Those hoping for a spring resurgence in ferrous scrap flows have had some of their expectations met, as many yard managers and processors in cold-weather states are reporting better inflows of material in April and May compared with the winter months.

Such improvements in purchasing were not universal, however, as other recyclers continue to report disappointment at the scale house. As well, the increased supplies have not yet been paralleled by increased demand, leading to another month of lower ferrous scrap prices in the May buying period.

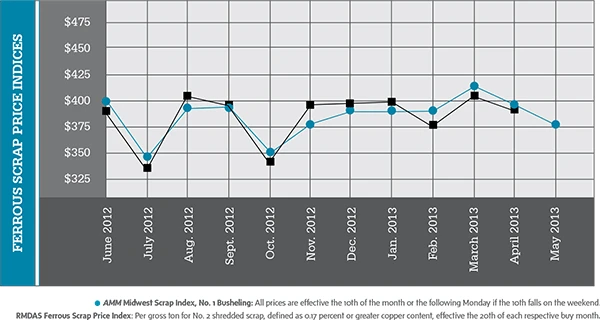

American Metal Market (AMM) reported that average mill buying prices for No. 2 shredded scrap in the Midwest fell by more than $20 per ton while prices for No. 1 busheling and No. 1 heavy melt fell by nearly $20 per ton in the May buying period.

May marked the second consecutive month in which ferrous scrap prices have sunk downward by about $20 per ton, as measured by AMM’s Midwest indexes.

On the domestic demand side, the American Iron and Steel Institute (AISI), Washington, D.C., reports that steel output in the first four months of 2013 has been more than 7 percent below the rate of production in early 2012.

“Adjusted year-to-date production through May 4, 2013, was 32.9 million tons, at a capability utilization rate of 76.3 percent,” reports the AISI. “That is a 7.5 percent decrease from the 35.6 million tons [produced] during the same period last year, when the capability utilization rate was 79.6 percent.”

Steelmaking activity in the U.S. essentially remained steady in the week ending May 4, with the production of 1.88 million tons up only slightly from the 1.87 million tons produced the week before.

One economic indicator may finally be pointing to a construction rebound, according to a report in Forbes magazine. The publication reported in mid-May that private company data collected by Sageworks, Raleigh, N.C., showed that “several categories of construction posted midteen percentage sales increases in the 12 months ended March 2013.”

Private companies in the residential building sector in categories including general contractors, construction management firms and design/build firms tracked by Sageworks are reporting sales increases in the 21 percent range. Nonresidential builders have posted a healthy 14.3 percent sales increase during the last 12 months as well.

According to Forbes contributor Mary Ellen Biery, the National Association of Home Builders is forecasting that single-family housing starts in 2013 will rise to more than 670,000, which would represent a 23 percent increase from 2012’s figure.

Recyclers gathered at the Institute of Scrap Recycling Industries Inc. (ISRI) 2013 Convention & Exposition reported varying levels of optimism as to how the rest of 2013 will play out in the ferrous scrap market.

Recyclers gathered at the Institute of Scrap Recycling Industries Inc. (ISRI) 2013 Convention & Exposition reported varying levels of optimism as to how the rest of 2013 will play out in the ferrous scrap market.

Speakers at the Spotlight on Ferrous session, held April 11, offered comments on key export markets. Phillip Hoffman, a vice president with Medtrade, the U.S. subsidiary of Turkish steel producer Colakoglu Metaluji, said 1.56 billion metric tons of steel were produced worldwide in 2012 using 579 million metric tons of ferrous scrap.

Turkey is a popular overseas destination for U.S.-generated ferrous scrap, with Hoffman saying 27 percent of scrap imports to the country are from the United States. Russia and the European Union supply much of the remainder, he added.

Turkey continues to add steelmaking capacity, despite excess industry capacity on a global scale, Hoffman added.

Sachin Shivaram, general manager of metallics purchasing for Severstal NA, Chicago, spoke about his company’s approach to purchasing ferrous scrap for its operations, which ship some 5.5 million metric tons of steel per year and purchase approximately 3.5 million metric tons of scrap metal.

Shivaram said Severstal NA’s ferrous scrap purchases are guided by steel pricing, with the company preferring to purchase material consistently throughout the month rather than at the beginning or the end of the month.

“The impression now is if I buy scrap midmonth, I am desperate for scrap,” he said. “That is not the case.”

Shivaram told attendees, “If you are not selling scrap in the middle of the month, you are missing out on a dynamic market.” He added that there is value in having more chances to transact purchases throughout the month.

The ISRI 2013 Convention & Exposition was April 9-13 at the Orange County Convention Center in Orlando, Fla.

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

*FOB New York, in metric tons; **FOB Los Angeles, in metric tons. The American Metal Market (AMM) Midwest Ferrous Scrap Index and the AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodologies are available at www.amm.com/pricing/methodology.html. The grades are based on the Institute of Scrap Recycling Inc. (ISRI) specifications from 2012.

Explore the June 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production