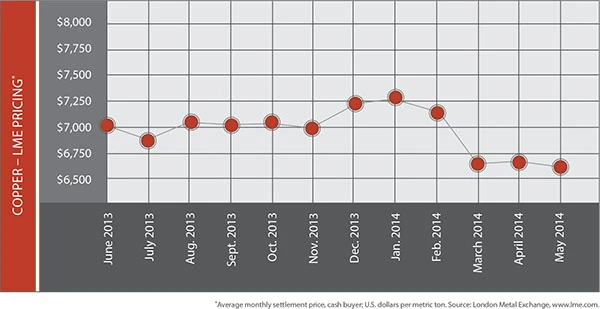

Volatility appears to be the only constant for nonferrous metals markets. Sharp price swings for copper, aluminum and stainless steel scrap have left some dealers scrap apoplectic. Copper, for instance, has been moving from multimonth highs to multimonth lows regularly.

Scrap dealers say the lack of copper scrap generation continues to be their biggest concern as competition for available material is compressing margins.

Addressing the U.S. market for copper scrap during the Bureau of International Recycling (BIR) conference in early June in Miami, Bob Stein, president of the BIR Nonferrous Committee and senior vice president of nonferrous marketing with Alter Trading, headquartered in St. Louis, said, “Margins for the scrap that merchants are handling through their processing yards continue to be compressed. Prices being paid don’t allow the merchants to replace what they sell at acceptable margins.”

Stein said the roaring markets seen earlier in the 21st century have dissipated and “are becoming too much of a distant memory.” He added that many experts now contend that “scrap arisings may never reach those levels again, regardless of where prices may trend.”

Despite the importance of nonferrous scrap to the world’s infrastructure, “Our industry is not well-understood” and legislation “is often biased against it,” Stein said. For instance, there are“more than 40 nations who, in some way, create false internal markets by reducing their consumer fabricators’ prices of feedstock by banning or impeding exports (of scrap).” In many cases, he added, “this amounts to nothing less than subsidizing prices of finished goods because of fictitious domestic scrap markets.”

Stein underlined BIR’s belief in free and fair trade as “the proven best economic system known to create responsible growth in industrializing nations.”

The outlook for stainless steel scrap markets appears to be more favorable, according to two other speakers during the BIR event, though volatility still will be seen.

Paul Gielen, director of sales for global metals recycling firm Cronimet, said Europe will have an oversupply of stainless steel scrap beginning this year and will need to export material, which he characterized as “a major change.”

He said Indonesia’s ban on mineral exports, imposed earlier this year, was the catalyst for a spike in stainless steel scrap prices. He added that China, which had been consuming a significant volume of nickel from Indonesia, has been forced to look for alternatives to fulfill its needs. China produces nearly half of the world’s stainless steel.

Sponsored Content

Redefining Wire Processing Standards

In nonferrous wire and cable processing, SWEED balances proven performance with ongoing innovation. From standard systems to tailored solutions, we focus on efficient recovery and practical design. By continually refining our equipment and introducing new technology, we quietly shape the industry—one advancement at a time.

Meanwhile, the improving U.S. economy is resulting in a pickup in demand for stainless scrap. Simon Merrills, president and CEO of ELG Metals, said there is a shortage of stainless steel scrap as a result. In his remarks at the BIR convention, Merrills said the shift occurred over six months. He added that stainless steel scrap will be on a “roller-coaster ride” for some time.

In light of the shortage, stainless steel scrap could be redirected from European and even South American buyers to U.S. consumers, depending on freight costs.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the July 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Sofidel agrees to purchase Royal Paper assets

- US Plastics Pact report charts expansion path for recycled content in packaging

- USTR announces phased measures designed to address China’s shipbuilding dominance

- APR, RecyClass release partnership progress report

- Clearpoint Recycling, Enviroo sign PET supply contract

- Invista expanding ISCC Plus certification program

- Redwood partnership targets recycling of medium-format batteries

- Enfinite forms Hazardous & Specialty Waste Management Council