As the fourth quarter ramps up, nonferrous metals markets have little in the way of positive news to offer. In fact, an attendee at the recently concluded Institute of Scrap Recycling Industries Inc. (ISRI) 2013 Commodities Roundtable Forum in Chicago, said, “I have never seen the market so on edge [as it is] right now.”

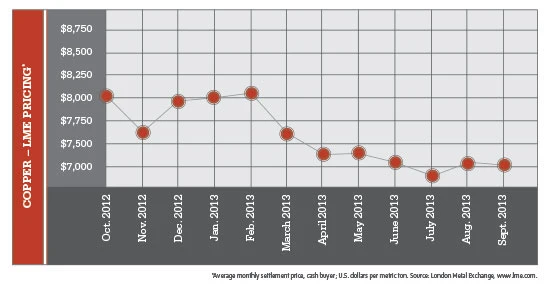

According to one report, prices for copper scrap have declined by 7 percent since the start of the year. However, several processors say they are bidding more aggressively for material, citing decent demand in the face of minimal supply.

Dealers say the lack of copper scrap is contributing to the difficulty in the market. In China, the largest consumer of copper scrap, a shortage of the material could lead consuming mills to switch to refined copper. According to a recent Reuters’ article, the copper scrap shortage could cut China’s production of refined copper by at least 100,000 metric tons in 2013.

One scrap trader tells Reuters that his company’s copper scrap supply has declined by 40 to 50 percent since the beginning of this year.

Aluminum scrap markets also have elicited angst. An estimated 5.4 million metric tons of aluminum are stockpiled in London Metal Exchange (LME) warehouses. Partly because of the oversupply, prices for aluminum have declined by more than 10 percent from the beginning of the year, though the market has rallied somewhat recently.

Figures from the Aluminum Association, Arlington, Va., show a modest improvement in finished aluminum markets. Production at U.S. and Canadian producers totaled 108.5 million pounds during August 2013, an increase of 10.3 percent compared with August 2012. At the same time, aluminum shipments increased 3.6 percent for the month compared with July. During the first eight months of the year, shipments totaled 877.9 million pounds, a 14.4 percent increase from the same time in 2012.

Despite these modest improvements in aluminum demand, the overall situation remains challenging. Global aluminum supply outstripped demand by 773,000 metric tons in the first seven months of 2013, according to the U.K.-based World Bureau of Metal Statistics. In 2012, the surplus totaled 506,000 tons.

As in the case of copper scrap, aluminum scrap supplies have declined, according to Harbor Intelligence, Austin, Texas. Harbor says aluminum scrap flowing into scrap processors has dropped 10 to 20 percent this year compared with the same time last year.

Harbor says consumers of aluminum scrap have been able to lock in only about 10 percent of their 2014 needs compared with four years ago, when they locked in more than 50 percent of the following year’s requirements.

Nickel and stainless steel scrap markets also are challenging. A significant amount of production capacity needs to be removed from the market. Despite capacity cuts by large stainless steel producers in Europe, new capacity continues to come online, especially in China.

The challenges are so significant that Keywell Corp., a large nickel and stainless scrap processor, recently filed for bankruptcy protection.

In its filing, the company says it sold only $142 million in scrap metal so far in 2013, which is roughly half of what it sold during the same time in 2012.

Explore the November 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production