Ferrous scrap prices rose during the July buying period, with domestic steelmakers in particular paying more for prime scrap grades, while Turkish mills placed two bulk cargo orders in mid-July.

Despite the good news on pricing for ferrous scrap dealers, the summer of 2013 is not necessarily shaping up to be an easy one, according to sources, especially in terms of securing supply.

A ferrous scrap buyer in the Midwest says generation has not necessarily declined, but it also has not bounced back in any meaningful way. “We’re still down some 15 percent compared to the [monthly tonnage] highs we hit back in 2007 or 2008,” the buyer says.

The demolition and construction sectors remain particularly sluggish, the buyer adds, especially in the Midwest. “Demolition had been a good source of tonnage for us, but in the Midwest there are not new businesses moving in and so not much pickup in either construction or demolition activity.”

|

A scrap buyer in the Southeast says demolition had picked up in the spring and early summer in his region but has subsequently tailed off. “Supply is relatively scarce” in the Southeast compared with the amount of processing equipment that has been installed, the buyer says. “We’d like to have 20 to 25 percent more volume to match our own processing capacity,” he comments.

Regarding peddler traffic and small dealers, the Midwest buyer cites two sources of difficulty: He says price-sensitive sellers are waiting for copper and stainless steel prices to bounce back, therefore they are holding on to their nonferrous and ferrous material.

In addition, he says, recyclers who operate near state borders or in a particular city may suffer from uneven anti-scrap-theft laws. While the perception may be that dishonest scrap sellers will be the ones gravitating to less-strict yards, the ferrous buyer says that is not an accurate portrayal.

Two different recyclers located in larger cities report losing out on contractor and peddler scrap flows to competitors in outlying areas beyond the reach of local ordinances.

“Even legitimate peddlers don’t want the hassle of fingerprinting or photos being taken, so they choose the easier path and go to recyclers across a state line or to ones who don’t follow all the rules,” the ferrous buyer comments.

In addition to an economic recovery moving at a glacial pace and anti-theft rules that can be unevenly applied or skirted, shifting global demand for ferrous scrap also is keeping ferrous scrap recyclers guessing.

In mid-July, American Metal Market (AMM) reported two bulk shipments sold off the Atlantic Coast to Turkish mills but said overall monthly demand was not great enough to lift the publication’s export pricing indexes.

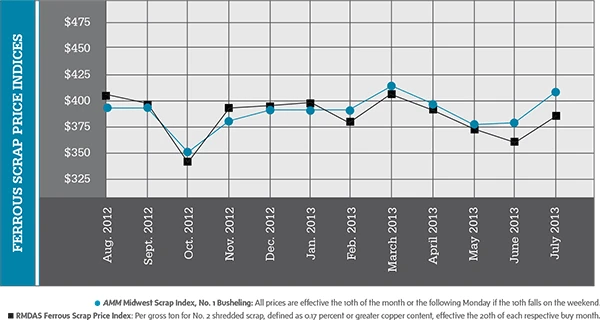

Domestic demand, however, helped boost AMM’s No. 1 busheling grade price by nearly 9 percent in July to more than $410 per ton.

Mills in the Great Lakes region and other parts of the Midwest were willing to pay more for prime grades, while scrap processors and brokers struggled to find enough material to fill their orders, according to AMM.

Prices for heavy melt scrap and shredded scrap also rose, but by from 5 to 6.5 percent rather than the larger increase enjoyed by prime grades.

On the demand side, the domestic steel industry has been stable in July, according to statistics gathered by the American Iron and Steel Institute (AISI), Washington, D.C. For the week ending July 13, 2013, domestic steel production was 1.88 million tons , produced at a mill capacity rate of 78.5 percent.

Production was up 3.2 percent from the identical week in 2012 and up 0.3 percent from the previous week (ending July 6, 2013). Year-to-date steel production of 51.6 million tons has occurred with an average capacity rate of 76.9 percent. That is down from last year’s total of 54.5 million tons of output in the same period.

Globally, steelmakers in China continue to churn out more steel despite news reports of an economy that is growing at a slower pace. In the first five month of 2013, China’s output was at 325 million metric tons, up considerably from the 301 million metric tons produced in the first five months of 2012.

Steelmakers in the critical export market of Turkey have been producing 4 percent less steel thus far in 2013, falling from 15 million metric tons of output in the first five months in 2012 to 14.4 million metric tons produced in early 2013.

In the first four months of 2013, data collected by the U.S. Census Bureau show ferrous scrap exports from the U.S. to Turkey having fallen by more than 20 percent. Turkey remains the highest-volume scrap export destination with 1.7 million metric tons purchased, followed by Taiwan with 1.0 million metric tons and South Korea with 745,000.

**FOB New York, in metric tons; **FOB Los Angeles, in metric tons. The American Metal Market (AMM) Midwest Ferrous Scrap Index and the AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodologies are available at www.amm.com/pricing/methodology.html. The grades are based on the Institute of Scrap Recycling Inc. (ISRI) specifications from 2012.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the August 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap

- Aimplas doubles online course offerings

- Radius to be acquired by Toyota subsidiary

- Algoma EAF to start in April

- Erema sees strong demand for high-volume PET systems