Scrap recyclers who felt prices for nonferrous scrap would bounce after a sharp downswing in early spring have been sorely disappointed as of early May. The consensus at this time seems to be that most nonferrous scrap metals will grind along into the summer season, with prices experiencing further downward pressure.

A combination of a U.S. economy that exhibits only modest improvement, China’s crackdown on incoming scrap shipments, limited new supply of scrap and increased competition for available tonnage has created a challenging environment for processors. With supply down and prices steadily moving to the downside, many processors say it is a daily struggle to get sufficient material to meet their orders.

Industrial generation continues to be light, making competition for material fierce. Margins are shrinking as a result and eroding profits.

An East Coast broker says, “Generation is down, and manufacturing and demolition scrap supplies also are down. There is just a lack of material on the market.”

A Midwestern recycler says, “Everything is trending downward.

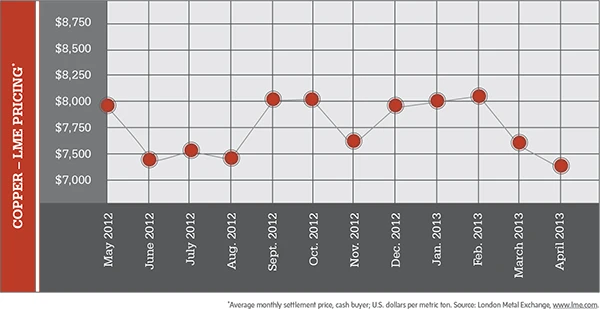

Copper prices continue to drop, and people are working on tight margins.” Copper prices have been inching downward through most of the spring, with early May prices falling to nearly $3 per pound.

Adding to the general downbeat news for copper scrap are recent reports from the International Copper Study Group (ICSG), Lisbon, Portugal, which show disappointing manufacturing data for the United States and China. The most recent figures from the ICSG show that copper supply exceeded demand by approximately 70,000 metric tons in January. Further, the ICSG report notes that global copper use dropped by 6 percent in January from figures for the same time last year. In China, demand for copper is expected to slip by 6.8 percent as net imports of copper declined.

According to the ICSG, China’s lower imports were accompanied by a decline in unreported inventories held in bonded warehouses in the country, which may have been directed all or in part to domestic industrial use.

Many U.S. scrap metal recyclers say tighter inspections in China are making imports of many grades of nonferrous metals, including copper and the zorba grade generated at auto shredders, more problematic.

The stricter import policies are having an effect on copper scrap consumers in China. A recent report by Reuters notes that two mid-sized copper producers there have been forced to cut their output in light of the shortage of copper scrap. Wang Gang, the head of the trading department at China’s Tantai Penghui Copper Industry, told Reuters, “We have not been able to buy scrap for almost one month now. Our production in April was cut by about 20 percent from the same time last year.”

Several suppliers say aluminum scrap movement remains inconsistent. A large aluminum scrap processor in the eastern U.S. says, “Demand is spotty at best, the supply is low, and spreads have narrowed.”

In light of slumping prices, Alcoa announced that it was considering further cuts in aluminum production, to the tune of 460,000 metric tons.

Explore the June 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production