The August bidding and buying period for domestic steel mills did little to change the flat nature of ferrous scrap pricing in the U.S., while import buyers also have refused to bid up prices.

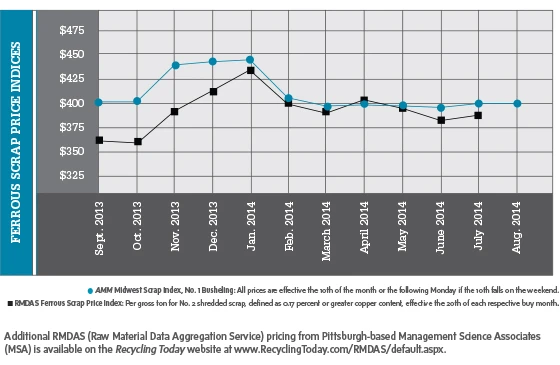

Summer pricing calculated by both the Raw Material Data Aggregation Service (RMDAS) of MSA Inc., Pittsburgh, and by American Metal Market (AMM), reflected ferrous scrap purchases occurring within a narrow trading range from February through August.

Shredded scrap transactions RMDAS tracks have shown monthly averages within a $20 per ton range from March to July.

AMM’s pricing for August showed No. 1 busheling rising by just 5 cents per ton in August on its Midwest Index. No. 1 heavy melting scrap (HMS) meanwhile, rose by less than $2 per ton, while shredded scrap lost about 80 cents per ton in value by the measure of AMM’s Midwest Index.

Using AMM’s No. 1 busheling Midwest Index price as a measure, scrap prices in the U.S. have been relatively static since February after losing about $35 per ton that month relative to January.

On the supply side, a scrap recycler in the Midwest describes flows into his company’s facilities as “just OK” and refers to an ongoing healthy flow of industrial scrap compared with demolition and construction scrap in his region. “Primes are coming in, but cuts are very slow,” he says.

In his company’s case, orders from mills are stable enough, but operational headaches are being caused by a combination of scrambling to procure enough scrap of the right grade and transportation problems.

Regarding freight issues, he says problems are on the rail and the trucking sides. “Transportation is still an issue,” he remarks. “Trucks are very hard to get and very expensive, and railroad cars also are difficult to get.”

The late summer and early fall harvest season often brings with it a lack of available rail cars and related bottlenecks.

In mid-August, farmers and grain elevator operators were likewise complaining about inadequate rail service. Agweek, Grand Forks, North Dakota, reported on its website, www.Agweek.com, from a co-operative-owned grain elevator in North Dakota that had ordered a 100-car train in March that arrived in early August.

Operators of the elevator in Fordville, North Dakota, told Agweek they have received just five multicar trains since May 2014 compared with receiving four multicar trains in July 2013 alone.

Western region railways contacted by Agweek said they saw substantial increases in demand for oil cars to serve western North Dakota as well as increased requests for container cars and for flatbeds to ship large equipment.

Recyclers on the coasts continue to experience lukewarm interest from overseas buyers. AMM, in calculating its East Coast and West Coast Ferrous Scrap Export Indexes in mid-August, retained the identical price on its West Coast index “due to an absence of demand.”

Ongoing turmoil in the Middle East (Iraq, Syria and Libya) has caused some Turkish steel mill buyers to proceed cautiously, often looking to nearby Europe first for ferrous scrap supplies.

Ongoing turmoil in the Middle East (Iraq, Syria and Libya) has caused some Turkish steel mill buyers to proceed cautiously, often looking to nearby Europe first for ferrous scrap supplies.

Figures collected and reported by the United States Geological Survey (USGS), Reston, Virginia, for the first five months of 2014 show the extent of the decline in ferrous scrap exports.

In the first five months of 2014, the U.S. exported 6.32 million metric tons of ferrous scrap, down 25.8 percent from the 8.52 million metric tons exported in the first five months of 2013.

Turkey, traditionally the largest customer for exported U.S. ferrous scrap, is foremost among the nations buying less in 2014. Its import volume has dropped 38 percent from the 2.39 million metric tons it bought in early 2013 to 1.48 million tons in the first five months of 2014.

Mills in China also are showing less interest in U.S. scrap, dropping from 898,000 metric tons purchased from January to May 2013 to just 335,000 metric tons in the same period in 2014. India has cut its shipments by more than 50 percent from 324,000 metric tons to 150,000 metric tons in the year-to-date comparison.

Increased output and operating rates at domestic steel mills may be one reason why less U.S. ferrous scrap is heading overseas.

According to the Washington-based American Iron and Steel Institute (AISI), in the week ending Aug. 16, 2014, steel output in the U.S. was 1.92 million tons, up by 3.3 percent from the 1.86 million tons produced in the same week in 2013. Mills in the U.S. are operating at a 79.8 percent capacity rate, up from 77.6 percent in mid-August 2013.

Production for the week ending Aug. 16, 2014, also improved from the prior week, increasing 1.2 percent from the week ending Aug. 9, 2014.

Year-to-date steel production in the U.S. through mid-August was 60.26 million tons, with mills operating at 77 percent of capacity. The output total is up slightly (0.5 percent) from the 59.96 million tons produced during the same period last year, when the capacity rate was 76.9 percent.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the September 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants