity rate is 72 percent—within the range the steel industry has been operating at in the U.S. in the past several years—no less than the nation’s President Xi Jinping has referred to it as a “salient problem.”

Most months, China is not among the three largest export markets for U.S. ferrous scrap. However, if finished steel inventories in that nation are high and steel production in China begins scaling back, it would likely have a ripple effect on the global steel and scrap industry.

Statistics gathered for the first nine months of 2013 by the World Steel Association, Brussels, do not point to a Chinese steel industry that is by any means shrinking. In the first three quarters of the year, the nation’s steel industry produced 587.4 million metric tons of output, up 8 percent from the 543.9 million metric tons produced in the first nine months of 2012.

That growth rate is not only well above the 2.7 percent global average growth rate, but the additional 43.5 million metric tons of steel made in China is more than the global increase.

Phrased another way, while China’s steel industry has grown by 43.5 million metric tons in 2013, the combined output from the rest of the world has actually decreased.

Steel production figures in North America, the European Union, the former Soviet Union, South America and Africa all declined in the first nine months of 2013, leaving only Asia and the Middle East as global regions where steelmaking has been on the increase.

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the December 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants