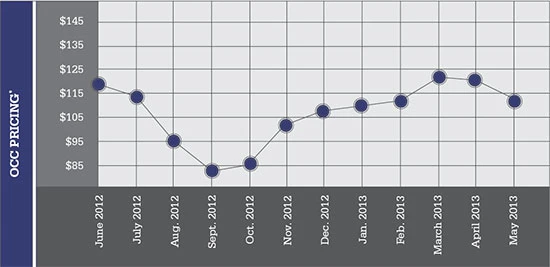

According to preliminary reports from various paper stock dealers, recovered fiber markets should not experience a significant slide in pricing through the summer. Depending on the fiber grade, markets are either holding their own or showing modest price movements. Old corrugated containers (OCC) could show some modest improvements in price and demand, while mixed paper and old newspaper (ONP) may dip, albeit slightly, through the next few months.

OCC continues to surprise paper stock dealers, as prices have increased nearly $10 per ton in some regions of the country. On the West Coast, one larger exporter says that despite the rhetoric about shipments to China becoming close to impossible in light of Operation Green Fence, movement of material into the country remains decent. “Things are pretty stable,” he says.

OCC supply continues to be a bit constrained, which is helping keep prices somewhat stronger than expected, with domestic board mills also looking to purchase more of the material to meet their needs.

The domestic market also is being helped by SP Fibertech’s (formerly SP Newsprint’s) paper mill in Dublin, Ga., which has switched part of its production from newsprint to packaging grades. As a result, the mill has boosted its intake of OCC.

.jpg) Price for baled, full truckloads of OCC Grade 11 on the open market reported June 10, 2013; source: Forest2Market’s Market2Mill, www.forest2market.com |

A large material recovery facility (MRF) operator in the eastern United States says the SP mill presently is buying roughly 1,000 tons of OCC per day, which has helped keep OCC markets in the Southeast fairly stable.

Helping to boost OCC demand in the eastern part of the country is Atlantic Packaging’s reopening of its Whitby, Ontario, mill earlier this year. The mill originally produced recycled newsprint. However, because of difficult newsprint markets, the mill had closed. Atlantic Packaging has reopened the mill and now is producing SmartCorr, a 100-percent-recycled lightweight paper for linerboard and corrugated medium. The mill’s short-term goal is to produce 300,000 tons of recycled linerboard and medium per year.

Another mill generating significant interest among paper stock dealers is the Greenpac recycled board mill slated to open in Niagara Falls, N.Y., in July. The mill is majority owned by the Canadian paper company Norampac, with a minority stake owned by two corrugated converters, Jamestown Containers and Containerboard Partners, as well as by the Quebec fund manager Caisse de dépôt et placement du Québec. One source says the mill has been building up OCC inventory throughout the past few months in anticipation of its startup.

The mill will manufacture a lightweight linerboard, made with 100-percent-recycled fiber, on a single machine with an annual production capacity of 540,000 tons, according to Cascades, Norampac’s parent company.

While OCC has held up fairly well, two other bulk grades—mixed paper and ONP—have seen a mild dip, though this decline was of a smaller degree than what dealers had earlier expected.

A West Coast exporter says that while shipments of mixed paper and ONP to China have been curtailed, several other Asian countries, including Korea, Malaysia and India, have increased their purchases of mixed paper, which is keeping prices from falling too sharply.

ONP also has seen a further softening in price. One source says several newsprint mills in China are taking extended downtime, which will cut into overall demand for ONP.

The ONP market also continues to suffer from limited demand from domestic buyers.

While Operation Green Fence has created anxiety since it was enacted several months ago, a number of sources say they have already seen an improvement in recovered fiber quality as MRFs respond to the new situation in China.

Domestic mills, which also have complained about the degradation of material quality, also are becoming more assertive in rejecting inferior grade shipments of recovered fiber, sources say.

Suppliers to these mills say they are concerned about a decline of another type: recovered fiber generation. The summer months typically are a low-generation time of the year, however, generation from the printing industry, which typically supplies a significant volume of higher-grade paper stock to dealers, is declining as more printers close down their operations.

|

Explore the July 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program