Paper stock dealers are showing a modest degree of optimism as the fourth quarter advances. Prices for most grades are fairly decent, domestic mills seem to be running at a good clip and the export market looks to be slightly more active.

A number of paper stock dealers and consumers say supply and demand are in balance, though generation continues to be problematic for most grades of recovered fiber.

Domestic paper and paperboard mills appear to be running fairly decent schedules, which is keeping recovered fiber flowing steadily into their plants. Paper stock prices have remained somewhat stable as a result. Several paper stock dealers say that with prices holding at decent levels it is possible to operate profitably.

Domestic paper and paperboard mills appear to be running fairly decent schedules, which is keeping recovered fiber flowing steadily into their plants. Paper stock prices have remained somewhat stable as a result. Several paper stock dealers say that with prices holding at decent levels it is possible to operate profitably.

Although production schedules at paper and paperboard mills are “decent,” one source says the expected pickup in production typically seen toward the end of the year has not yet occurred. This steadiness is keeping recovered paper prices from surging to 1994 levels. A number of paper stock dealers point to the weak U.S. economy as a reason the nation has not seen the seasonal uptick in production.

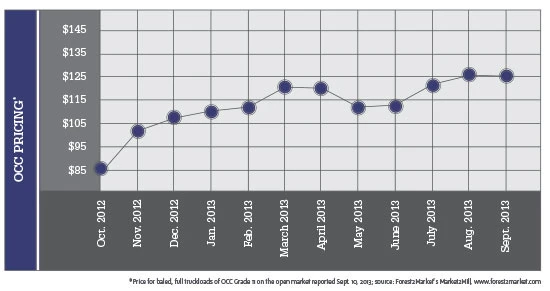

However, several sources say demand is still good. “Everything is moving,” one East Coast broker says. “OCC (old corrugated containers) is at a good price.”

One source adds that despite Norampac and Atlantic Packaging adding recycled paperboard capacity, there hasn’t been a significant upswing in OCC price and demand. However, both mills remain in startup mode as of early October.

Following the recent trend of mills converting their existing operations to produce various paperboard products, SP Fibertech (formerly SP Newsprint) has converted one of its newsprint machines to make packaging grades.

Demand for OCC likely will grow to feed this new capacity. Other paperboard mills, including Carthage Specialty Paperboard (formerly Climax Manufacturing), have announced plans to add capacity, which also will result in an increase in OCC demand.

Pratt also has announced plans to build a new recycled paperboard mill in Indiana. The mill, scheduled to be complete by the middle of 2015, will produce 360,000 tons of recycled-content paperboard products.

Buying activity is strong in the western half of the country. One large broker based on the West Coast says prices for bulk grades, such as OCC, old newspapers (ONP) and mixed paper are moving at historically good levels. As of early October, he says OCC is selling for $135 to $140 per ton, ONP is selling for about $122 per ton and mixed paper is selling for $110 to $112 per ton.

A paper stock dealer based in the South says he is more optimistic about the long-term health of the paper recycling industry now than he has been in several years.

An East Coast paper recycler says the only grade that is a bit concerning is white ledger, which is becoming harder to acquire in light of the growth in document destruction.

Adding to the somewhat softer market for high grades, a number of Mexican mills, which traditionally purchase large volumes of deinking grades, have reduced recent purchases. A Midwestern packer says, “Over the next two months, these mills will be reducing their inventories for tax purposes.”

Capacity cuts continue in the printing paper market throughout North America. Recently, International Paper, Memphis, Tenn., announced plans to permanently close its Courtland, Ala., paper mill, which will remove nearly 1 million tons of printing paper from the market.

Boise, which was recently acquired by PCA, Lake Forest, Ill., has shuttered two machines at one of its Minnesota paper mills. Boise also sold a machine in Washington state to Cascades.

Offshore markets for a number of grades have improved modestly. China, which has been retrenching with Operation Green Fence, is starting to increase its bulk grade purchases.

India, which sharply reduced the amount of recovered fiber it was importing in light of the decline in the value of its currency, the rupee, is reportedly re-entering the market, with one exporter saying, “We are starting to see some activity in India.”

According to Reuters, the rupee has recovered 12 percent from its low of 68.85 to the dollar, reached Aug. 28.

While the rupee rallied somewhat in early October, it declined again before the end of the month, leading some sources to say India’s paper mills just needed to rebuild their raw material inventories.

Explore the November 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production