The increase in ferrous scrap prices in early July helped bring out more scrap throughout the month, bolstering supply but putting the brakes on further price increases.

In the August buying period, steel mills were able to shop among a number of sellers with ferrous shred in their inventories, ultimately keeping the American Metal Market (AMM) monthly pricing at or below the July levels.

A scrap processor in the Midwest says volume in his yard was up nearly 20 percent in July compared with June, providing a much needed boost in activity.

How the volume increases affected pricing may provide a case study in how the growth of the shredder population is affecting the supply and pricing of shredded scrap.

With more shredders now running and dispersed in small and medium-sized cities, the percentage of shred produced versus heavy melting steel (HMS) likely has continued to rise.

As ferrous scrap flowed into yards in July, much of it was turned into shredded product, building up the supply of the grade and giving mill buyers negotiating leverage.

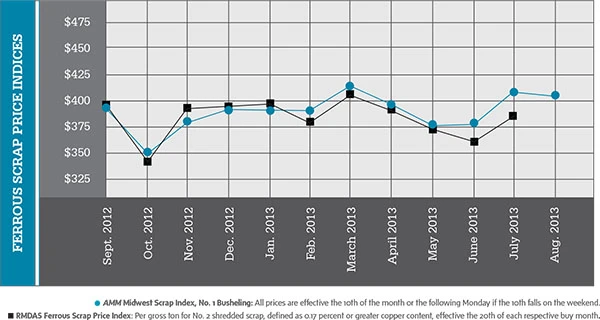

While as recently as May shredded scrap and No. 1 busheling were trading within a few dollars per ton of each other, the newly bountiful supply of shred meant mill buyers could purchase shred for about $40 less per ton (compared with No. 1 busheling) in early August.

The AMM Midwest August buying period average price for shred was just $369 per ton, compared with $410 for No. 1 busheling. Shredded prices ended up closer to the $354 sellers could get for their No. 1 HMS rather than a prompt grade price.

To what extent scrap processors can or will scale back their shredder output if premium pricing is not being paid for the grade may become a strategic question in the months ahead.

Considering shredders, once purchased and equipped with downstream systems, also help processors maximize their nonferrous revenue, it is not a step easily taken.

What also remains a question is to what extent recyclers will see improved scrap flows in the rest of 2013. Statistics tracking new construction continue to show incremental improvements, though backward months continue to slow the momentum.

Although July’s improved prices brought additional scrap into some yards, processors who were contacted say they do not see the type of demolition or construction activity in their regions that causes them to think that sector is in the midst of a revival.

Steelmakers in the U.S. are producing output at a rate that mimics the static construction market, according to the American Iron and Steel Institute (AISI), Washington, D.C. In the week ending Aug. 10, 2013, domestic steel production was 1.86 million tons, with the industry operating at a 77.7 percent capacity rate.

That is nearly identical to the 1.89 million tons produced in the week ending Aug. 10, 2012, when the capacity rate was 76.3 percent. Year-to-date production through Aug. 10, 2013, was 59.1 million tons, down 4.6 percent from the 61.9 million tons produced through Aug. 10, 2012.

The AISI says imported steel is among the culprits causing steelmaking activity in the U.S. to be lower than last year. The group says global overcapacity—some of it government subsidized—means “the U.S. saw a surge of steel imports in 2012 compared to 2011 with an 18 percent increase in finished steel imports into the U.S. market versus 2011 and a 37 percent increase over 2010.”

For ferrous scrap exporters, steel producers in some of the leading destinations are seeing drop-offs in activity similar to what U.S. steelmakers are experiencing.

For ferrous scrap exporters, steel producers in some of the leading destinations are seeing drop-offs in activity similar to what U.S. steelmakers are experiencing.

According to figures for the first half of 2013 collected by Brussels-based World Steel Association, steel output in Turkey is down 2.9 percent compared with the first half of 2012, while output in South Korea is down 5.3 percent.

Steelmakers in China continue to produce as if the market knows no limits. In the first half of 2013, more than 389 million metric tons of steel were produced in China, up 7.9 percent from the world record 363 million metric tons produced in the first half of 2012.

Another net ferrous scrap importer, India, has produced 2.5 percent more steel in the first half of 2013 compared with 2012, growing from 38.7 million metric tons of output to 39.6 million.

Altogether, the 64 countries included in the World Steel Association’s statistics, which account for 98 percent of the world’s total crude steel production in 2012, have produced 2 percent more steel in the first six months of 2013 compared with the same period in 2012, increasing from 774 million metric tons produced to nearly 790 million.

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

*FOB New York, in metric tons; **FOB Los Angeles, in metric tons. The American Metal Market (AMM) Midwest Ferrous Scrap Index and the AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodologies are available at www.amm.com/pricing/methodology.html. The grades are based on the Institute of Scrap Recycling Inc. (ISRI) specifications from 2012.

Explore the September 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- NRC seeks speakers for October event

- LME identifies Hong Kong warehouses

- Greenville, Mississippi, launches aluminum can recycling program

- Cotton Lives On kicks off 2025 recycling activities

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic

- Wisconsin Aluminum Foundry is a finalist for US manufacturing leadership award

- MetalX announces leadership appointments