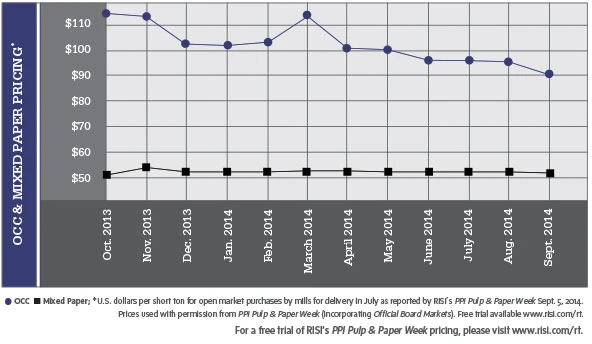

The old corrugated containers (OCC) grade, which held up fairly well through most of the summer, started autumn on a down note. The combination of slowing demand from domestic sources and a significant decline in shipments to China has resulted in prices dropping by $5 to $10 per ton, depending on the region of the country. In some areas, prices are down by as much as $15 per ton.

Several paper stock dealers say they feel further softening in the OCC market may lay ahead. In early September there were indications OCC prices could decline by an additional $5 to $10 per ton. Prices for OCC could remain soft over the next several months as few signs indicate a pickup in orders from domestic or offshore consumers.

Early fall is typically a time of high OCC generation and reduced demand, which could lead to further softening, especially if export orders do not pick up.

Several sources report that RockTenn was taking extensive downtime in late August at a number of its mills in the South, dampening demand for OCC, and in the Midwest, several paper stock dealers say International Paper is taking advantage of ample supplies of OCC to reduce its buying price for the material.

Cascades also has announced that it is permanently closing its kraft paper manufacturing facilities at its East Angus, Quebec, board mill because of difficult market conditions.

In terms of export demand, the flow of material to China has been flat at best. While Chinese mill buyers continue to purchase significant volumes of recovered fiber, new orders haven’t been as robust as in the past. Several exporters add that a number of large board mills in China also are taking extensive downtime, which has softened prices for OCC in coastal areas, especially on the West Coast.

However, a number of other Asian countries have been stepping up their purchases, though mills in Thailand, Indonesia, India and other Asian countries buy far less than Chinese mills do.

Old newspaper (ONP) also continues to struggle presently. A number of paper stock dealers say demand for clean deinked (No. 8) news exists. However, it is a difficult grade to find. One West Coast exporter says his firm has been working closely with several sources to guarantee an adequate supply of No. 8 news. However, U.S. generation of this grade likely will shrink further.

Office and high grades continue to be bright spots. Prices are holding at their present levels; demand from consumers in the United States and Mexico is enough to prevent a sharp correction in pricing. Several sources say Mexican consumers have been playing a fairly active role in the market this summer, helping to firm pricing for high grades. Several sources say office and deinking grades have been locked in a steady price for most of this year.

Reflecting the positive outlook for high grades, Bio-Pappel, the largest paper company in Mexico, recently announced plans to acquire the Scribe paper mill from Kimberly-Clark. Scribe manufactures and distributes printing and writing paper. It also has mills that produce newsprint, kraft paper and packaging products.

The closure of FutureMark’s Chicago-area recycled paper mill in late August has concerned some dealers, especially those in the Midwest. Continued problems with mechanical paper markets coupled with the Canadian government providing a $200 million subsidy to reopen a bankrupt paper mill in Nova Scotia, contributed to FutureMark’s decision. The company noted nearly 40,000 tons of supercalendered paper per month from this mill flooded an already depressed market, causing most U.S. coated paper producers to operate at a loss.

The FutureMark mill is not the only printing and writing paper mill shuttering. Canada’s Resolute Paper announced it would shutter its Laurentide printing and writing mill in Grand-Mère, Quebec, by mid-October, removing 190,000 metric tons of printing and writing paper from the North American market.

Explore the October 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards

- Goldman Sachs Research: Copper prices to decline in 2026

- Tomra opens London RVM showroom

- Ball Corp. makes European investment

- Harbor Logistics adds business development executive

- Emerald Packaging replaces more than 1M pounds of virgin plastic