Paper stock markets are in balance this summer. The current stability follows a tumultuous winter and early spring, when extreme weather wreaked havoc on the paper industry supply chain.

The calmer market is improving many paper stock dealers’ optimism, with some sources saying the second half of 2014 could show modest improvements.

The improvements, one source says, will not necessarily lead to surging prices for many paper stock grades, though some sources say prices may strengthen into the fall.

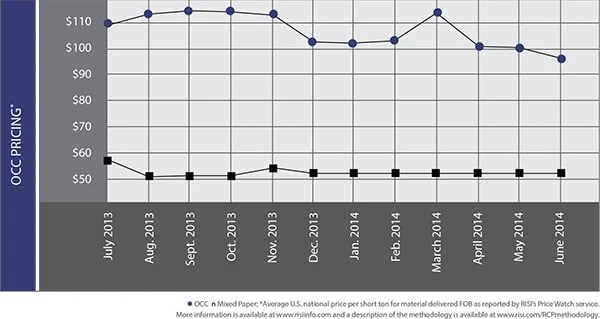

One of the biggest challenges for the U.S. paper stock industry continues to be the short-term outlook for the Chinese paper industry. Shipments of bulk grades, especially old corrugated containers (OCC) have been on a downward arc, with a commensurate dip in pricing, in light of the challenging environment in China.

Although softer buying from Chinese mills is problematic, several brokers say the trend has been fairly obvious during the past 18 months and many of them have adjusted their business models, diversifying offshore end markets or focusing more on domestic mills.

The dip in recovered fiber exports is reflected in the most recent figures provided by the American Forest & Paper Association (AF&PA), Washington, which shows overall exports of recovered fiber down for 2013. The decline for the year was driven by the sharp drop in the export of OCC, which declined by nearly 1 million tons between 2012 and 2013, with the majority of the decline tied to the slowdown in buying from China.

With more recovered fiber being redirected to domestic consumers, many have become pickier regarding quality. Inventories are fairly high, which is giving mill buyers the ability to be more selective with the recovered fiber they accept.

The AF&PA says domestic containerboard production in March dropped by 5.6 percent from March 2013. The monthly figure also declined by 0.8 percent relative to February 2014. Adding to the inauspicious start of the year, the AF&PA’s month-over-month average daily production figure dropped 2.4 percent, resulting in a 94.7 percent capacity rate.

Benefiting most from the present market are paper recyclers who have been able to pack fairly high-quality loads of recovered fiber. Several sources say they have not seen much resistance to their domestic shipments because of their consistent quality levels.

Several sources say companies that can meet tighter specifications are still having no problem moving material to many sources, though prices are a bit fluid, with some board mills hoping to push prices for grades such as OCC a bit lower.

Conversely, a number of paper recycling operations that have been aggressively processing postconsumer fiber, especially OCC and old newspapers, are encountering a modest degree of difficulty when shipping material to consumers, according to some sources, who add that some single-stream processing facilities are challenged. They say many operators must slow down their sorting lines and add more labor to improve the quality of their recovered fiber.

In a possible negative development for the paper industry, the waste management firm Covanta is seeking to build $40 million facility in Indianapolis that would allow it to handle all of the solid waste and recyclables genearated in the city. Under a new contract, residents of the city would be encouraged to throw all their waste and recyclables into a single bin. Covanta says the city’s recycling rate would increase as a result of the new program. Households could continue contracting for traditional curbside recycling, though it wouldn’t be the city’s main means of recycling.

Several recycling advocates in the area, howwever, are expressing concern that the commingling of recyclables and solid waste will degrade recovered paper quality.

At the same time, Pratt Industries is contructing a large recycled board mill in Valparaiso, Indiana, which could consume some of the fiber collected through the Indianapolis program, provided it is available.

Explore the July 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- OnePlanet Solar Recycling closes $7M seed financing round

- AMCS launches AMCS Platform Spring 2025 update

- Cyclic Materials to build rare earth recycling facility in Mesa, Arizona

- Ecobat’s Seculene product earns recognition for flame-retardant properties

- IWS’ newest MRF is part of its broader strategy to modernize waste management infrastructure

- PCA reports profitable Q1

- British Steel mill subject of UK government intervention

- NRC seeks speakers for October event