|

|

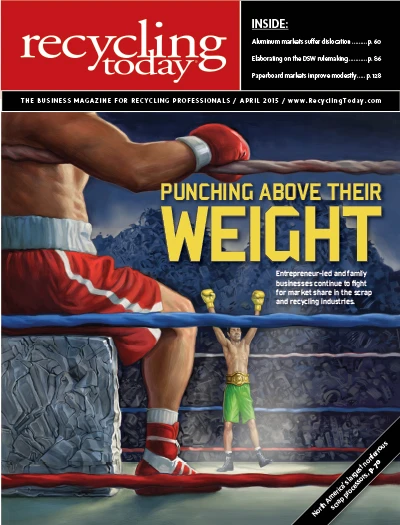

Officers and managers in family-owned and midsized recycling companies expressed a variety of viewpoints on how their sectors are faring when interviewed for the cover story of this edition of Recycling Today. That small and medium-sized companies in the recycling industry continue to enjoy certain advantages was one common opinion expressed in the article, which begins on page 54 of this issue. Providing attentive, personal service was an often-cited advantage, with the opinion widespread that customer service is best observed firsthand and close to home. Despite this and other perceived advantages, industry veterans expressed almost unanimous certainty that their industry is now more consolidated than it used to be and that, in all likelihood, transactions will continue that serve to consolidate market share within regions or on a wider national and even global scale. Deeper pockets and economies of scale that accrue to larger operators do count for something. While smaller operators may score victories by reclaiming some accounts from larger competitors because of their inattentive service, on numerous other fronts the big companies have bottom-line advantages. The periodic waves of consolidation fueled by eager investors and deal-makers are bound to be a part of the future of the scrap and recycling industries. Executives and managers at smaller companies expressed little doubt on this point, even in light of the return of severe pricing volatility and the prospect of one publicly traded scrap firm currently exploring potential exit strategies. In 2015 most small and medium-sized company owners are in no mood to wave the surrender flag. As has been the case for decades, second- and third-generation family business members and entrepreneurs alike are eager to work for themselves—not for shareholders and investment bankers. This determination and desire, combined with deep industry knowledge, will go a long way to ensure the recycling industry remains one where family businesses and entrepreneurs can find a suitable (and profitable) home. It is probably unwise, however, to think there will be anything easy about competing and operating profitably as a small company in the midst of well-capitalized competitors that can outspend smaller firms and withstand expensive mistakes. Sponsored Content Redefining Wire Processing StandardsIn nonferrous wire and cable processing, SWEED balances proven performance with ongoing innovation. From standard systems to tailored solutions, we focus on efficient recovery and practical design. By continually refining our equipment and introducing new technology, we quietly shape the industry—one advancement at a time. As much as anyone else who is part of the recycling industry, I’ll be rooting for it to remain a sector that is attractive to entrepreneurs and family firms. After observing the recent volatile market conditions and hearing about the advantages enjoyed by (well-run) larger firms, though, it will be with the understanding that such a future will require tremendous effort. |

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the April 2015 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Ferrous price hikes may be poised to pause

- BIR prepares for Spanish exhibition

- Copper exempted from latest round of tariffs

- Interchange Recycling's EPR stewardship plan approved in Yukon

- Making the case for polycoated paper recovery

- Novolex, Pactiv Evergreen finalize merger

- In memoriam: Danny Rifkin

- BIR adds to communications team