|

Hope of a strong recovery in nonferrous markets by the end of the year is rapidly disappearing.

During the first quarter of 2013, a number of scrap metal recyclers said they expected the overall economy to rebound by the second half of 2013. The improvement, many theorized, would result in an improvement in nonferrous scrap markets. However, many of these same scrap metal dealers are now saying that a sustained improvement in nonferrous metals won’t take place until 2014 at the earliest.

In adjusting their outlook, scrap metal recyclers say they see little that could boost the overall manufacturing sector, which would stimulate scrap supply and demand.

In fact, several sources say they wouldn’t be surprised if the overall economic recovery stalled by the end of this year.

“Granted, the summer is usually a slower time of the year for the scrap market, but it seems much slower now than usual,” one Midwestern scrap recycler says. “Supply just isn’t out there right now.” He adds that there is significant competition for the material that is available.

Another recycler says the market has slowed because the office phones are not ringing as much as usual. “The phones aren’t ringing, and the future seems to be getting softer.”

The big problem for most scrap dealers is the lack of generation. This trend has plagued the industry for the past year, though it appears to be more challenging now. One source in the East says that with less material available, competition for supply is heated, shrinking margins to levels that make it difficult to run profitably.

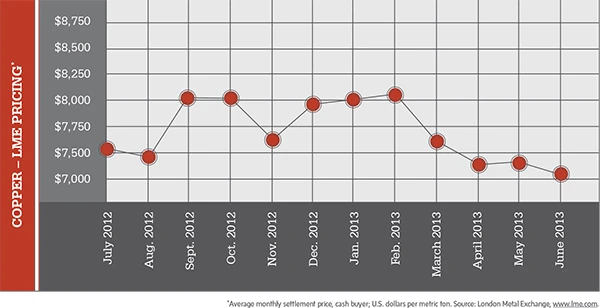

The copper market has been buffeted more than most grades. Despite a recent upward move toward the latter half of July, prices for the red metal have been trending downward. Primary copper appears to be in oversupply, with new capacity reversing the shortages seen in the market several years ago. This is keeping a lid on prices for scrap material.

“We seem to be waiting for something to happen to get the grade going,” one broker on the East Coast says.

Unfortunately, China, which has been the go-to destination for a growing volume of copper scrap, has been reducing its buying as its economy continues to slow down. One exporter says China is buying far less copper scrap than it has in the recent past. “There just is no spark there,” he says. “There is nothing to be optimistic about.”

Aluminum markets are stuck in oversupply. Aluminum producers continue to shutter plants, despite a pickup in some sectors of the economy, notably the auto industry, that require a growing amount of aluminum.

Estimates from the Aluminum Association, Arlington, Va., show that aluminum demand in the United States and Canada totaled 8.18 billion pounds in the first four months of 2013, a 2 percent increase over the same period in 2012.

Despite the reported growth in demand, the Aluminum Association and the Aluminum Association of Canada, Montreal, report that primary aluminum production in the United States and Canada stood at an annual rate of 5.04 million metric tons during May 2013, down 0.5 percent from April.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the August 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Green Cubes unveils forklift battery line

- Rebar association points to trade turmoil

- LumiCup offers single-use plastic alternative

- European project yields recycled-content ABS

- ICM to host colocated events in Shanghai

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria