Domestic steel mills paid about the same for ferrous scrap in early October as they did in September, causing dealers to be optimistic that pricing will hold steady through the rest of 2013 as mills begin preparing for winter.

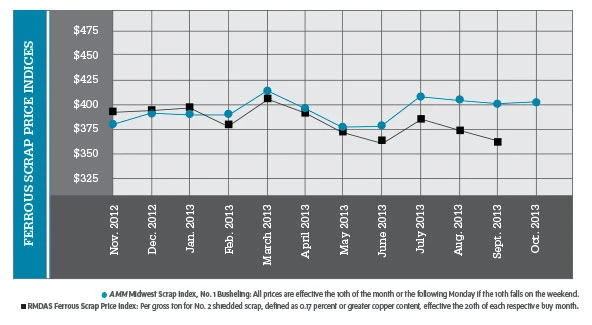

The American Metal Market (AMM) October indexes, reflecting Midwest steel mill purchases in the first 10 days of the month, held steady or rose slightly, with the No. 1 busheling grade remaining just above $400 at $401.16 per ton.

Scrap generation also remained steady through September, according to a recycler in the Midwest. “Scrap from construction sites has kept coming in, probably a little stronger than I would have expected,” he says.

Another recycler in the Midwest says scrap flows were up about 4 percent in September 2013 compared with September 2012, but he was not as quick to credit construction or demolition activity. “We just don’t get the big demo jobs like we used to before the financial crisis,” he comments.

As of mid-October on the demand side, export activity remained subdued, with AMM reporting early October export prices falling slightly while freight costs were increasing.

Domestic steel production in the first week of October increased compared with the previous week and with the comparable week in 2012. The American Iron and Steel Institute (AISI), Washington, D.C., reports that in the week ending Oct. 5, 2013, U.S. raw steel production was 1.87 million net tons at a capacity utilization rate of 78.2 percent.

U.S. raw steel production is up 1.1 percent from the 1.85 million tons produced the week before and is up 9.6 percent from the 1.71 million tons produced in the week ending Oct. 5, 2012.

The good start to October will help slightly as steelmakers strive in 2013 to match 2012 output. “Adjusted year-to-date production through Oct. 5, 2013, was 74,026,000 net tons, at a capability utilization rate of 77.2 percent,” says AISI. This figure decreased 3 percent from the 76.4 million net tons produced during the same period in 2012.

The AISI’s Southern and Great Lakes regions are competing for steelmaking supremacy within the U.S. For the week ending Oct. 5, 2013, production in net tons was divided this way by AISI district: Southern, 678,000; Great Lakes, 676,000; Midwest, 220,000; North East: 211,000; and Western, 88,000 tons, for 1.87 million net tons total.

Federal spending was again the victim of a political standoff in October, with a shutdown that lasted the first 16 days of October causing the closure of offices and national parks and the suspension of wages to many federal workers.

Economic data collection was another victim of the government shutdown, which provided an opportunity for an industry trade group to scold the federal government for its level of dysfunction. Associated General Contractors (AGC), Arlington, Va., was unable to distribute and analyze construction spending figures for the month of August. These figures would normally be released by the Census Bureau in early October. “It is hard to get a sense of where the industry is heading when basic construction spending data isn’t available,” said Ken Simonson, AGC chief economist.

The bigger concern for the steel and scrap industry is that construction activity itself will slow in the public and private sectors if developers are uneasy about the government’s ability to remain open beyond its most recent settlement.

During the October shutdown, the AGC “urged members of Congress to quickly resolve the political impasse that resulted in a federal shutdown,” adding that “solicitations for new federal construction projects will be delayed until the federal government reopens.” The AGC also expressed concern that “other federal construction projects may be delayed as many federal supervisors will not be available to answer questions [or] approve change orders.”

During the October shutdown, the AGC “urged members of Congress to quickly resolve the political impasse that resulted in a federal shutdown,” adding that “solicitations for new federal construction projects will be delayed until the federal government reopens.” The AGC also expressed concern that “other federal construction projects may be delayed as many federal supervisors will not be available to answer questions [or] approve change orders.”

Stephen E. Sandherr, AGC CEO, adds, “This shutdown poses a real risk of undermining the [construction] industry’s long-awaited recovery.”

While such a scenario—which would affect order books at many steel mills and ultimately scrap yards—was avoided in October, the next funding deadline that could result in a standoff occurs in mid-January of next year.

Although it has not resulted in a ferrous scrap export boom from the U.S., steelmakers in the rest of the world produced much more product in August 2013 compared with August 2012.

According to the World Steel Association, despite analysts’ concerns about steel mill overcapacity in China, that nation produced 66.28 million metric tons of steel in August 2013, a 12.8 percent increase over its August 2012 output.

Global steel production year to date has increased 2.3 percent compared with the first eight months of 2012, even though production in the European Union is down 4.9 percent and output in North America is down 5.5 percent.

Other nations with increased output year to date include Taiwan (up 6.6 percent), Saudi Arabia (up 7.1 percent), India (up 2.5 percent) and the United Kingdom (up 17.4 percent).

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the November 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production