Market conditions for most nonferrous scrap metals are showing modest signs of improvement. After several straight quarters of declining prices, many scrap metal dealers say they expected to see some type of rally as summer drew to a close. However, few signs of a sustainable recovery in nonferrous scrap markets have been evident.

The biggest source of optimism for U.S. scrap metal dealers is the sign that the Chinese economy appears to be renewing its strength and, therefore, its consumption of raw materials. Supporting this upbeat outlook, several industry reports note that copper scrap imports into China in July increased by 8.1 percent to more than 410,000 metric tons compared with the prior month’s figure of about 380,000 metric tons.

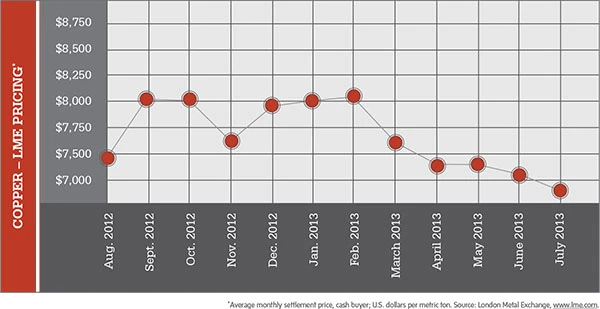

Reuters notes that in mid-August, copper prices posted their best weekly gain since September 2012. Further, refined copper imports have increased by 50 percent since April 2013. While the rally has helped stoke optimism, skepticism remains that these trends in China will be enough to jump-start the U.S. nonferrous scrap markets.

One large copper scrap exporter says China may be strengthening its buying, but some of the uptick is being driven by Chinese ports that are looking to increase their value-added taxes (VAT) by taking in more shipments. This strategy could lead to the relaxation of restrictions on the import of some grades of scrap metal into the country.

Several other sources say that even with the recent improvement in the Chinese buying, sings of a sustainable upswing in the global copper scrap market are not apparent.

Aluminum scrap markets continue to be challenging. One large dealer says that despite a healthy automotive sector, a key end market for aluminum, other large industry sectors continue to languish, keeping aluminum scrap flat at best. While residential construction has shown improvement, growth in commercial construction, he adds, could help stir aluminum scrap markets.

“Aluminum is better, but not good,” he says. While acknowledging a slight uptick in price, the dealer says demand from secondary aluminum consumers remains flat. “Mills are full and are not looking to buy any more material.”

The reality, recyclers say, is that aluminum remains in an oversupply, working to cap prices.

While the first quarter was strong, the subsequent quarters have weakened, and one dealer says this will continue over the next few quarters.

Explore the September 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- USTR announces phased measures designed to address China’s shipbuilding dominance

- APR, RecyClass release partnership progress report

- Clearpoint Recycling, Enviroo sign PET supply contract

- Invista expanding ISCC Plus certification program

- Redwood partnership targets recycling of medium-format batteries

- Enfinite forms Hazardous & Specialty Waste Management Council

- Combined DRS, EPR legislation introduced in Rhode Island

- Eureka Recycling starts up newly upgraded MRF