Ferrous scrap demand has not plummeted and supply has not completely dried up, but one steel analyst’s recent description of a “rutted road” for the steel and scrap industries does not provide much encouragement for a swift improvement.

Speaking at the 2013 Bureau of International Recycling (BIR) World Recycling Convention in Shanghai in late May, steel industry analyst Peter Marcus of World Steel Dynamics, Englewood Cliffs, N.J., said the steel industry will continue to travel the “rutted road” it started out on in 2008 through the rest of this year and into 2014.

Marcus was bearish about ferrous scrap and iron ore pricing during that stretch, declaring “Steel’s iron age is over.” He predicted, though, that raw material costs are on their way to swinging back in favor of ferrous scrap as a feedstock, with the pendulum moving in scrap’s favor by 2015.

China’s ferrous scrap reservoir has been building, said Marcus. He forecasts that by 2025 China will have a 145-million-tons-per-year ferrous scrap surplus, “given the same EAF (electric arc furnace) steelmaking and BOF (basic oxygen furnace) scrap usage figures.”

Even if China adds EAF capacity and charges more scrap into its BOF mills, Marcus foresees “75 million tons of surplus” scrap in China annually by 2025. (For more on the state of the steel industry, see “Empty Pages” starting on page 66 of this issue.)

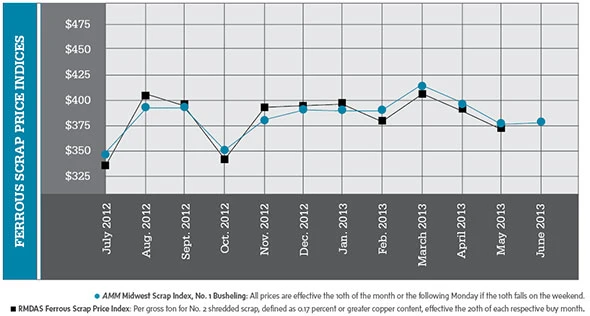

In the short-term, prices stabilized for most grades of ferrous scrap in early June, as many mill buyers in the United States agreed to pay per-ton prices similar or identical to what they had paid 30 days earlier.

.jpg) Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx. |

The American Metal Market (AMM) June Midwest Ferrous Scrap Index for No. 1 Busheling, released June 10, rose by 6 cents per ton from the month before. Shredded scrap in the Midwest, however, dropped by some $6.40 in the early June buying period, according to AMM.

|

Market reports offered at the BIR Ferrous Division meeting offered a mixture of resignation, concern and a few hints of optimism regarding the global market.

Division Chair Christian Rubach of Germany’s TSR Recycling remarked that “economists are starting the discussion [of] whether we are at the end of the commodity super cycle [that] fueled our steel recycling industry for the last [several] years.”

A report submitted by United Kingdom-based Tom Bird of Van Dalen Recycling noted that “prices have continued to weaken during the month [of May] and we could see further reductions for June across the board.”

Bird added, “Like 2012, 2013 is proving to be a difficult year. After a fairly positive start to the year, the market has gradually tightened though April and May.”

Bird did refer to a positive scenario, saying, “If steel demand does recover in the second half of the year, then this will filter into the scrap market with a revival of sorts from mid-June onwards. We should also see a lift after Ramadan [which ends Aug. 7 in 2013].”

Summarizing the U.S. market, Blake Kelley of Sims Metal Management, New York, described declining prices in May and referred to “trade opinion” predicting declines of $10 per ton or more in June.

Prices for finished hot-rolled coil steel in the U.S., at from $606 to $639 per metric ton, are “the lowest since 2010, as steelmakers struggle to maintain order books where lead times are reportedly three to four weeks.”

Kelley noted that the world’s steel industry in 2013 continues to produce more steel than ever before and is on pace to produce 1.56 billion metric tons of steel this year—54 million more metric tons than in 2012.

However, with much of the growth occurring in China, where iron ore-fed basic oxygen furnaces predominate, the world in 2013 will “apparently consume 11 million metric tons less purchased scrap,” according to Kelley.

In the U.S., according to the American Iron and Steel Institute (AISI), Washington, D.C., in the week ending June 1, 2013, domestic raw steel production was 1.84 million tons at a capability utilization (capacity) rate of 77 percent. That was down some 100,000 tons from the week ending June 1, 2012, when production was 1.95 million tons at a capacity rate of 78.6 percent.

Year-to-date production of 40.4 million tons (at a capacity rate of 76.6 percent) represents a 7 percent decrease from the 43.4 million tons made during the same period in 2012, when the capacity rate was 79.6 percent, according to AISI.

However in May 2013, the Worldsteel Association reported that crude steel production in the 63 reporting countries was up 2.6 percent for the month compared with May 2012 to 136 million metric tons.

*FOB New York, in metric tons; **FOB Los Angeles, in metric tons. The American Metal Market (AMM) Midwest Ferrous Scrap Index and the AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodologies are available at www.amm.com/pricing/methodology.html. The grades are based on the Institute of Scrap Recycling Inc. (ISRI) specifications from 2012.

Explore the July 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards

- Goldman Sachs Research: Copper prices to decline in 2026

- Tomra opens London RVM showroom

- Ball Corp. makes European investment

- Harbor Logistics adds business development executive

- Emerald Packaging replaces more than 1M pounds of virgin plastic