|

Material recovery facilities (MRFs) and paper stock processors appear to be adjusting to the new normal under Operation Green Fence.

After the initial drama generated by the implementation of China’s Operation Green Fence, it appears that many single-stream MRFs have made adjustments to ensure they are producing cleaner bales of material. Several sources say that many of these facilities have slowed down their operations and added more personnel on the line to ensure that outthrows and contaminants are kept to a minimum.

Other paper stock dealers who had been shipping significant quantities of mixed paper to China have opted to stop shipping this material for fear of their shipments being rejected, according to sources.

Many people say the move to improve recovered fiber quality will benefit the paper industry in the long term. However, in the short term a number of smaller single-stream operations are struggling to remain in business because they have had to cut run times and spend more time cleaning up loads at the same time pricing has softened, according to sources.

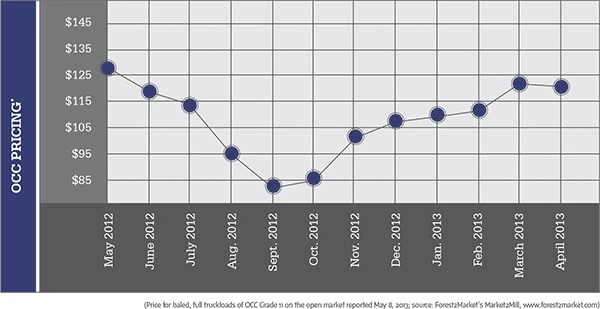

Despite the challenges associated with shipping recovered fiber to China, a number of paper recyclers say the market for old corrugated containers (OCC) remains in balance. Orders for OCC destined for China have picked up a bit this summer, an exporter notes. This has helped to keep material moving.

The moderate increase in recovered fiber shipments to China follows several months earlier this year when Chinese buyers had reduced their purchases of OCC from the U.S. market.

One East Coast paper stock dealer says the OCC market “is looking pretty good right now. Exports are seeing a nice rebound in pricing.”

At the same time, he continues, domestic board mills are reportedly sitting on large inventories of OCC and are not looking to buy much more material presently. “They are crammed solid with bales,” he adds.

Packing plants, however, have little in the way of inventory, another source says.

Part of the reason packers have sparse inventories is the decline in generation. While not as extreme as in other commodities, a number of sources say less OCC is on the market now than in the past.

While OCC is holding up fairly well, mixed paper and old newspaper (ONP) are having problems. “Mixed paper is in the pits,” one source says. “It is awful. Exports are in shambles.”

The main reason these grades have slumped in the export market has to do with quality, sources say. A number of paper stock dealers fear that mixed paper shipments to China and other Asian countries will be rejected based on quality, which has reduced the amount of material U.S. dealers are willing to ship there.

As a result, one paper stock dealer says, some processors are encountering financial difficulties. “You can’t store your way out of the market right now,” he says.

A number of other paper stock dealers say they are blending their mixed paper and ONP together, labeling the load ONP and adjusting for the inevitable material downgrade once the shipment arrives to the customer.

Domestically, Pratt continues to buy a fairly significant amount of mixed paper. The company, with locations in New York, Georgia and Louisiana, is one of the few paper mills that is actively looking to buy sizable quantities of the grade. However, with the downturn in the offshore market for this material, Pratt has become more discriminating in its purchases of mixed paper, sources say.

While bulk grades are in somewhat of a bind, markets for high grades of recovered fiber have picked up a bit. Domestic mills are running at a pretty decent clip, and prices are holding up fairly well.

Coated book stock, sorted white ledger and office pack all are finding ample end markets and solid prices. “We are having no problems moving these grades,” a broker says. “Premiums being paid are good.”

Another source says, outside of the United States, purchases of deinking grades are somewhat weak. “Mexico is not buying right now, and South America is not strong,” he says.

The source adds that demand and pricing for pulp substitutes, which were hot earlier this year, also have cooled off a bit as the summer heats up.

|

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the August 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- ReMA opposes European efforts seeking export restrictions for recyclables

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- Aimplas doubles online course offerings

- Radius to be acquired by Toyota subsidiary

- Algoma EAF to start in April

- Erema sees strong demand for high-volume PET systems

- Eastman Tritan product used in cosmetics packaging