Paper stock markets appear to be in an uneasy balance as spring progresses. Pricing for some grades has shifted modestly, and the short-term outlook is uncertain.

Many paper stock dealers, especially those who deal extensively with the Chinese market, say they are concerned about how that country’s Green Fence policies will play out.

China’s ramped up inspections of incoming recyclables, which seemed to explode onto the scene in March 2013, will run until November 2013, according to Wang Jiwei, vice president and secretary general of the China Nonferrous Metals Industry Association Recycling Metal Branch (CMRA), who spoke in April at the Institute of Scrap Recycling Industries Inc. (ISRI) 2013 Conference and Exposition. Several sources say the flow of material, especially old newspapers (ONP) and mixed paper, from single-stream processing systems in the U.S. has been halted as a result.

While a number of recyclers say they still can ship material to some Chinese ports fairly easily, others say inspection policies contribute to shipping costs. One source says his company is now being asked to provide photographs of container loads, including photos of the inspector.

The challenge of shipping material to China may be the focal point of most exporters, but problems in Europe also are becoming more acute. A Midwest-based broker who moves a fair amount of fiber offshore says the European market is deteriorating quickly. “Europe is shut down for most high grades. In particular, the exporter says, German mills are in “bad, bad shape.”

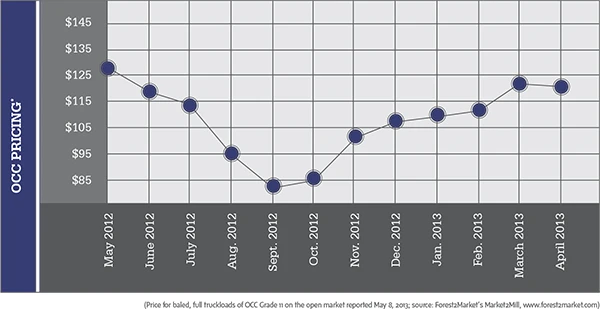

While domestic markets for OCC (old corrugated containers) are set up for strength later this summer, one exporter says, OCC will likely feel pressure from a cap on offshore orders in the short term.

Domestically, OCC prices have declined modestly in a couple of regions of the United States, though positive developments are occurring. The new Greenpac mill in Niagara Falls, N.Y., which is slated to open this summer, has been purchasing a significant volume of OCC from the Midwest, sources say. Formerly idled mills also are reopening, according to reports. Also, some paper mills are looking to switch their production from newsprint to packaging grades, which should help demand for OCC.

One large OCC processor expresses optimism concerning the current market. “Domestically, I feel good. There is new capacity coming online and there are some conversions of paper machines, as well.”

He says SP Fiber Technologies LLC’s Dublin, Ga., mill already has switched one of its paper machines from newsprint production to packing paper production.

ONP, on the other hand, is seeing stronger offshore buying, sources say. One paper stock dealer even describes ONP as “hot.” He adds that offshore buyers are looking to purchase large blocks of ONP. Combined with the lack of ONP available, this has helped strengthen the market.

Mixed paper may be the paper stock grade under the greatest scrutiny currently. Some paper stock dealers are halting mixed paper shipments to China because the material is viewed as more likely to be rejected in the inspection process.

“We have made the decision not to ship any ONP or mixed paper from single-stream operations,” the exporter says. “The risk of rejections is far too high for the profit potential.”

While mixed paper is suspect for offshore shipments, Pratt has become an influential buyer of the grade domestically. Several recyclers say that when the company is in need of material, it aggressively pursues mixed paper, driving up prices.

The “boom/bust” scenario created by Pratt’s purchasing has roiled the mixed paper market in the eastern half of the country, according to sources.

High grades, which saw some softness earlier this year, may be finding better footing now. One large dealer of high grades says he has standing orders from consumers in Mexico. While Mexican mills have eased back on some recent orders, the recycler says he is still able to ship all the deinking grades the company handles.

Explore the June 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production