Recyclers and steel mill buyers awaiting a dramatic change in scrap prices have made it through the summer of 2014 without experiencing any such thing. In what seems to indicate an ongoing stable balance between supply and demand, ferrous scrap prices traded in the same narrow range in August and early September that has characterized most of the year.

Recyclers are reporting flat but steady demand from domestic steel mills and foundries, while export purchases remain muted. On the supply side, many recyclers say their July and August books indicated that summer 2014 flows were better than one year ago but not heavy enough for them to build large inventories.

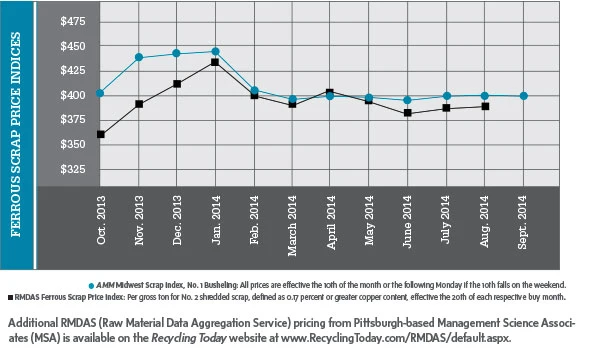

If there are imbalances between supply and demand, they are not reflected in pricing tracked and maintained by the Raw Materials Data Aggregation Service (RMDAS) of MSA Inc., Pittsburgh, or by American Metal Market (AMM). RMDAS pricing for No. 2 shredded scrap was virtually unchanged in August 2014, ticking upward by $1 per ton from the July price. The $384 August 2014 average price is up $9 per ton compared with August 2013, reflecting a 2.4 percent rise.

AMM Midwest Index pricing for the September 2014 buying period (based on purchases made by domestic mills up through about Sept. 10) reflected a continuation of the stable pricing trend. The price of No. 1 busheling remained exact to the penny in September compared with August at $400.98 per ton. Prices for the other two high-volume grades tracked by AMM—shredded scrap and No. 1 heavy melting steel (HMS)—likewise remained virtually even with August prices.

Export pricing and demand remains moribund, according to AMM. Although some bulk cargoes are being booked on the Pacific Coast, exporters there continue to hear more about impending orders as opposed to receiving them.

East of the Mississippi, an increase in orders from Turkish mills helped keep prices stable in the Northeast and Midwest in September, as U.S. mills had to at least match August pricing to keep ferrous scrap flowing into their facilities.

While the market may be balanced, that has not brought with it any good news in terms of better margins, according to a recycler in the Mid-Atlantic region. “Shredder feed is flowing better the last three months, but margins continue to be tight,” he comments.

A somewhat improved construction climate is helping boost the flow of plate and structural and HMS grades into scrap yards, the same recycler says. “Demo jobs are increasing in the area, and cut grades are more abundant, but often at high ‘auction’ pricing,” he comments.

A somewhat improved construction climate is helping boost the flow of plate and structural and HMS grades into scrap yards, the same recycler says. “Demo jobs are increasing in the area, and cut grades are more abundant, but often at high ‘auction’ pricing,” he comments.

Congested rail service continues to be decried by shippers in the agricultural, automotive and chemical sectors in their complaints about slow service and a lack of rail cars. Ferrous scrap shippers are pointing to similar difficulties.

The U.S. Senate Committee on Commerce, Science and Transportation held a hearing on freight rail service in mid-September. According to a report on the Progressive Railroading website (www.progressiverailroading.com), Alliance of Automobile Manufacturers Vice President of Federal Government Affairs Shane Karr testified that rail congestion has cost automakers “tens of millions of dollars per month.”

The recycler in the Mid-Atlantic region said he is grateful his company has its own fleet of railcars and that he operates in a region away from both the Grain Belt and the oilfields in those same prairie states.

On the global demand side, government leaders in China are indicating that they intend to melt more scrap in their steel mills, which are largely basic oxygen furnace (BOF) mills.

The policy change may be too late to have a major influence on U.S. recyclers, as China is beginning to generate more domestic ferrous scrap at the same time its steel mills face a need to trim production with China’s building boom slowing.

As of late August, a Hong Kong-based motor trader says ferrous scrap prices actually were sliding in China, a historically stable market.

The last time China was deemed to have a major influence on the U.S. ferrous scrap market was 2009, when Chinese mill buyers came in to buy scrap after it dipped dramatically in price.

Whether a combination of government policies, pricing and availability will create another scenario where Chinese bulk purchases from the U.S. Pacific Coast become widespread remains to be seen, but the likelihood is that Chinese mills will look first at increasing domestic supplies.

Steel mills in the U.S. are continuing to operate at stable levels, according to WorldSteel and the Washington-based American Iron and Steel Institute (AISI). WorldSteel has U.S. mill output at 51.2 million tons in the first seven months of 2014, up 1.3 percent from the same months of 2013.

Year-to-date output in the U.S. is 65.99 million tons at a 77.2 percent capacity rate, according to AISI, up 0.7 percent from the same period last year, when the capacity rate was 77 percent.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the October 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production

- STG selects SolarPanelRecycling.com as exclusive recycling partner

- Toyota receives $4.5M to support a circular domestic supply chain for EV batteries

- Greyparrot reports 2024 recycling trends

- Republic Services opens Colorado hauling facility

- ABTC awarded $144M DOE grant